The National Institute for Economic and Social Research (NIESR) forecasts inflation in the UK to surge to about 4% in the second half of 2017.

The decline in the value of the pound sterling, which makes imports more expensive, will pass on to consumers and prices will “accelerate rapidly” next year.

The NIESR’s latest forecast is a full percentage point increase from the 3% that it had predicted in August.

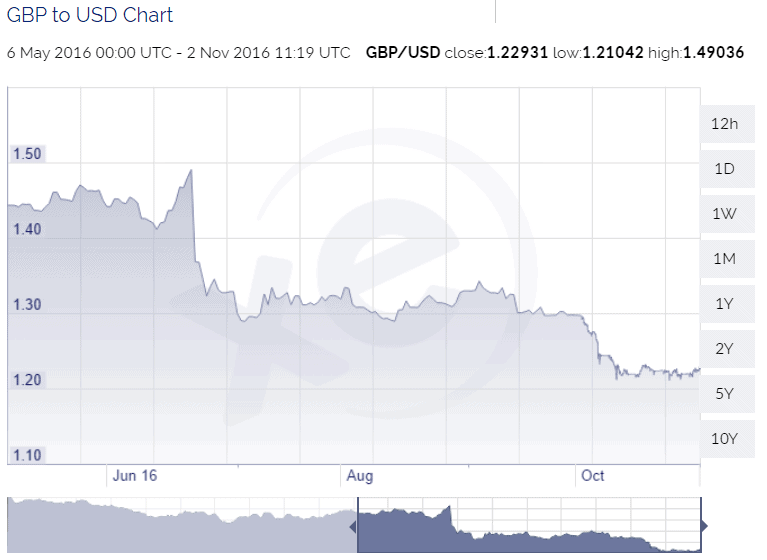

The think tank expects the pound to remain at around $1.22 and €1.11 both this year and in 2017.

Since the EU referendum vote in June the sterling has plunged to a 31-year low against the dollar and a 5-year low against the euro.

The UK economy is forecast to expand by 2% this year before slowing to 1.4 per cent in 2017 – with the triggering of Article 50 there are downside risks to next year’s outlook.

NIESR says that there are “significant risks” that could affect UK economic growth.

Dr Angus Armstrong, director of macroeconomics at NIESR, told the BBC’s Today programme:

“Households have really got a choice. Do they spend less or do they start saving less?”

Dr Armstrong pointed out that the savings ratio was at the lowest level in over seven years.

“The most likely scenario is that they [consumers] spend much less, hence weaker [growth] forecast for next year.”

NIESR expects the Bank of England to look through the near-term inflation increase and hold the stance of policy constant until the second half of 2019. “After this point, Bank Rate is expected to tighten gradually, reaching just 1¾ per cent by the end of our forecast horizon,” the think tank added.

“The slowdown in activity coupled with uncertainty could lead to a delay in firms’ hiring plans which we expect to be only partially offset by weak real wage growth. We project unemployment to peak at 5.6 per cent in 2017, before gradually returning to its long-run level.”

Simon Kirby, Head of Macroeconomic Modelling and Forecasting at NIESR said: “The positive outturns for GDP growth in the near term are very welcome, but these give little to no guidance as to what will be the long run impact from leaving the EU will be. The depreciation of sterling has been the most striking feature of the post-referendum economic landscape.

“This will pass through into consumer prices over the coming months and quarters. By the end of 2017 we expect consumer price inflation to have reached almost 4 per cent. While we expect this to be only a temporary phenomenon, it will nonetheless weigh on the purchasing power of consumers over the next couple of years”.