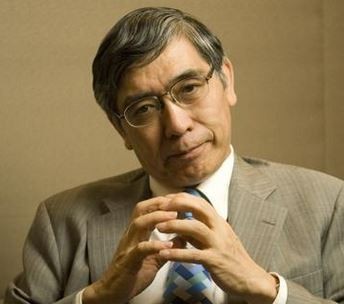

Bank of Japan Governor Haruhiko Kuroda quoted Charles Darwin during his Christmas Day speech in order to encourage employers to hike wages.

The Bank of Japan is trying to get its country to meet its 2% annual inflation target by encouraging companies to raise wages and increase capital expenditure.

For over two decades the Japanese economy has been caught in a deflationary spiral with virtually no GDP (gross domestic product) growth.

During his Christmas Day speech, addressed to prominent business leaders, Mr Koroda quoted the famous English naturalist (Charles Darwin):

“It is not the strongest of the species that survives, but the one that is the most adaptable to change.”

Mr. Kuroda did not go as far as directly urging for higher wage increased. Instead, he explained that prices have started to rise in Japan, thus altering the business environment. Those that adapt to the change by investing more and securing their employees before their rivals will be the survivors and winners in the new era.

Mr. Kuroda wants to break the deflation-recession cycle that has afflicted Japan for so many years.

Mr. Kuroda wants to break the deflation-recession cycle that has afflicted Japan for so many years.

As the economy emerges from deflation, the rule book for business will be rewritten, he said.

Mr. Kuroda said:

“Firms that are able to get ahead of a change in the environment promptly and to adapt to the economy in an expanding equilibrium will become the winners of the competition and enjoy prosperity in the new era.”

“This is a great chance, on a first-come-first-served basis.”

The falling yen and declining oil prices will favor some Japanese companies more than others. Those that benefit the most will be in a better position to respond to Mr. Kuroda’s call.

However, firms highly dependent on imported products may not be in a position to raise their costs further by hiking wages.

Mr. Kuroda concluded:

“Firms can expect that corporate profits will be favorable on the back of the decline in commodity prices and the depreciation of the yen. Households can expect that nominal wages will increase. Real wages are also expected to recover since the inflation rate is likely to be at around the current level for the time being and the increase in prices attributable to the consumption tax hike will disappear in April 2015 on a year-on-year basis, although the year-on-year rate of increase in prices is affected by the future developments in crude oil prices. There seems to be a tailwind to Japan’s economy.”

“In this situation, the challenge for next year is, as Chairman Sakakibara often mentions, that firms should change by taking advantage of such a favorable environment, so that the next virtuous cycle in the economy will be firmly in place.”

So far, the falling yen and oil prices have resulted in businesses hoarding record amounts of cash, but there have been no increases in capital expenditure or significant wage rises (not enough to keep up with increasing living costs).

Prime Minister Shinzō Abe handpicked Mr. Kuroda nearly two years ago to lead the fight against falling prices. Mr. Kuroda led a decision at the end of October to significantly expand an already huge monetary stimulus program.

Read Mr. Kuroda’s full speech “Welcome to the 2% Club.”