The total number of mortgage approvals in the UK in November for home buyers declined to a nearly 18-month low, while consumer credit jumped to a seven-year high, the Bank of England reported on Friday.

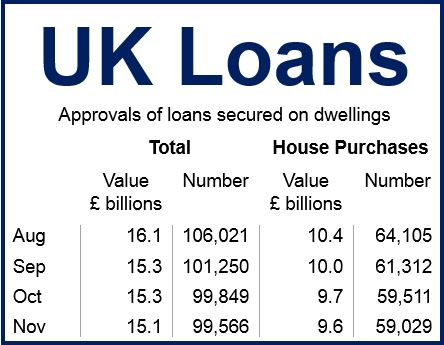

There were 59,029 mortgage approvals for home purchases worth £9.6 billion in November – the lowest monthly total since June 2013. Over the previous six months, mortgage approvals had averaged (monthly) 63,191.

Consumer credit, which includes loans, overdrafts and borrowing on credit cards in the run-up to Christmas saw the steepest rise since 2008.

November consumer credit grew by £1.3 billion, compared to the (average) monthly increase of £1 billion recorded during the previous six months. The last time this expansion was exceeded was in February 2008 (£1.4 billion increase).

According to National Debtline and StepChange, the BoE’s figures showed an alarming rise in consumer’s reliance on credit. The charity warned it expects a deluge of borrowers seeking help when they get their next credit card bills.

Source: “Money and Credit: November 2014,” Bank of England.

StepChange Debt welcomed the new cap on payday loans which came into force on January 2nd, 2015. CEO Mike O’Connor said on the day the cap came into force:

“Today ought to herald a new chapter for payday lenders and their customers, with more responsible lending and less detriment to consumers. But the FCA must be watchful that new products and practices don’t emerge that circumvent the cap. Caps on interest and charges are welcome, but on their own they only deal with part of the supply side of the problem, not the demand.”

“Every week, more than 10,000 people come to us in financially desperate situations. Millions are living on the edge of falling into problem debt, and these people need much more support so that short-term high-cost credit is not seen as the best, or indeed only, answer. The economy is growing but 2015 will still be tough for many. We need a comprehensive action plan to tackle problem debt and help 2.9m individuals and their families in severe problem debt get back on their feet.”

The Bank of England’s report backs the findings published by the British Bankers’ Association in December 2014.