Investors are concerned that the shift to cloud is not making up for the decline in Microsoft Corp’s Windows and Office to big business sales. They had expected the transition to have become more evenly balanced by now.

The Redmond-based multinational giant forecast a marginal sequential fall in commercial licensing sales this quarter, with only a slight rise in cloud-based revenue for the quarter ended December 31, 2014.

While investors favor Microsoft’s move from the old model of selling software to businesses to install in their computers, to a cloud based model, the transition is not plain sailing.

With the old model, customers paid a license fee up front, while with the cloud-based model they pay a regular subscription, i.e. before Microsoft had lots of cash right at the beginning, but now it receives that money spread out over the year.

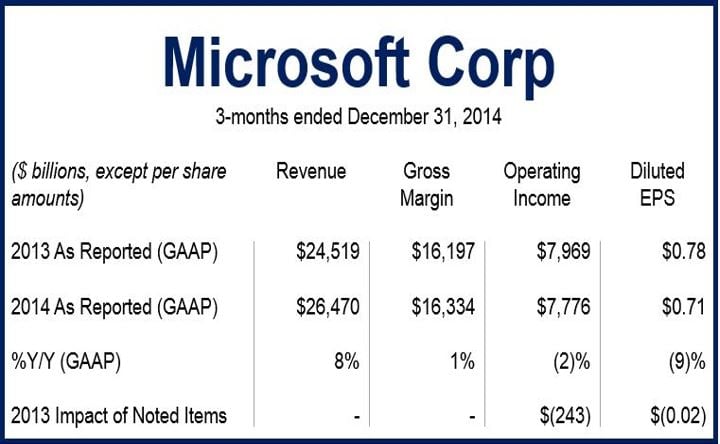

Source: Microsoft Corp.

For the quarter ended December 31, 2014, Microsoft announced revenue of $36.5 billion. Gross margin, operating income, and diluted EPS (earnings per share) were $16.3 billion, $7.8 billion and $0.71 respectively.

The company wrote in a statement today:

“These financial results include $243 million of integration and restructuring expenses, or a $0.02 per share negative impact, related to both Microsoft’s restructuring plan announced in July 2014 and the ongoing integration of the Nokia Devices and Services (“NDS”) business. There is also a $0.04 per share negative impact related to income tax expense resulting from an IRS audit adjustment.”

Microsoft added that it also intends to complete the existing $40 billion share repurchase authorization by the end of 2016.

Chief executive officer of Microsoft, Satya Nadella, said:

“Microsoft is continuing to transform, executing against our strategic priorities and extending our cloud leadership. We are taking bold steps forward across our business, and specifically with Windows 10, to deliver new experiences, new categories, and new opportunities to our customers.”

Amy Hood, executive vice president and chief financial officer of Microsoft, said:

“We remain disciplined in our approach to operational and execution excellence, balanced with investments that drive meaningful growth for the business while increasing capital return to shareholders.”

Ms. Hood said on Monday the company expected sales from commercial licensing to be approximately $9.7 billion to $9.9 billion in Q2, compared to $10.7 billion for the last quarter. The decline was due to the continuing sluggish market for new PCs, which drives sales of new Office and Windows software.

PC sales surge over

The slight increase in PC sales observed last year, as companies replaced their old computers running on Windows XP, is over, she added. The strong dollar is expected to reduce earnings by about 4%.

Microsoft forecasts revenue for its cloud-based businesses to be from $2.6 billion to $2.7 billion this quarter, compared to $2.6 billion in the last quarter.

According to Mr. Nadella, the company is on its sixth consecutive quarter of triple-digit growth in its commercial cloud business. However, investors point out that the growth comes from a relatively small figure last year.