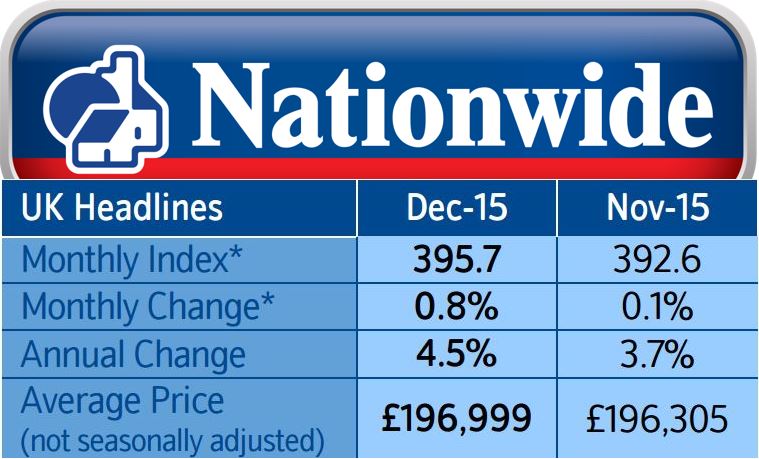

House prices rose at their fastest rate in December since April 2015, says the Nationwide Building Society. An average house in the UK today is worth 4.5% more than it was in December 2014, compared to 3.7% in November versus November 2014.

Just in December, house prices increased by 0.8%, which was considerably more than experts had expected, after rising by just 0.1% in November.

The average price of a house in Britain today stands at £196,999.

Experts were surprised to see prices rising by so much in December. (Image: Nationwide)

Experts were surprised to see prices rising by so much in December. (Image: Nationwide)

According to Nationwide’s forecast, over the next 12 months prices should increase by 3% to 6%.

Prices in line with earnings growth

Robert Gardner, Nationwide’s Chief Economist, made the following comment on the figures:

“After moderating during the first six months of 2015, house price growth remained in a narrow range between 3% and 4.5% in the second half of the year. This is broadly in line with earnings growth and close to the pace we would expect to prevail over the longer term.”

“However, as we look ahead to 2016, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, despite the likelihood of interest rate increases from the middle of next year.”

“Further healthy gains in employment and rising wages are likely to bolster buyer sentiment, while borrowing costs are expected to rise only gradually. However, the main concern is that construction activity will lag behind strengthening demand, putting upward pressure on house prices and eventually reducing affordability.”

After reaching a peak in the middle of last year, house price rises were much more moderate in the second half of 2015. (Image: Nationwide)

After reaching a peak in the middle of last year, house price rises were much more moderate in the second half of 2015. (Image: Nationwide)

Nationwide unsure whether regional price divergence will widen

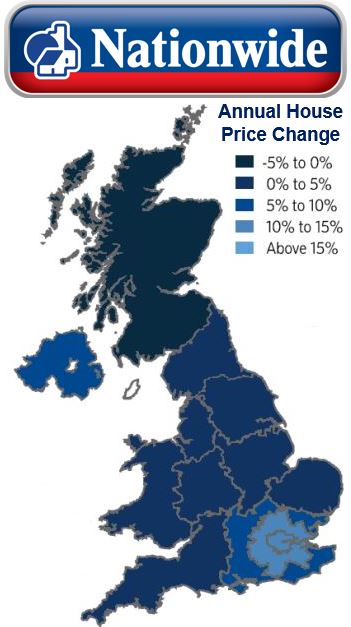

The Nationwide team said it remains an open question whether the large regional divergence in house prices will continue next year.

House prices in the South of England, especially in London, have risen at a faster rate than in the rest of the country by a wide margin.

The average price of a house in the South of England today is considerably higher than before the financial crisis, while in large parts of the North of England, Wales and Scotland they remain below.

Mr. Gardner added:

“With affordability metrics in the Capital stretched by historic standards, another year of above-average price gains appears unlikely.”

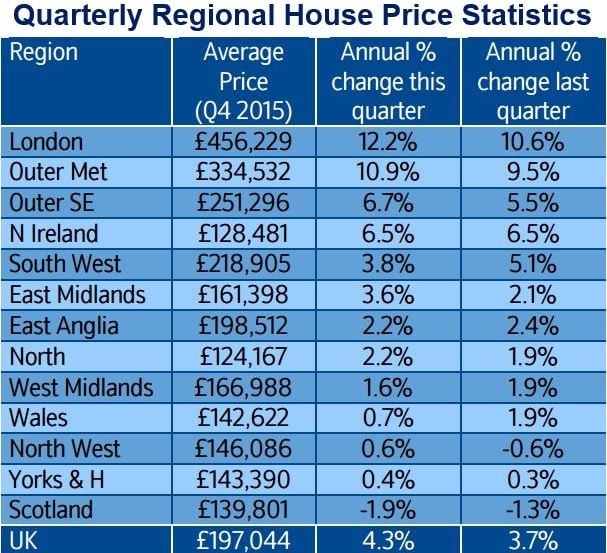

London and its outer metropolitan areas saw by far the strongest increase, while Scotland posted a fall. (Image: Nationwide)

London and its outer metropolitan areas saw by far the strongest increase, while Scotland posted a fall. (Image: Nationwide)

House prices in the fourth Quarter

In the Fourth Quarter (Q4), regional house price performance was again mixed. Five regions recorded a slowdown in the yearly rate of growth, while in seven prices rose at a faster rate.

All UK regions posted house price rises for 2015 with the exception of Scotland, where they declined by -1.9%.

The pattern of regional price growth in the last quarter of the year is largely a continuation of the trends we have seen over the last two years, where rates in growth generally moderate as one moves from the South of the country to the North.

Variations in labour market conditions have a strong impact on the regional differences. “Indeed, there is a strong relationship between employment growth since the financial crisis and the rate of house price growth,” Mr. Gardner said.

The difference in average house prices between the North and South of England widened by by £23,000 to £159,000.

There is a clear difference in house price changes between the South East of England and the rest of the country. (Image: Nationwide)

There is a clear difference in house price changes between the South East of England and the rest of the country. (Image: Nationwide)

Strongest growth in London

For the fifth successive year, London posted the strongest growth (12.2%), bringing the average property value in Britain’s capital to £456,229.

Sky News quoted Howard Archer, chief UK & European economist at IHS Global insight, as saying:

“The stronger Nationwide data for December reinforce our belief that house prices are likely to see solid increases over the coming months.”

Mr. Archer believes prices will continue to rise given that wages and employment are increasing, consumer confidence is buoyant, mortgage rates remain low, and the shortage of properties will probably continue.