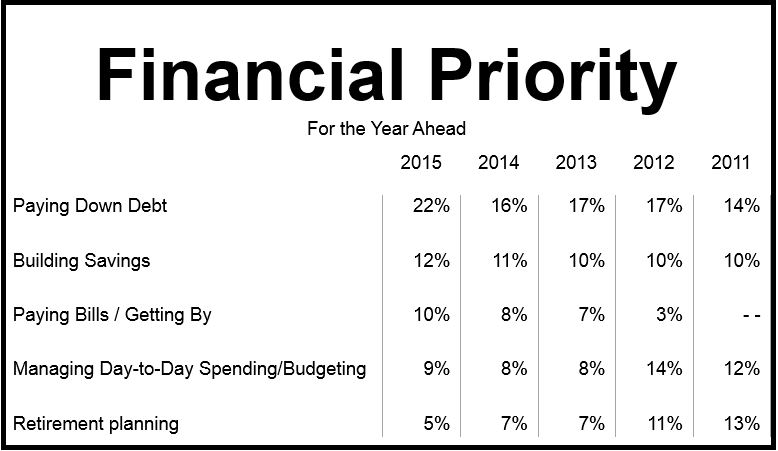

Canadians see paying down debt as their top financial priority for 2015, a CIBC poll informed on Tuesday. The poll, carried out by Nielsen on CIBC’s behalf, found that retirement planning is increasingly being pushed back as people focus on more pressing matters.

This is the fifth successive year that Canadians responded with debt repayments as their number one concern. Even those nearing retirement age have shifted their focus to reducing debt.

Christina Kramer, Executive Vice President, Retail and Business Banking, CIBC, said:

“Not only have Canadians told us debt repayment is their number one financial priority for five years running, for 2015 we see an even greater number of Canadians focused on better managing debt in the year ahead.”

“While it is encouraging that paying down debt is important to Canadians, it is also important not to lose sight of longer term goals like retirement planning.”

Source: CIBC Poll.

Baby boomers also focused on debt

Respondents reaching retirement age also placed paying down debt as their top priority. More Canadians aged between 45 and 64 placed debt repayment as their top priority today than last year. People born between about 1945 and 1965 are a baby boomers.

Thirty-one percent of 45 to 54 year-olds said their top financial priority for 2015 was to pay down debt, compared to 16% in 2013.

Twenty-five percent of 55 to 64 year-olds said the same, versus 14% in 2013.

Ms. Kramer said:

“We’ve seen debt repayment close to doubling in importance for age groups that would typically be in their peak retirement savings years, but it is important that they don’t put off retirement planning indefinitely. The good news is that by getting advice and taking small steps now, you can still focus on your retirement savings at the same time as you tackle your debt.”

The poll also found that only 45% of Canadians have met with an advisor this year, compared to 47% in 2013. Ms. Kramer explained that talking to an advisor and creating a financial plan is key to helping people get ahead of their debt and “reach their broader financial goals in 2015.”