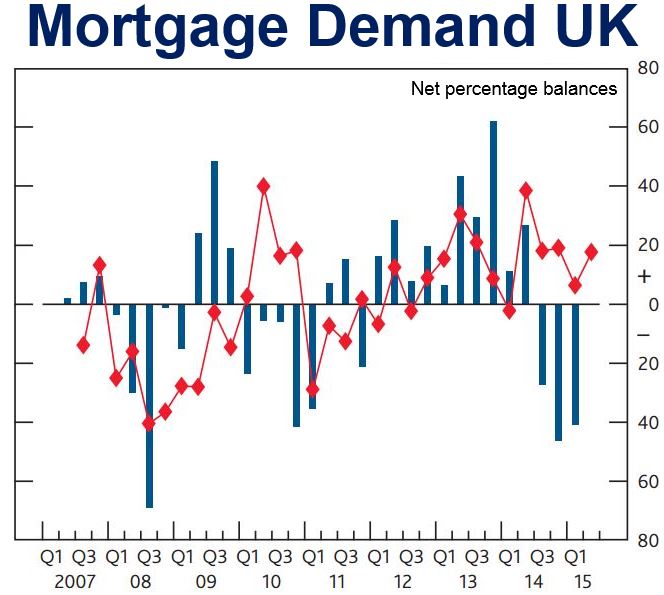

Mortgage demand declined steeply in the UK in the first quarter of 2015, according to the Bank of England’s Credit Conditions Survey, making it the third successive quarter to post a fall.

Mortgages for more expensive properties posted the biggest decline in demand since Q3 2008.

Most experts across the country are expecting demand to bounce back in the second quarter.

Several UK lenders said the decline in demand over the last three quarters was due to changes in regulatory policy, concerns regarding housing affordability, and uncertainty about the future of the housing market.

Source: Credit Conditions Survey – 2015 Q1.

In an interview with the BBC, Jonathan Samuels, CEO of Dragonfly Property Finance, said:

“For demand to have fallen particularly sharply at the upper end of the market underlines the sensitivity of this demographic to political uncertainty.”

“Many prime and super-prime buyers are sitting on their hands and want to see what the next government looks like before they commit to a purchase. That this is the most uncertain election in decades has certainly triggered more caution at this level of the market than normal.”

Demand for credit card lending from households fell slightly in the first quarter, and is expected to remain unchanged in the next quarter, the report informed.

Demand from households for other unsecured lending products, such as personal loans, also declined marginally in Q1, but was expected to increase in Q2.

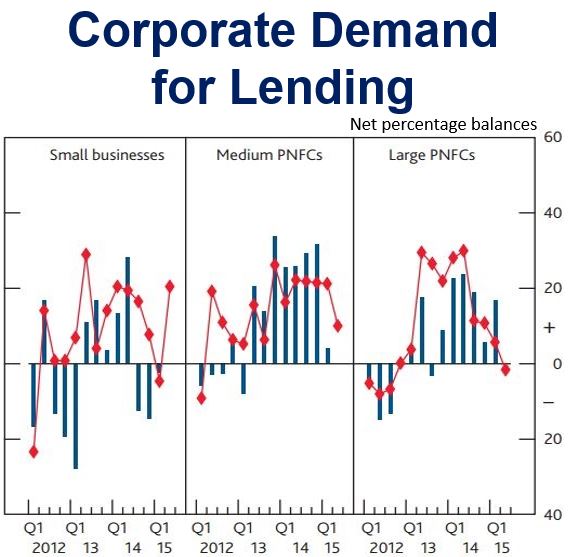

Source: Credit Conditions Survey – 2015 Q1.

While demand from large companies grew in the first quarter, demand from small enterprises and medium-sized firms remained unchanged. The report authors expect lending demand from small businesses to rise considerably in Q2.

According to the survey, in the first quarter lenders appeared to be more willing to lend to borrowers who could only raise a deposit of less than 10% of the value of the property they sought to buy. A large proportion of these borrowers were first-time buyers.