Bad credit can be crippling, and when your credit is in disastrous shape, it’s easy to despair. You need to know, however, that you’re not alone and that thousands of people, year after year, have been able to turn their credit situation around. One of the many reasons why people often give up on improving their credit is that they don’t know how credit actually works. Even worse, it has been estimated that around 40% of Americans have no idea what their credit score is.

You also have a subset of people who think that there’s nothing that can be done to consciously improve their credit, but they’re wrong. There are many things that you can do starting today that could allow you to get your credit back into respectable territory. Let’s take a look at 3 ways in which you can improve your credit fast.

Review Your Credit Report

The very first thing you have to do is get a copy of your credit report. Know that you are entitled to a free copy of your report from one of the 3 main credit reporting agencies: Experian, TransUnion, and Equifax.

Knowing what your credit report looks like is important for many reasons. For one, you may not know what may be affecting your credit. You might have an account on there that you forgot about that you could fix immediately. Doing that alone will instantly improve your credit.

However, in some cases, you might have errors on your report that could be holding you back. For instance, you might have an account you have paid off that hasn’t been removed from your report. This could have a major negative impact on your credit score and this is something that could’ve been easily avoided had you paid more attention.

Also, you may not be aware of the statute of limitations on certain types of debt. Most states will have their own rules regarding time limits. It’s usually between 3 to 6 years depending on the type of debt, though it can be longer. Checking your credit report could be a relief knowing that your situation is not as critical as you thought and is still salvageable.

Once you’ve received your copy of your credit report, examine it carefully. Check to see if there are any mistakes. If there are, each bureau will have a simple procedure to contest the entries on your report. Usually, you will be required to explain in writing what the error is and send the letter through certified mail. You can find a sample request letter here. You will also need to enclose the copies (not originals) of documents that support your dispute.

Work with a Credit Report Expert

We also suggest that you speak with a professional immediately. While you can repair your credit by doing a few simple steps, there are things that credit repair companies will be able to do better than you. They might be able to help you settle a difficult item on one of your reports. They might also come up with a negotiation plan that will allow you to reduce debt payments or even have some of them forgiven. Also, a credit report expert will be able to tell you what you shouldn’t do from now on and how you can start rebuilding your credit slowly.

You have to make sure that you choose the right agency, however. For that, you need to take a look at their track record. You want to work with a service that has been there for a while. Also, you have to make sure that there will be someone assigned to your account that will be able to answer your questions promptly.

Another very important thing to look for is a guarantee. Some will give you a money-back guarantee if they start working on your case and can’t fix your situation. This is the type of company you want to work with.

Start Paying and Creating Activity

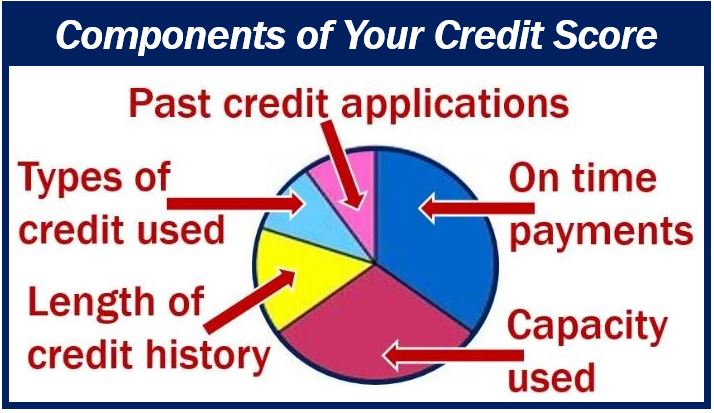

Next, what you will need to do is lower your credit utilization rate. This is the amount of money that you owe compared to your total credit available. It’s estimated that about 30% of your FICO score is calculated based on this factor alone, so this isn’t something you can take lightly.

For example, if you have a credit limit of $20,000 with a $10,000 balance, then that means that your utilization ratio is 50%. If your $20,000 limit is maxed out, then this ratio is 100%.

Many people will have their number when it comes to the ideal ratio. However, Experian suggests that you always keep it at 30% or less. This means that you should never go over $6000 if you have a $20,000 limit. Lowering your debt utilization rate is the best and fastest way to increase your score.

Next, you will need to show some financial activity and that you can be trusted. This means that you will need to start opening accounts. Also, make sure that you don’t close accounts that you have paid off unless you have serious self-control issues, as this will negatively affect your credit utilization ratio.

It’s also very important that you only make credit applications if you’re 100% sure that you’ll get accepted. This is because multiple inquiries on your credit report will show signs of distress which will end up affecting your score negatively.

One of the best instruments to increase activity and show trustworthiness is a secured credit card. Secured cards allow you to deposit an amount that will be used as the credit limit for the card. What’s great about these cards is that activity will be reported to credit bureaus. Also, once you get established and show that you can be trusted, they might offer to boost your credit limit or upgrade your card to a regular credit card.

As you can see, repairing your credit is not only possible, but rather simple. The most important thing is to reduce the amount of debt you have relative to your limit, and work with someone who will be able to give you the right tools to rectify the situation fast.

Interesting related article: “What does Credit Score mean?”