Once again, the world’s major economies have signed up to a package of measures which they say will make it much harder for multinationals to avoid corporate tax, a global habit that the general public in North America and Europe feel is grossly unfair, and lawmakers repeatedly pledge to combat.

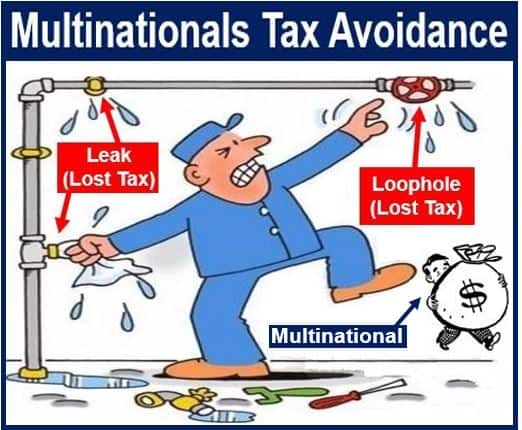

The finance ministers of the Group of 20 major economies, during a meeting chaired by Turkish Deputy Prime Minister Cevdet Yilmaz, said that this time their actions will really work. Whether they really will follow through on their pledge, or leave loopholes that clever accountants can exploit, remains to be seen.

Proposed legislation put forward by the OECD (Organization for Economic Cooperation and Development), aimed at updating rules that are nearly a century old regarding taxation of profits from international commerce, has been backed by the 20 finance ministers.

Why are there so many corporate tax loopholes for multinationals and virtually none for employees?

Why are there so many corporate tax loopholes for multinationals and virtually none for employees?

People sick of tax avoidance by multinationals

Tax avoidance by multinational giants such as Google, Amazon and Starbucks over recent years, if eliminated, would help replenish the coffers of the advanced economies’ cash-starved governments. Tight government finances have become the norm since the 2007/8 global crisis and the Great Recession that followed.

Public anger among North American and European employees has grown. While the rich get richer and giant corporations get away with what they see as daylight robbery, the middle and working classes have had to suffer very low or zero wage growth and hefty tax bills.

In an interview with Reuters, European Economic Affairs Commissioner Pierre Moscovici, said:

“This is a reaction of people who cannot stand anymore that they pay their fair share of taxes, that they contribute to fiscal consolidation while companies, especially multinationals, can avoid tax.”

Multinationals have, according to several media reports, made shady super-low tax (or zero tax) deals with the governments of Luxembourg, Bermuda, and Ireland, and have moved profits out of countries where they earned money into those nations. The result has been that although they earned billions of dollars, they paid a tiny fraction in tax. This practice is known as Base Erosion and Profit Shifting (BEPS).

Lawmakers say they will plug the loopholes

According to the 20 finance ministers in Lima on Thursday, their endorsement of the OECD proposal will close the gaps in existing international regulations.

OECD Secretary-General Angel Gurría, said:

“Base erosion and profit shifting is sapping our economies of the resources needed to jump-start growth, tackle the effects of the global economic crisis and create better opportunities for all. The G20 has recognised that BEPS is also eroding the trust of citizens in the fairness of tax systems worldwide, which is why we were called on to prepare the most fundamental changes to international tax rules in almost a century.”

“Our challenge going forward is to implement the measures in this plan, rendering BEPS-inspired tax planning structures ineffective and creating a better environment for businesses and citizens alike.”

Update October 12th, 2015: Social media giant Facebook paid just £4,327 ($6,642) in corporation tax last year in the UK, which was less than the average salaried British employee (£5,392.80) paid out in income tax and national insurance contributions.

Video – OECD launch of package to close tax loopholes

This video explains how the OECD’s BEPS (Base Erosion and Profit Shifting) package should help make it much harder for large multinationals avoid tax.