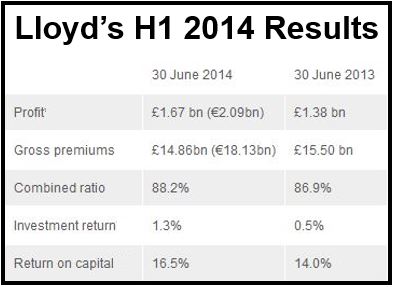

On Thursday, the world’s largest insurance and reinsurance marketplace Lloyd’s of London posted a 21% pre-tax profit jump to £1.67 billion(€2.09 billion, $2.72 billion) for H1 2014 compared to £1.38 billion in H1 2013.

The London-based reinsurer posted a return on capital of 16.5% (H1 2013: 14%), investment income of £642 million (€783 million), a Fitch ratings upgrade in June to A+ from AA-, and a combined ratio of 88.2% compared to 86.9% last year. An insurer’s combined ratio tells us how profitable its underwriting operations are – any figure below 100% means it is bringing in more money from premiums than loss claims plus expenses.

Lloyd’s warned that while the results are encouraging, market conditions “are becoming increasingly challenging.”

Inga Beale, CEO of Lloyd’s, said:

“This is an excellent set of half year results for the Lloyd’s market. This is in large part down to the market’s expert underwriting. Continued innovation, combined with robust oversight and financial strength, all ensure the successful operation of the market despite challenging conditions.”

Ms. Beale also wonders whether new technologies are helping the re-insurance industry. In an interview with CNBC on Thursday, she said “I’m not sure technology is actually helping us predict the weather any better to assist insurance.”

Ms. Beale, who joined Lloyd’s in January, said the aviation sector had suffered an “unusually high incidence (of claims). “The global aviation hull war market accounts for around $65 million of premium per annum, yet already in 2014, claims could exceed $600 million for the insurance industry. In a period when premium rates have generally fallen this is a reminder of why pricing must reflect the underlying risks which are being written,” she explained.

Chairman John Nelson, said:

“I am delighted by these half year results, especially as they come against a backdrop of an intensely competitive environment. The Lloyd’s market remains in a strong financial position, and this solid foundation means Lloyd’s is in a great position to expand in both established and high-growth economies around the world.”

Acting Finance Director, John Parry said H1 2014 was a fairly benign period for major catastrophes. When catastrophes are thin on the ground, insurance underwriters tend to have lower incomes because premiums are smaller.

The sector has become much more competitive since hedge funds have entered the reinsurance business.

According to Lloyds, governments still end up having to pay out a lot of money when disasters strike, given that there is an estimated global insurance shortfall of about $168 billion.

There are rumors in the City of London that Lloyd’s is considering leaving its 1 Lime Street building, and moving into a new development opposite known as “The Scalpel”.

Lloyd’s of London is not a company, it is a place. It is a corporate body governed by the 1871 Lloyd’s Act and other laws subsequently passed by Parliament. It is a marketplace comprising 94 syndicates that underwrite insurance at Lloyd’s. Listed companies include Amlin, Hiscox and Catlin.

Lloyd’s syndicates provide insurance and re-insurance against catastrophes (natural disasters and major accidents).