Pay increases, excluding bonuses, are expected to slow down over the next twelve months to 1.8% from 2% during the previous three months, says a new report by the Chartered Institute of Personnel and Development (CIPD).

Consistent with the findings of the 2014-2015 winter report, median pay hike expectations are lower in the public sector (1%) than in the private (2%) and voluntary (1.4%) sectors.

“The modest falls are consistent with other survey indicators (XpertHR, EEF). When we compare the current average pay forecasts with the LMO pre-recession average, we see that the average pay increase remains well below the pre-recession levels. In spring 2008, the average (mean) pay increase forecast was 3.6%.”

Source: cipd.co.uk

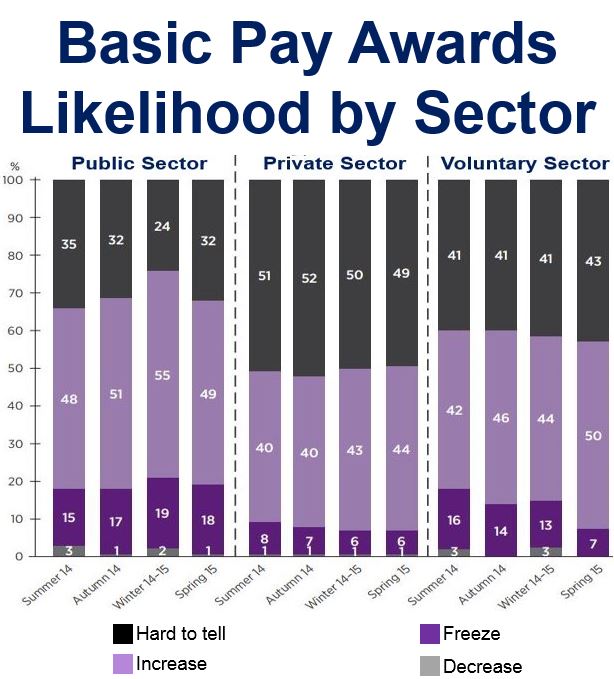

Forty-five percent of employers who are currently planning to make a pay decision in the next year expect basic pay to rise within their organisation, compared to 9% who plan to freeze pay. The figures are the same as those in the 2014-15 winter report.

Forty-five percent of employers said they did not know how their organisation’s basic pay will be affected with the next pay decision, or that it is too difficult to tell and will depend on how their organisation performs.

This is less prevalent in the public sector (32%) than the private sector (49%).

The distribution of pay increases is fairly evenly spread. Thirty-four percent of employers expect to raise pay by 0.1% to 1.99%, thirty percent expect an increase of 2% to 2.99%.

Twenty percent of employers plan to increase pay by at least 3%.

Reasons for pay award decisions

Employers reporting planned pay awards of at least 2% say inflation or the cost of living (51%) are the main reasons for their decision. Thirty-six percent said it was because of their ability to pay, while 33% said their decision was driven by the market rate.

When employers were asked why they could not match the inflation rate target of 2%, pay restraint in the public sector (41%) was the main reason.

Thirty-two percent of employers said they could not afford to pay more as their main reason for deciding on awards below 2%.

The Bank of England is watching pay hikes closely as it considers when to begin raising interest rates, which for the past six years have been at a record-low of 0.5%. Analysts expect official data (that will be published on Wednesday) to show that overall pay grew by 1.7% in the first quarter of this year.