India GDP growth of +4.6% for the first quarter of 2014 (the fourth quarter of India’s financial year) was the same as in the previous quarter, less than analysts had forecast. The country’s lackluster economic performance was mainly due to a slowdown in manufacturing, which declined by -1.4% (annualized), says the Ministry of Statistics and Programme Implementation.

While mining declined by -0.4% in the first quarter, agriculture expanded by +6.3%.

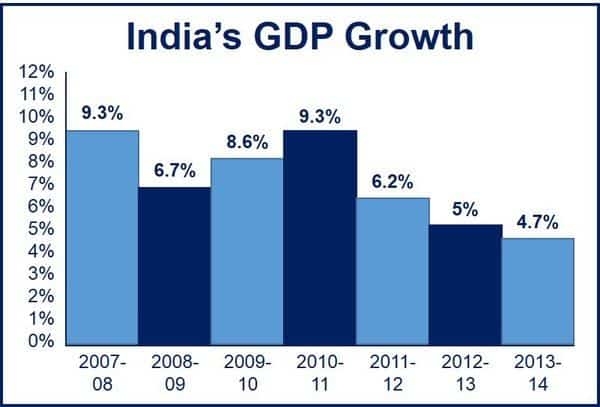

Indian GDP growth for the full 2013-2014 financial year was +4.7%, the second consecutive year the economy expanded by less than 5%.

At the beginning of the millennium, India was expected to grow at the same rate as China and to soon be among the top three economies globally. Unfortunately, it has failed to delivery. Today, China’s economy, which expanded by 7.4% in Q1 2014, is nearly five times the size of India’s.

According to Nomura, stressed loans total $100 billion in India, and currently make up 10% of all lending. Indian’s companies’ debt-equity ratio hit 97.9%, a 20-year high.

A bad year for mining and manufacturing

Below is a breakdown of growth rates in various sectors for the full 2013-14 financial year:

- Agriculture, forestry and fishing: +6.3%

- Mining and quarrying: -0.4%

- Manufacturing: -1.4%

- Electricity, gas and water supply: +7.2%

- Construction: +0.7%

- Trade, hotels, transport and communication: +3.9%

- Financial, insurance, real estate and business services: +12.4%

- Community, social and personal services: +3.3%

Not enough new jobs

Two years ago Indian GDP growth reached 8%. In order to fill the estimated 10 million new jobs each year required for the country’s growing population, it needs expansion of at least 8% per year. Over a period of seven years the previous government only managed to create 53 million jobs, i.e. 7.57 million jobs annually.

India’s growth rate in per capita income was 2.7% in 2013-14, compared to 2.1% in 2012-2013. There was an increase in credit rates in 2013 as well as very slow credit growth, which dampened investment.

In recent years India’s economy has been burdened with a volatile currency, high inflation and declining foreign investment.

Mr. Modi brings hope

After Mr. Narendra Modi’s election victory, the strongest electoral mandate in 30 years, economists are optimistic about India’s economy and employment outlook. As soon as he implements policies geared towards growth investors are expected to return.

Mr. Modi is head of the first single-party parliamentary majority in thirty years. He is in a strong position to take politically sensitive decisions.

Analysts say that for sustained long-term economic growth, Mr. Modi needs to simplify India’s tax code, streamline agricultural production, and encourage foreign investment.

During his election campaign, Modi emphasized his record of high foreign investment and low unemployment in the state he led since 2001 – Gujarat. He has pledged to bring down inflation and eradicate corruption.

Mr. Modi’s Bharatiya Janata Party needs to free up over $200 billion’s worth of industrial and infrastructure projects that were blocked as the previous government got bogged down with environmental and land acquisition clearances. It also faces the challenge of encouraging investment while the central bank keeps interest rates high to control inflation.

So far this year, the rupee has strengthened by nearly 5%, while the benchmark Mumbai Sensex index has risen by almost 15% over the same period. According to The Conference Board, India’s outlook improved in April.

What about the fiscal deficit?

Any short-term measures that Mr. Modi’s government takes to boost the economy could undermine his administration’s commitment to reducing the fiscal deficit to 4.1% of GDP during the current financial year.

(Source: Ministry of Statistics and Programme Implementation)

The federal fiscal deficit declined to 4.5% of GDP in the 2013-14 fiscal year, compared to 4.9% in the previous year.

Fragile global economic growth may also make it harder to boost exports, which account for nearly one quarter of India’s domestic economy.