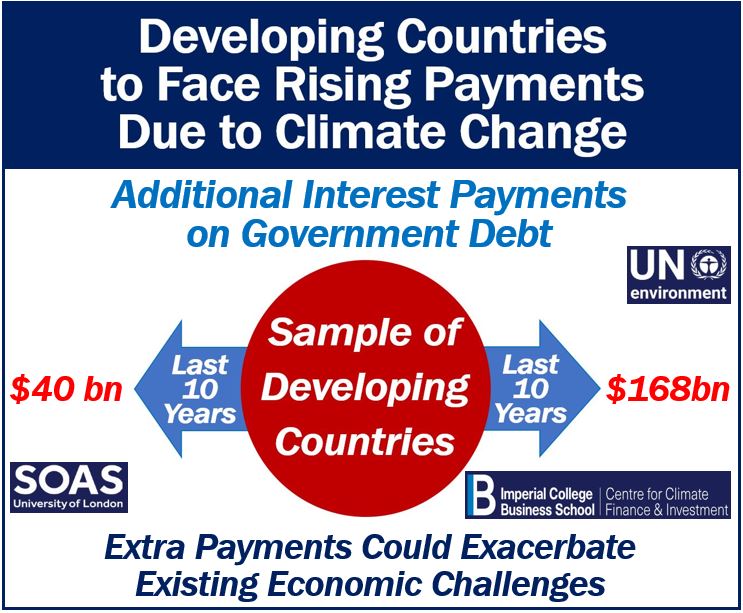

Developing countries will have to endure increasing payments over the next decade due to climate change. Their debt payments over the next ten years could total $168 billion due to their vulnerability to climate change. This is what researchers from Imperial College Business School and SOAS University of London predict.

Dr. Charles Donovan and colleagues discovered that man-made climate change is raising the cost of capital. Specifically, the cost of capital in developing countries.

Dr. Donovan is the Director of the Centre for Climate Finance and Investment at Imperial College Business School.

The researchers found that for every ten dollars developing nations pay in interest payments, an extra dollar is due to climate vulnerability.

Climate change refers to the long-term shift in the world’s average temperatures and weather patterns. When temperatures rise, we also use the term global warming.

Increasing payments – the last decade

The researchers found that over the past ten years, a sample of developing nations has endured $40 billion in extra interest payments. This figure was just for government debt.

They predict that these extra interest costs will increase to between $146 billion and $168 billion over the next decade.

These increasing payments could exacerbate the economic challenges that developing countries globally already face.

The researchers also found, however, that investments in climate resilience have benefits. They can, for example, help improve a country’s fiscal health at the national level. ‘Fiscal‘ refers to government revenue, as well as government borrowing, expenditure, and taxes.

Dr. Donovan said:

“Our work demonstrates that climate change is not only imposing economic and social costs on developing countries, but it is also amplifying existing risks that are already priced in fixed income markets. These impacts will grow.”

“The good news is that investments in climate adaptation can not only reduce social, ecological and economic harm but can buffer against fiscal impairments. But to be effective, these investments need to be made now.”

Adaptation projects and investments in effective climate mitigation could include planting trees. They could also include building dikes for coastal protection in Vietnam, Sri Lanka, Haiti, and Honduras. Fiji, Cambodia, Barbados, and Bangladesh would also benefit from the construction of dikes along their coasts.

Increasing payments – reducing the burden

The researchers identified several policy and market initiatives that could help reduce the burden.

Dr. Donovan and colleagues found that climate adaptation initiatives must accomplish at least one of three imperatives to be effective from a financial perspective:

– Reduce the total economic costs due to climate change.

– Accelerate the pace of economic recovery.

– Transfer climate-related financial risks cost-effectively.

This is the first study to look at how climate change is altering the cost of capital in developing countries. In other words, the relationship between increasing payments and climate change.

Citation

“Climate Change and the Cost of Capital in Developing Countries,” Bob Buhr, Charles Donovan, Gerhard King, Yuen Lo, Victor Murinde, Natalie Pullin, and Ulrich Volz.

UN Environment commissioned the study, which the MAVA Foundation supported financially. SOAS University of London and the Centre for Climate Finance and Investment at Imperial College Business School carried out the study.