Out of 34 OECD countries, 25 have had increases in personal income tax over the past 36 months, as nations bring down the value of tax-free allowance and tax credits and raise the tax burdens on labor income, according to a new OECD Taxing Wages publication.

Portugal and the Slovak Republic saw the greatest increases in tax burdens on labor income in 2013, the former due to higher statutory rates and the latter because of higher employer social security contributions.

The US was also among the countries with the highest personal income tax rises, due to the expiry of previous reductions in employee social security contributions (SSCs).

Personal income tax increased in 2013

Across the 34 nations belonging to the OECD, the average tax burden on employment incomes rose 0.2 of a percentage point in 2013, reaching 35.9%. It was raised in 21 out of 34 countries last year, remained unchanged in one, and dropped in 12.

Personal income tax increased significantly in 2011 and moderately in 2012. Since 2010, personal income tax has risen in 21 OECD nations, and declined in 9, partially reversing the declines from 2007 to 2010.

Income tax and wealth distribution

The report includes a special chapter which assesses how effectively income taxes have been in achieving a better distribution of wealth in OECD countries since 2000.

In a press release, the OECD wrote:

“The design and interaction of personal income tax systems, social security contributions and benefit systems is shown to have become more progressive for low-income households across the OECD, particularly since the global economic crisis began in 2007, and notably for poorer households with children. This is principally attributed to growth in targeted tax credits or “make-work-pay” provisions for low-income workers, as well as increased child benefits for low-income households.”

On the other hand, **progressiveness in taxation for childless single mothers or high earners is little changed, although there are wide differences between nations.

** Progressive income tax is a system which takes a greater proportion of high-earners’ income than that of low-earners.

(Source: OECD Taxing Wages 2014)

Personal income tax on childless single workers

The greatest rises in progressive taxation for single people without children occurred in Slovenia, Sweden and Ireland, with the greatest decreases in childless single taxpayer progressivity seen in Israel, Hungary and Germany.

Taxing Wages also reported:

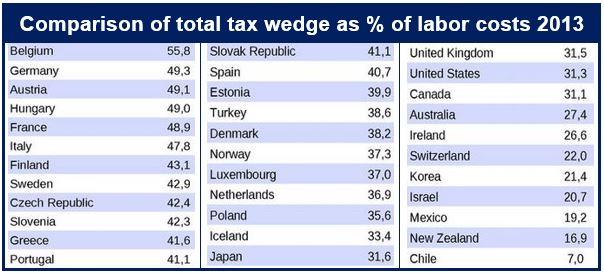

- The countries with the highest personal income tax levels for single workers without children earning the average wage in their country were Belgium 55.8%, Germany 49.3%, Austria 49.1%, and Hungary 49%. The lowest were in Mexico 19.2%, New Zealand 16.9% and Chile 7%.

- Between 2007 and 2010, the average tax burden for individuals earning the average wage rose by a 0.8 percentage point, reaching 35.9%. It had dropped to 35.1% from 36.1% between 2007 and 2010.

- The main contributor to the 2013 rise in the average OECD total tax wedge was personal income tax, with twenty nations reporting increases as percentage of labor costs. Portugal (+3.5 percentage points) and Luxembourg (+1.1) had the highest increases.

- In nations where the tax level dropped, reductions in employer PIT and SSCs were the key factors. The greatest declines in the tax burden were in the Netherlands (minus 1.8 percentage points) Greece (-1.4) and France (-1.2). In France, the burden of employer SSCs was reduced by 1.9 percentage points due to a new tax credit for competitiveness and employment.

- The highest tax wedges for families with two children and just one earner at the average salary were in Greece 44.5%, France 41.6%, Belgium 41%, and Austria 38.4%. New Zealand (2.4%) had the lowest, followed by Ireland 6.8%, Chile 7% and Switzerland 9.5%. The average for all OECD members was 26.4%.

- New Zealand, Portugal and the Slovac Republic reported the highest increases in the tax burden for one earner families with children (+1.9, +1.9, and +1.8 respectively). France and the Netherlands had the largest fall (-1.5 percentage points each).

In all OECD member states, with the exception of Chile and Mexico, the tax wedge for families with children is lower than for childless workers. The differences are especially large in Slovenia, Ireland, Germany, Luxembourg and the Czech Republic.