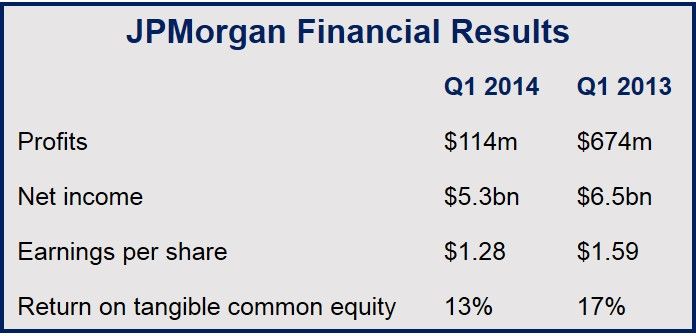

JPMorgan profits fell steeply in the first quarter of 2014, down from $674 million to $114 million. The largest bank in the US said its sharp profits fall was mainly caused by a slump in its mortgage business. JPMorgan shares declined 3% in pre-market trading.

Net income dropped to $5.3 billion in Q1 2014, a 19% decline compared to Q1 2013’s $6.5 billion. Mortgage business profits fell $559 from last year to $114 million.

Earnings per share in Q1 2014 were $1.28 compared to $1.59 in the same quarter in 2013. Analysts had expected earnings per share to be around $1.40.

Revenue was $23.9 billion, 8% down on Q1 2013. The bank’s return on tangible common equity dropped to 13% in Q1 2014 versus 17% in Q1 2013.

This is the second consecutive quarter of falling profits for JPMorgan, which is in the process of firing thousands of workers because of financial problems but managed to award its Chief Executive Office a pay rise of 74%.

“A good start to the year,” said JPMorgan’s CEO. All analysts disagreed.

JPMorgan profits fell but Wells Fargo rose

Not all banks are reporting falling profits in the US. America’s largest mortgage lender, Wells Fargo, surprised analysts when it reported a 14% increase in Q1 2014 profits. Wells Fargo added, however, that its mortgage business had slowed down and rising profits were mainly due to several equity investment gains.

Jamie Dimon, JPMorgan’s CEO, said he was pleased with the bank’s first quarter results, describing them as “good”. Tom Braithwaite, writing in the Financial Times, described JPMorgan’s first quarter financial results as “the worst start to the year in fixed income trading since the depths of the financial crisis, causing the largest US bank to report a sharp decline in profits.”

In 2013 JPMorgan paid out over $20 billion in settling legal disputes with both private litigants and the federal government. Earlier this year, Mr. Dimon described 2012 as “the most painful, difficult and nerve-wracking experience that I have ever dealt with.”

“A good start to the year”

Regarding Q1 2014 financial results, Dimon said:

“JPMorgan Chase had a good start to the year, given there were industry-wide headwinds in Markets and Mortgage. Consumer & Community Banking deposit growth and card sales volume both remain above the industry average2, and we have made significant progress in Business Banking originations – up 22%. The Corporate & Investment Bank was #1 in Global IB fees, with #1 positions in global debt and equity, global syndicated loans and global long-term debt. Gross investment banking revenue with Commercial Banking clients was up 31%. Asset Management had its twentieth consecutive quarter of positive net long-term client flows and had record loan balances, up 20%.”

“We have growing confidence in the economy – consumers, corporations and middle market companies are in increasingly good financial shape and housing has turned the corner in most markets – and we are doing our part to support the recovery. JPMorgan Chase provided credit and raised capital of over $450 billion for our clients during the first quarter of 2014, which included $5 billion for U.S. small businesses.”

Dimon concluded: “As I said in my letter to shareholders this week, we will dedicate extraordinary effort in 2014 adapting to the new global financial architecture, and we will continue to make significant progress on our control agenda. We face the future with a strong foundation, a fortress balance sheet and excellent franchises built to serve our clients.”

Dimon now faces a range of weaknesses across the bank’s business as the economic environment for bankers appears to have become much more hostile.