Impressive Financial Performance with Revenue Growth

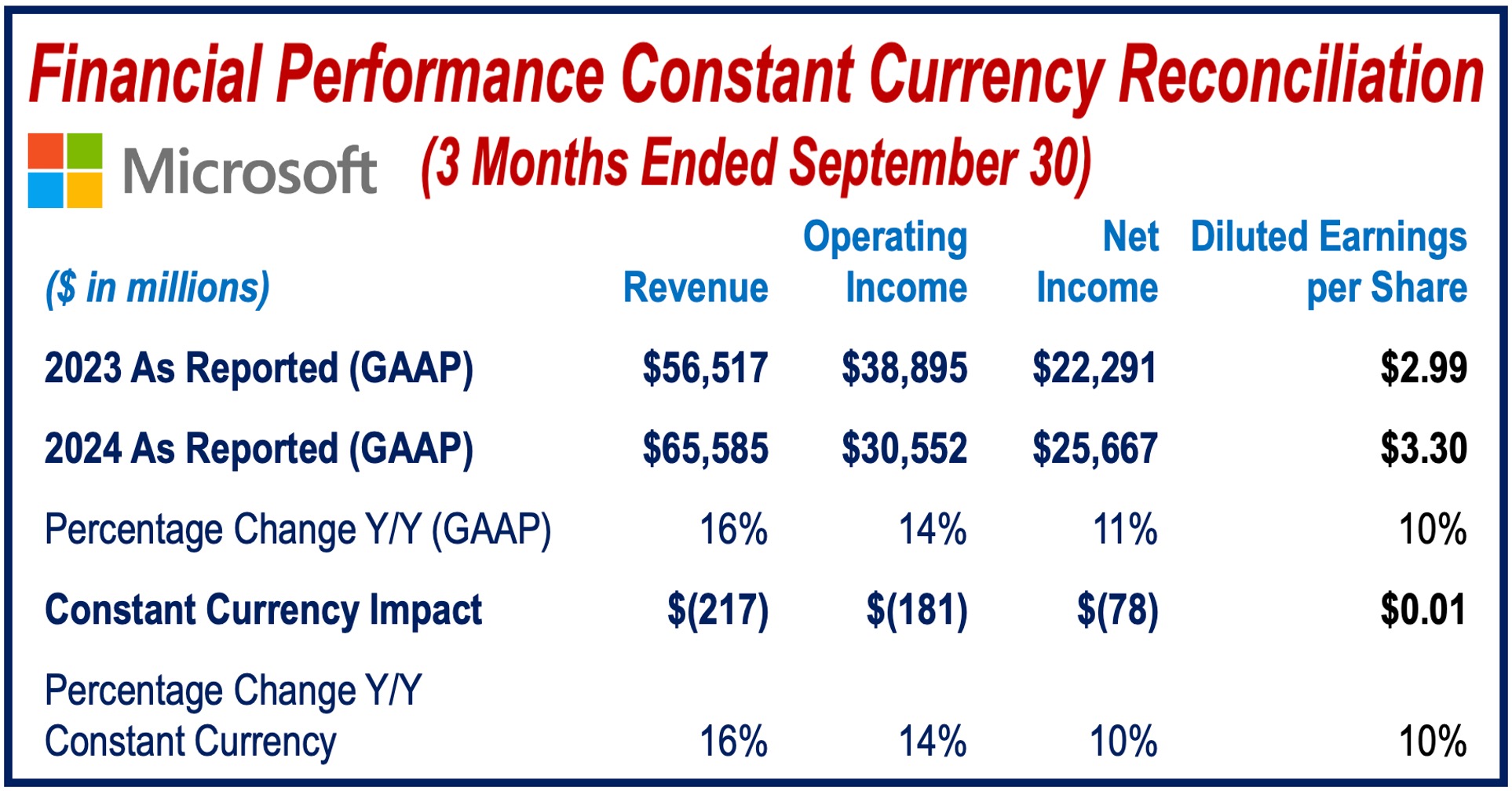

Microsoft Corporation reported revenue of $65.6 billion for Q1 of fiscal year 2025, marking a 16% year-over-year increase. Analysts had expected revenue of $64.5 billion.

Earnings per share, at $3.30, were higher than the same period last year, showcasing the company’s ability to leverage its cloud and Artificial Intelligence (AI) assets in a fiercely competitive landscape.

What is Microsoft’s Fiscal Year?

For Microsoft, fiscal year 2025 (FY25) runs from July 1, 2024, to June 30, 2025. The first quarter of 2025 (Q1 of FY25) covers the period from July 1, 2024, to September 30, 2024.

This differs from the calendar year, as Microsoft’s fiscal year starts in July and ends in June the following year. Fiscal means relating to a company’s financial year for accounting and budgeting purposes.

Azure and Intelligent Cloud Lead the Way

-

Azure

The Azure cloud service, one of Microsoft’s major success stories, saw revenue surge by 33%, surpassing predictions and reflecting the company’s continued investments in artificial intelligence (AI) and cloud infrastructure.

Azure’s notable growth, boosted by a 12-point increase, was partly due to demand for its AI capabilities. These capabilities support applications like Dynamics 365 and Microsoft 365—two very popular productivity tools.

-

Intelligent Cloud Division

Microsoft’s Intelligent Cloud division saw overall revenue grow by 20% to $24.1 billion.

This division, which includes Azure, is central to Microsoft’s strategy as it focuses on expanding its AI offerings, particularly in generative AI.

* Generative AI is a type of artificial intelligence that creates new content—such as text, images, music, or code—based on patterns learned from existing data. Examples include ChatGPT for text and DALL-E for images.

Satya Nadella, chairman and chief executive officer of Microsoft, made the following comment regarding AI:

“AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business process. We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.”

Other Key Segments and Future Outlook

-

Productivity and Business Processes Division

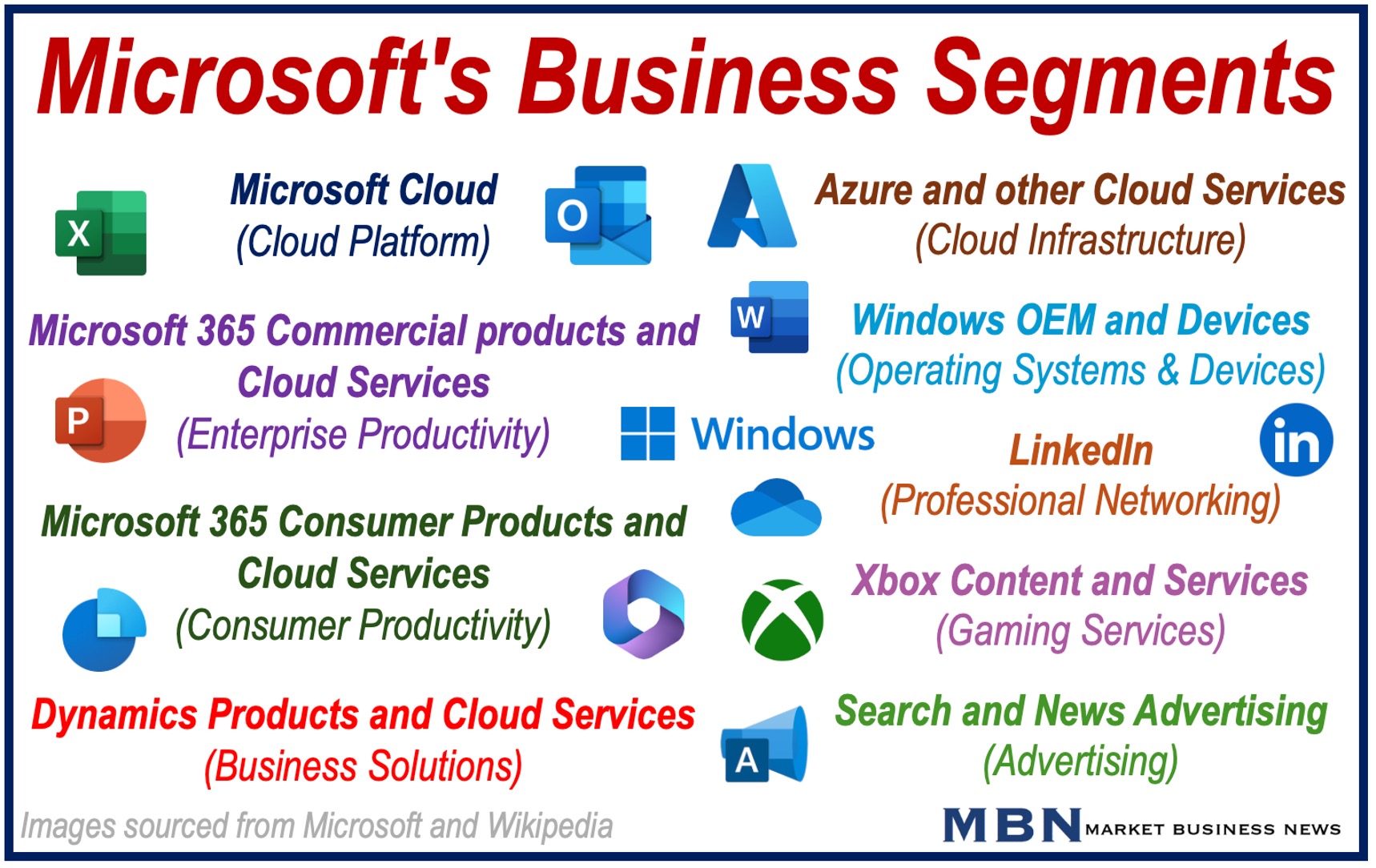

Microsoft’s Productivity and Business Processes division, which includes Microsoft 365, LinkedIn, Dynamics 365, Teams, Power BI, and SharePoint, generated $28.3 billion in revenue, a 12% increase year-over-year.

-

More Personal Computing Division

Microsoft’s More Personal Computing division, which includes Windows OEM, Surface devices, Xbox hardware, Xbox content and services, Bing search, and news advertising, experienced notable gains, with revenue climbing 17% to $13.2 billion.

Xbox content and services saw revenue grow by 61%. This was partly due to Microsoft’s acquisition of Activision Blizzard, a video game development and publishing company.

However, Xbox hardware sales continued to drop. Gamers are shifting from Xbox consoles to cloud-based gaming services and other platforms, where Microsoft has made its games more widely accessible.

Revenue from Windows OEM and Devices, which involves partnerships with PC manufacturers, increased modestly by 2%, suggesting a stable but mature market that may be in the cash cow phase.

* OEM stands for Original Equipment Manufacturer. In the context of Windows OEM, it refers to versions of Windows that are pre-installed on devices (like PCs or laptops) by the manufacturer, such as Dell or HP, before being sold to consumers.

Continued Investment in AI and Infrastructure

Looking forward, Microsoft projects steady growth, driven largely by its AI and cloud offerings.

However, the company expects growth to be slightly slower in the second quarter as competition in the AI sector from companies like Amazon and Google intensifies.

It forecasts revenue in Q2 will range from $68.1 billion to $69.1 billion, which is slightly less than analysts’ expectations.

Investing in cloud services and AI requires substantial financial resources. Microsoft’s spending on infrastructure has increased by 50% from last year to meet the high demand for its AI services.

Conclusion

Microsoft’s first quarter of fiscal year 2025 has started well, with a strong foundation built on cloud and AI services. Revenue has increased solidly, as has profitability in the company’s core business areas.

The company has consistently exceeded expectations despite rising costs, underscoring its leading position in the technology market.

Investors will be watching closely as Microsoft navigates the opportunities and challenges of the fast-growing AI market.