Zimbabwe has run up arrears on repayments on previous debts with the IMF (International Monetary Fund), which said on Saturday that it cannot lend any more. A specialist Africa IMF team is in Zimbabwe’s capital Harare, helping the government complete a program aimed at reviving the devastated economy.

In an interview in the BBC World Service’s Business Update program, Domenico Finazza, IMF Assistant Director for Africa, said:

“We cannot in the current situation, because Zimbabwe runs arrears with the Fund and also other institutions like the World Bank and African Development Bank.”

Mr. Finazza said the Zimbabwe government spends more than 75% of its tax revenues on paying salaries for its more than 250,000 civil servants.

The IMF says that Zimbabwe needs to grow, and it desperately needs investment. The country has no money, there is not enough support anywhere, and all the tax collections go into paying people’s salaries.

In August 2008, Robert Mugabe’s government posted an inflation rate of 11,200,000%.

Patrick Chinamasa, Finance Minister, said:

“I am embarrassed that our wage bill is some 76% of whatever revenue we receive. It’s not good, it’s not sustainable. We have to create the necessary political climate, build consensus in order to tackle the issues. I can assure you that we are working on this issue.”

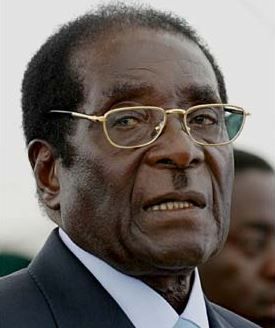

In the run up to last year’s general elections, President Mugabe, who has been in power since December 1987, promised he would raise civil service wages. Earlier this year they were increased by 14%.

The Zimbabwe government fears that any reversal in state-worker salaries would trigger serious unrest throughout the country.

Mugabe blames the US and EU

While Mr. Mugabe has clearly ransacked his country and left its economy in a total mess because of his economic policies and arbitrary measures, he continues to blame his woes on a conspiracy led by the United States and the European Union.

Throughout the 1980’s, Zimbabwe’s GDP (gross domestic product) increased by 5% annually, and 4.3% in the 1990s. In 2000 it shrank by -5% and then by -8% in 2001, -12% in 2002 and -18% in 2003.

Its involvement in the war in the Democratic Republic of the Congo (1998-2002), rampant corruption, gross mismanagement, and the eviction of 4,000 white farmers in the land redistribution of 2000, brought the country to its knees.

Since 2009, the country has started to recover.

However, to finance its rebound and build virtually non-existent infrastructure is going to be challenging. The country owes the IMF and foreign companies $140 million and $10 billion respectively. Some of these debts are more than two decades old.

Before Mr. Mugabe’s official visit to China last month, the government had to find $180 million to repay Chinese debts.

According to South African media, Mr. Chinamasa is approaching South Africa for loans.