Building up your credit score has several advantages. Borrowers with above-average credit scores receive better interest rates and more favorable loan terms.

If you know anything about credit score calculations, you will know that payment history is one of the most important factors in your credit score. However, one area that is often overlooked is something called the credit mix.

This part of the credit score essentially weighs the types of debt that you have in your name. Is it credit card debt? Is it a student loan? Is it a mortgage? Credit agencies and the lenders who would potentially loan you money will want to see diversity in your debt.

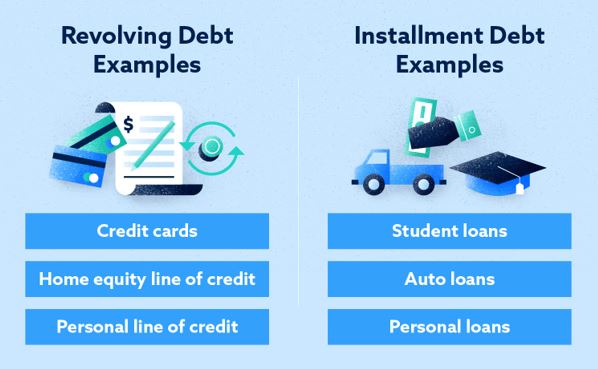

All debt isn’t equal in the eyes of credit scoring agencies. To dive deeper into the credit mix, there are two main categories: revolving and installment. Both of these impact a borrower’s credit score in unique ways. Lending companies will give preference to borrowers who show that they can capably handle both installment debt and revolving debt.

For those that are unfamiliar with these different forms of debt, there’s no need to worry. Here’s everything that borrowers need to know about managing their installment and revolving debt.

Installment Loan Debt Defined

Installment debt involves borrowing one fixed amount in a lump sum.

An installment debt or installment loan have predetermined end dates—like 3 years, 48 months, or, in the case of a mortgage 30 years. Installment debts are typically repaid monthly in equal amounts that combine interest and principal into one payment. Source: SimpleFastLoans

Installment loans are generally used for financing large assets such as homes and cars. Lenders allow this form of debt, as it provides steady cash flow to lenders throughout the loan. In many cases, these loans can stretch out over longer terms and this means the borrower pays interest for quite a long time.

Revolving Credit Debt Defined

Revolving credit debt is when a borrower is given access to a set amount of money. Borrowers can keep accessing the money up to a certain point, also known as their credit limit.

A credit limit is the amount of buying power borrowers get from a financial institution. For example, your credit limit—which is calculated based on your credit score and your income—could range from $1,000 to upwards of $10,000. The most common instrument that offers revolving credit is credit cards. Source: WalletHub

How Revolving and Installment Debts Affect Your Credit

Both types of debt impact your credit score. Having a mixture of credit products in your name helps strengthen your overall credit profile. While both impact your credit score, one is much better than the other when it comes to actually improving your credit score.

Here’s everything borrowers need to know about how installment debt and revolving debt impact your credit score.

Revolving Debt and Your Credit Score

Revolving debt has such a significant impact on your credit score because of credit utilization. Several credit scoring agencies list credit utilization as one of the most important factors when determining credit score because a high utilization rate indicates that the borrower may be overspending.

Credit utilization is a measure of the balance borrowers owe on their credit cards against their credit limit. For example, let’s say your credit limit is $20,000 and you owe $13,000 in credit card debt. You have used 65% of your available credit and the bureaus are going to take points off your credit score for having a lot of debt. On average, the recommended credit utilization ratio is 30% or lower.

It’s important to understand that this rule does not apply to individual cards, but rather an individual’s total credit limit to total credit used. Using the rule of thumb above, a ratio higher than 30% will decrease the borrowers’ credit score, as lenders will worry that the borrower will have trouble repaying any further debt—because you already have a lot of outstanding payments!

Additionally, the age of open revolving accounts also has an impact on your credit score. These are typically a good indication of how good an individual is at managing their debt.

Think about it: if you have had a credit card for 15 years and you have always paid it on time, you might know how to handle your money!

Installment Debt and Your Credit Score

In the eyes of credit scoring agencies, installment debt is much less risky than revolving debt. This is mostly because installment debt often requires the borrower to list an asset as collateral.

If you’ve never heard that word before, “collateral” means an asset like a car or a house that secures your loan. In short, if you fail to pay, the bank or lender takes the collateral to try to recover the money that you failed to pay. Collateral is like a security blanket for the lender.

Even the most massive installment loans are considered relatively stable, and, in effect, have a lower impact on your credit scores. On average, borrowers can easily manage a good credit score above 700 while managing a large balance of installment debt. For example, a typical consumer’s mortgage might be $700 and a car payment might be $200 a month. These payments are manageable for most American families.

What’s the Ideal Ratio of Installment and Revolving Debt?

Credit mix refers to the different loan products that individuals have in their credit history. Scoring models take into consideration the ability to responsibly manage both installment and revolving debt. Even though there’s no formula for a perfect mix, having multiple debt types is good for the borrower’s credit score.

Which Should You Pay Down First?

Ok, since there is no exact science to paying down your debt to lift your credit score, which one makes the most logical sense to pay off first? Good question.

And the answer is…mix it up.

Both installment loans and revolving credit will help improve your credit score, as long as you manage to pay bills when they’re due. Paying off both types of debt promptly and over a long period of time will demonstrate to lenders this simple fact: no matter the type of debt, my bills are being paid.

However, if you’re must decide which one to pay off first, it’s better to focus on credit card debt. Here’s why borrowers should focus on credit card debt first—there is even more on this debate here.

Which Debt Is Costing You More?

One of the biggest questions that experts recommend when deciding which debt to pay off first is considering which one costs the most.

This essentially depends on how the borrower behaves…For example, if you regularly pay off your credit cards and pay well more than the minimum payments, but only owe a lot in installment loans, well, then you may want to knock out those installment debts. Mathematically, those installment debts are going to accrue more interest and will likely cost more in the end.

However, if you carry a balance on your credit card every month, the increasing amount of interest will likely cost more. So, you may want to take care of that outstanding credit card balance. In short, making the best decision will take a minute for you to analyze your own behavior.

| Loan Type | Average Interest Rate |

| Credit Card | 16.6%

|

| Federal Student Loan | 2.75%

|

By the numbers, on average, the APR for a credit card is much higher than a federally-backed student loan.

Initially, it might seem like installment debt is costing the individual more, but the cost of revolving debt—if left unchecked—is significantly higher. That’s why most financial experts recommend that borrowers should look at paying off their revolving debt first.

Look at the Tax Benefits

One benefit of focusing on paying off installment loans first is the tax benefits that they provide. With mortgage loans, borrowers might be eligible for a tax benefit, which results in deductible interest. This could mean money back at the end of the year!

Mortgage loan interest payments are among the most common income tax deductions available to borrowers that itemize their federal returns. It is crucial to remember that the loan payment isn’t tax-deductible, but the interest paid.

The way the amortization schedule works is that the initial mortgage payments primarily cover a portion of the loan. As a result, the tax deductions for mortgage loans are typically utilized during the loan’s early years.

Mortgage loans aren’t the only form of installment loans qualifying for tax-deductible interest. Under certain conditions, both home equity loans and student loans can be eligible for tax-deductible interest.

On the other hand, credit card payments are not tax-deductible and there are little to no tax benefits of making these payments. Be honest—you just bought those new boots when you technically did have the cash in your account, and you got them on credit!

Financial Clues

Revolving credit also has a higher impact on your credit score. It offers more financial clues about what kind of borrower you are.

There are fixed monthly payments with an installment loan, and the borrower either manages to make these payments or falls behind.

However, when it comes to revolving credit, there are several strategies that the borrower can use.

- They can choose to charge a little and pay the entire bill

- They can max out the card and also pay the entire bill

- They can infrequently use the card and pay it back above the minimum payment, but not in full.

- They can max out the card and then make only minimum payments.

There are so many variations! And all of them will tell a lot about how you manage your money!

Taking Out an Installment Loan to Pay Off Revolving Debt

If you’re looking to pay off your revolving debt as soon as possible, a good way to do so might be through an installment loan. Personal installment loans often have attractive terms, and an increasing number of borrowers are using them to pay off their revolving debt, such as their credit card debt.

An installment loan, as stated before, will require you to make monthly payments until a fixed payoff date. You can use this loan to pay off your card and then lower your credit utilization ratio.

To do this, leave your card open after you’ve paid it off. This will reduce your balance and lower its ratio against the total limit. However, if your card has high annual fees, there’s no point in keeping it open.

Conclusion

Building up a good credit score can help open up a world of possibilities. It can also mean easy access to cash during an emergency. To build a credit score, the borrower should have the right blend of loan products including both installment loans and revolving credit accounts.

However, the impact of revolving debt is much more significant on the credit score. As a result, for those looking to manage both installment debt and revolving debt, the best strategy is to resolve the revolving debt first.

But, bear in mind, showing the ability to manage both successfully is crucial to building a good credit score. Once individuals have a good credit score, they can avail powerful financial tools such as 0% interest credit cards!

Interesting related article: “What is my credit history?“