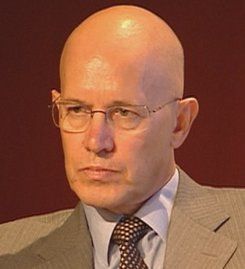

Novo Banco now has a new leader. Eduardo Stock da Cunha, an audit director at Lloyds Banking Group, has been appointed by Portugal’s central bank to head Banco Novo.

Three Novo Banco executives resigned because their mandate had been changed. Novo Banco was the bank that kept the good assets after Banco Espírito Santo SA crashed.

The three men were appointed to run Banco Espírito Santo, the country’s largest lender, in July. Within a few days they reported the bank’s massive exposure to bankrupt companies. The collapse of Espírito Santo was the biggest commercial crash of any company in the history of Portugal.

The bank had been run by the Espírito Santo family as part of several family-controlled enterprises. In 2014, regulators expressed concern about a string of irregularities in the finances of its corporate parent.

Since the collapse of Banco Espírito Santo, several companies controlled by the family have sought protection from creditors.

Banco Espírito Santo was split into Novo Banco (the good bank) and a “bad bank”.

CEO Vitor Bento, deputy CEO José Honório, and Chief Financial Officer João Moreira Rato, were appointed to run (the “good bank”) Novo Banco, which would eventually be sold.

Mr. Bento and team took over after family patriarch, Ricardo Espírito Santo Silva Salgado, resigned as executive chairman. Not long after resigning, Mr. Salgado was arrested on suspicion of tax evasion and money-laundering. He had to post €3 million ($3.88 million) bail.

Mr. Salgado’s intention had been to appoint someone of his own choosing to take over, but the central bank insisted on a team with no connections to the family.

Banco Espírito Santo posted an H1 2014 loss of €3.58 billion.

Novo Banco executives stress there was no conflict

In an official statement, the three executives emphasized that they were not leaving due to any conflict. They said:

“Our decision to resign is because our mandate significantly changed since we started our roles, in the middle of July.”

The Banco de Portugal, Portugal’s central bank, announced its aim is to have a bank with a stable shareholding structure as soon as possible. “The new management of Novo Banco, which will be unveiled as soon as certain procedures are finished, will guarantee the development of a project that creates value for the bank,” it wrote.

According to Portuguese media, there had been a disagreement between the executive team and the Banco de Portugal regarding the long-term strategy of Novo Banco.

Portuguese newspaper Expresso wrote that the team had wanted the bank to be sold off over the medium term, while the Banco de Portugal sought to sell it as soon as possible.

A total of €3.9 billion had been used to bail out the bank. The Banco de Portugal is keen on recovering this money immediately. The three executives felt more time was needed to solidify Banco Novo.

The Banco de Portugal says it will soon have a replacement team to run Novo Banco, and emphasized again today that it plans to sell the bank “within the shortest reasonably feasible period.”

A test for EU’s new rules

How the Banco de Portugal deals with the collapse of a major financial institution is seen by experts as a test of the new regulations in the European Union on how to manage a failing bank. The new rules aim to reduce the cost to the taxpayer to a minimum, while at the same time protecting the financial system.

This potential financial shock comes just three years after Portugal received a €78 billion bailout from the IMF (International Monetary Fund), the European Central Bank, and the EU. Portugal, along with Spain and Greece were badly damaged by the global financial crisis.