Morgan Stanley profits increased by 56% in the first quarter of 2014; the financial services giant reported rising revenues in all of its major business. Analysts were surprised that its fixed-income and commodities trading business also posted good results.

Morgan Stanley, founded in 1935, is today one of the world’s largest investment banks, with operations in over 42 nations and approximately 60,000 employees.

Since taking over as CEO from John Mack in 2010, James Gorman has been restructuring the whole company. He scaled back the historically volatile fixed-income trading arm and boosted the company’s wealth-management business.

A Morgan Stanley press release quotes Mr. Gorman, who said:

“This quarter we generated higher year-over-year revenues in all three of our business segments, demonstrating the momentum we have built across the Firm.”

“We continue to execute on our multi-year strategy to deliver consistent returns for our shareholders through revenue growth and strong expense discipline. We are pleased that this year we will commence a further share repurchase of up to $1 billion and double our dividend.”

Gorman’s overhaul paying off

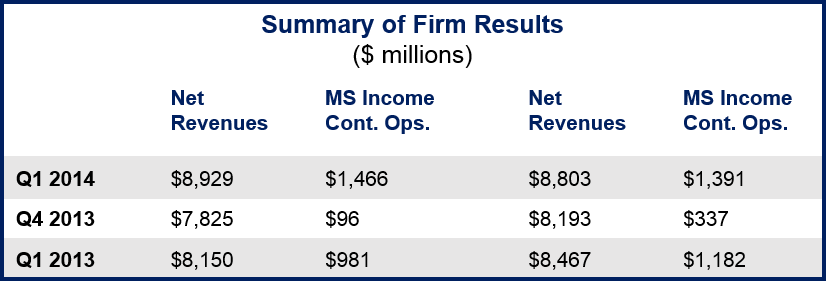

Gorman’s strategy appears to have paid off as far as Q1 2014 is concerned. Morgan Stanley’s net income increased from $962 million to $1.51 billion this quarter. The firm earned 74 cents (68 cents excluding accounting adjustments) on a per-share basis, much higher than the 59 cents predicted by a Thomson Reuters poll of analysts.

Revenues grew by 10% to $8.93 billion, or 4% to $8.8 billion excluding accounting-related adjustments linked to its own debt prices.

Investment banking and trading arm surprised analysts

Over the last few quarters, Morgan Stanley’s wealth-management arm had been the main contributor to income growth.

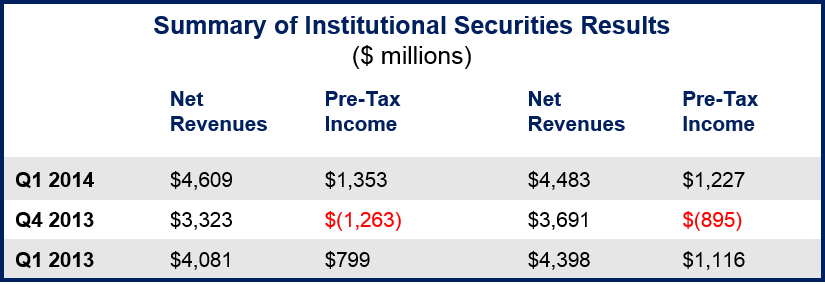

In Q1 2014, however, the company’s traditional business of investment banking and trading provided a surprise boost.

The company’s two businesses, which form part of its institutional securities unit, reported revenues of $4.6 billion, a 3-year record.

Gorman’s big bet on wealth-management is looking healthy as commissions, fees and interest collected by its 16,000+ brokers pushed the business’ Q1 2014 net income 13% higher than in Q1 2013 to $423 million.

Morgan Stanley has more brokers than any other company in the world.

Wealth management during the first quarter of 2014 represented 40.6% of Morgan Stanley’s total revenue, and 30% of the company’s pretax profit from continuing operations.

(Source: Morgan Stanley)

Moving income from commissions to fees

Brokers at Morgan Stanley are basing more of their sales on fee-based accounts instead of transaction-based commissions and encouraging brokerage clients to purchase mortgages and other loans from their bank affiliate. This trend is occurring in other financial institutions such as Wells Fargo Advisors, and Merrill Lynch.

Morgan Stanley has caught up with its main rival Goldman Sachs – both companies have reported approximately $33 billion in overall revenue over the last 12 months. In 2012, Goldman was $7.5 billion ahead, and $21 billion ahead in 2009.

Last year was seen as a success for Gorman, who managed to achieve four consecutive quarters of profits.

(Source: Morgan Stanley)

Goldman Sachs is still ahead regarding return-on-equity. While Morgan Stanley’s exceeded 8% in Q1 2014, Goldman Sach’s was ahead by two percentage points.

Morgan Stanley says it is aiming towards having less than $180 billion of risk-weighted fixed income assets by the end of next year, so that it can free up capital. Its decision to dive deeper into the wealth-management business has helped shield it from the shrinking fixed-income trading revenue that has afflicted all Wall Street institutions since 2009.