House prices fell in May for the third consecutive month, according to the Nationwide House Price Index – this is the first time house prices have declined for three months running since 2009.

The annual rate of growth weakened to 2.1%, which is the weakest in nearly four years. This latest data adds to growing evidence that the UK’s housing market is losing momentum.

Experts say that May’s house prices data may be indicative of a broader slowdown in the overall housing sector.

With real incomes under pressure again as inflation has outpaced wage growth, the number of individuals in work has continued to increase at a healthy pace, the Nationwide added. In March, unemployment declined to a 42-year low.

House prices have fallen for the third month in a row. Is this the beginning of a long-term housing slump, or just a blip? Experts say it is too early to tell. (Data Source: nationwide.co.uk)

House prices have fallen for the third month in a row. Is this the beginning of a long-term housing slump, or just a blip? Experts say it is too early to tell. (Data Source: nationwide.co.uk)

House prices not linked to June elections

Robert Gardner, Nationwide’s Chief Economist, made the following remark regarding May’s house prices and June’s general elections:

“If history is any guide, the slowdown is unlikely to be linked to election-related uncertainty. Housing market trends have not traditionally been impacted around the time of general elections.”

“Rightly or wrongly, for most home buyers, elections are not foremost in their minds while buying or selling their home.”

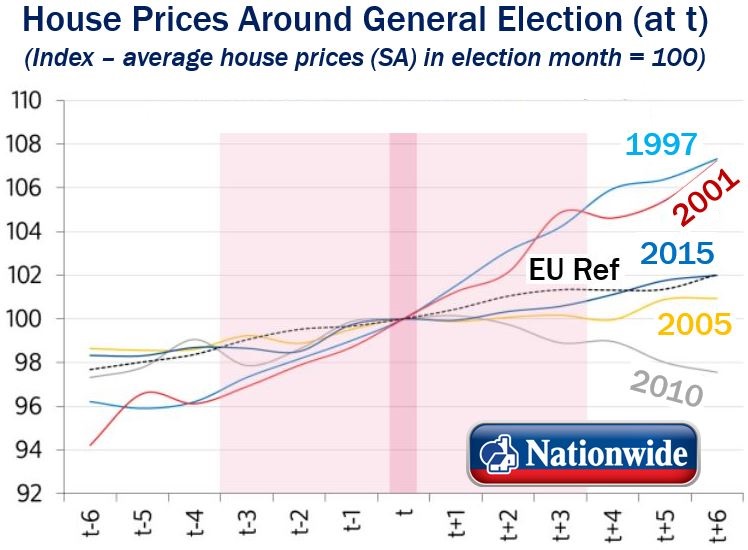

Nationwide’s economists analysed patterns in house prices in the months leading up to and following previous elections, as well as the 2016 referendum in which the electorate voted for BREXIT – BRitain EXITing the European Union.

They found that past general elections have not generated volatility in house prices or triggered changes in price trends in a significant way.

Nationwide writes: “In the chart we have indexed average house prices so they equal 100 in the election month in each of the years shown. We can then compare house price movements in the months leading up to each election (t-6 to t-1) and following each vote (t+1 to t+6).” (Data Source: nationwide.co.uk)

Nationwide writes: “In the chart we have indexed average house prices so they equal 100 in the election month in each of the years shown. We can then compare house price movements in the months leading up to each election (t-6 to t-1) and following each vote (t+1 to t+6).” (Data Source: nationwide.co.uk)

Mr. Gardner added:

““On the whole, prevailing trends have been maintained just before, during and after UK general elections. Broader economic trends appear to dominate any immediate election-related impacts.”

“We also examined how activity, in particular house purchase mortgage approvals, responded to past UK general elections (see chart on the next page). Here the picture is less clear, but again there does not seem to be any clear impact in the three months either side of a general election.”

In the period immediately following last year’s EU referendum, activity slowed. However this was a continuation of a slowdown caused by the introduction earlier in 2016 of additional stamp duty on second properties.

House prices fall a blip?

The Nationwide team believes that it is too early to determine whether this slowdown in house prices is just a blip, or a reflection of the effects of the squeeze on people’s purchasing power.

The United Kingdom is going through a period of uncertainty. The British electorate voted to leave the European Union. Hard negotiations with Brussels and the EU’s member states lie ahead. Nobody knows what kind of deal we will end up with.

Mr. Gardner says that the future movements and trends in house prices will depend crucially on developments in the country’s wider economy.

Regarding which way house prices are likely to go, Mr. Gardner said:

“Household spending is likely to slow in the quarters ahead, along with the wider economy, as rising inflation increases the squeeze on household budgets. This, together with mounting housing affordability pressures, is likely to exert a drag on activity and house price growth in the quarters ahead.”

“However, the subdued level of building activity and the shortage of properties on the market are likely to provide support for prices. As a result, we continue to believe that a small increase in house prices of around 2% is likely over the course of 2017 as a whole.”