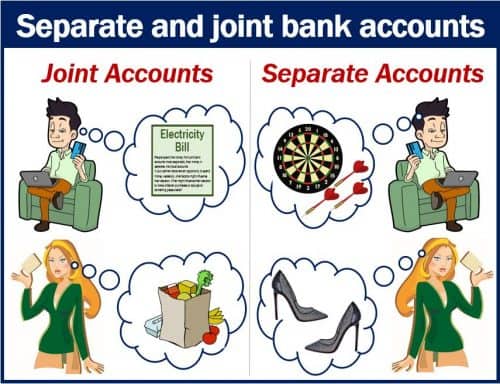

People spend money from joint bank accounts more responsibly than money in separate, individual accounts.

If your partner discovers an opportunity to spend money wastefully, what factors might influence their decision? What might influence their decision to make utilitarian purchases or splurge on something that is not practical?

Emily N. Garbinsky and Joe J. Gladstone found that people using money from joint bank accounts were less likely to buy pleasure products on a whim. Their study showed that joint bank accounts encourage people to favor utilitarian purchases.

In other words, people with a joint bank account are more likely to buy sensible things. Individuals with their own separate account, on the other hand, are more likely to be pleasure seekers.

The researchers wrote about their study and findings in the Journal of Consumer Psychology (citation below).

Garbinsky is an Assistant Professor of Marketing at the University of Notre Dame. Gladstone is an Assistant Professor of Consumer Behavior at UCL School of Management (UCL = University College London).

Joint bank accounts and separate accounts

Prof. Garbinsky said:

“We found that this spending pattern was not a one-time occurrence,” says Emily Garbinsky. People made these decisions over and over, which resulted in thousands of dollars spent.”

Experiment 1

In their first experiment, the authors talked to participants who were in romantic relationships. They asked them whether they had access to both their joint bank accounts as well as their separate accounts.

They asked the participants with access to both accounts to remove one of the account cards from their wallets. The participants then had to buy either a beer mug or a coffee mug. Both items were on a table in front of them.

People using their joint account card were more likely to make the sensible choice, the researchers found. In other words, more of them bought the sensible and utilitarian coffee mug rather than the hedonic beer mug.

Experiment 2

The researchers wanted to determine whether the need to justify was influencing the participants’ decisions. In this experiment, the volunteers in romantic relationships had access to both separate and joint bank accounts.

The authors randomly assigned the participants to use one of their two accounts. They also asked them to imagine that they were buying new clothes.

The participants, who were on a budget, had to choose just one of the following options:

- Clothes for fun and social occasions – price $75.

- Clothes for work – price $75.

After choosing their items, the participants had to indicate to what extent they felt the need to justify their purchase decision to their partners. The researchers gave them a justification scale of one to seven.

Those using a joint account felt a greater need to justify their spending to their better half. They were also more likely to purchase work clothes.

12-month joint account study

The researchers then analyzed the bank account data of people in romantic relationships over a twelve-month period.

They found that people who used joint bank accounts spent considerably less on hedonic purchases. Alcoholic drinks, vacations, beauty/hair items, and eating out, for example, are hedonic purchases. They spent more on utilitarian goods, such as insurance, electricity, and gasoline.

Prof. Gasbinsky said their findings suggest that sharing finances may be a simple way to encourage sensible spending.

Prof. Gabinsky said:

“Intuitively, people tend to think that there are advantages to keeping money separate because it allows freedom to spend money without feeling guilty, but we are living in an era when 50 percent of Americans are living paycheck to paycheck.”

Couples with joint bank accounts should not let their need to justify their purchases go too far, the authors said.

Regarding hedonic purchases, Prof. Gabinsky said:

“Hedonic purchases are associated with happiness, so there could be negative consequences if couples are never spending money on hedonic purchases.”

Citation

“The Consumption Consequences of Couples Pooling Finances,” Emily N. Garbinsky and Joe J. Gladstone. Journal of Consumer Psychology. First published: 12 December 2018. DOI: https://doi.org/10.1002/jcpy.1083.