The falling pound boosted manufacturing output in the UK last month, but also sharply increased the prices of imports.

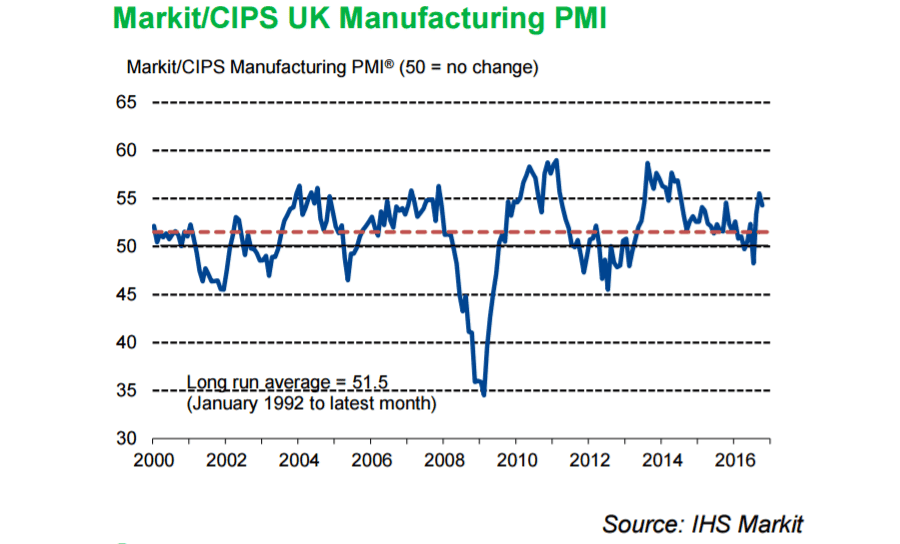

The Markit/CIPS UK Manufacturing purchasing managers’ index (PMI) dropped from a two-year high of 55.5 in September to 54.3 in October – a reading in line market expectations. Anything above 50 signals growth.

New order volumes increased for the third straight month and at a pace close to September’s recent high.

Rob Dobson, senior economist at IHS Markit, said: “The UK manufacturing sector remained on a firm footing in October and should return to growth in the fourth quarter.

“The main topic of the latest PMI survey was, however, the impact of the sterling depreciation on manufacturers.

“On the positive side, the boost to competitiveness drove new export order inflows higher, providing a key support to output volumes.”

The depreciation of the pound drove import prices up, increasing purchasing costs.

The survey revealed that 90% of companies that offered a reason for the rise in purchasing costs made some reference to the declining value of the pound sterling.

“The down-side of the weaker currency is becoming increasingly evident, however, with increased import prices leading to one of the steepest rises in purchasing costs in the near 25-year survey history,” Mr Dobson added.

“Around 90% of companies offering a reason for increased costs made some reference to the sterling exchange rate.”

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, said:

“The sector held firm in positive territory as new orders, staffing levels and overall activity rose – though generally at a slower rate than the previous month. Growth continued to be driven by both domestic and particularly export markets buoyed by the weak pound and bringing orders from China, the US and the EU.