Tim Cook, the CEO of Apple, the world’s richest company, is accusing the European Commission, the world’s largest bureaucracy, of ‘political crap’ in its ruling that the multinational technology giant owes the Irish government €13 billion ($14.5bn) in taxes, and only paid 0.005% tax in Ireland in 2014.

The European Commission says that Apple received what was effectively a €13 billion subsidy when the Irish government gave it preferential tax deals, and that the world’s richest company must pay back that money.

Ireland is a pawn in the wider European Commission plan to harmonise taxes across the EU, Mr. Cook claimed.

Should the world’s richest company get away with paying just 0.005% tax? That is not the question. The question is: Did Apple get preferential treatment that was not available to all companies, from the Irish Government? The European Commissioner for Competition thinks it did, and that it was effectively a subsidy.

Should the world’s richest company get away with paying just 0.005% tax? That is not the question. The question is: Did Apple get preferential treatment that was not available to all companies, from the Irish Government? The European Commissioner for Competition thinks it did, and that it was effectively a subsidy.

Despite having some serious misgivings now regarding the European Commission’s attitude to businesses as soon as they become successful, Mr. Cook emphasized that his company will definitely continue with its expansion plans in Cork, a city in southwest Ireland.

Apple and Irish government will appeal ruling

Apple plans to appeal against the European Commission’s ruling, and said it sincerely hoped that the Irish government would do so too.

The Irish government has said it has decided to appeal against the ruling. Its decision needs to be endorsed by parliament next Wednesday. According to most Irish media sources, parliament will definitely endorse the appeal, even though it is a huge amount of money, especially for heavily-indebted Ireland – more than €2,800 per head of the population.

In an exclusive interview with the Independent.ie, Mr. Cook said regarding Apple and the Irish government:

“I think we’ll work very closely together, as we have the same motivation. No one did anything wrong here and we need to stand together. Ireland is being picked on and this is unacceptable. It’s total political crap”

“They just picked a number from I don’t know where. In the year that the Commission says we paid that tax figure, we actually paid $400m. We believe that makes us the highest taxpayer in Ireland that year.”

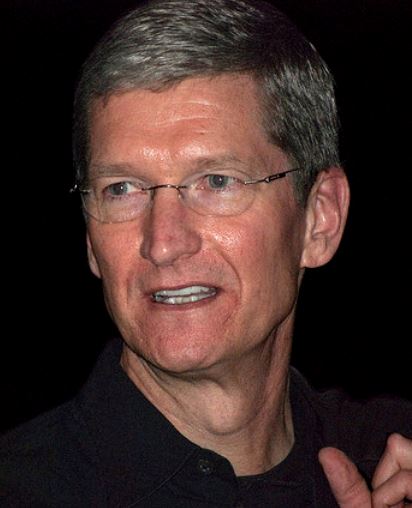

Tim Cook, Apple’s Chief Executive Officer, believes the European Commission is picking on Ireland for political reasons, in order to harmonise the tax system across the whole European Union. (Image: Wikipedia)

Tim Cook, Apple’s Chief Executive Officer, believes the European Commission is picking on Ireland for political reasons, in order to harmonise the tax system across the whole European Union. (Image: Wikipedia)

Mr. Cook said that Margrethe Vestager, the European Competition Commissioner, was wrong when she claimed that his company just paid 0.0005% tax in 2014 in Ireland.

According to Ms. Vestager, over a period of ten years Apple had improperly routed taxable income into a subsidiary that appears to have no physical head office anywhere in the world.

Apple said it played by the rules

The Irish government and Apple’s board of directors insist that they have ‘played by the rules’ and will win the case on appeal.

Mr. Cook accuses the European Commission of playing politics. “I can’t see another explanation for it. So I think it clearly suggests that this is politics at play,” he added.

If the European Commission wants to harmonize the tax system across the European Union (EU), it should invite public discussion rather than taking its current underhanded approach, said Apple’s CEO.

Jack Lew, the United States Secretary of the Treasury, said this retroactive €13 billion tax bill is an attempt by the EU to snatch taxes that are owed to the US Treasury.

The European Commission has other giant multinationals in its sights, including Starbucks, McDonald’s, Amazon.com and Fiat.

US Treasury Secretary Jack Lew says the European Commission is singling out American companies for tax investigations. “I have raised the issue that the pattern of the action appears to be highly focused on U.S. firms. They point to some small actions against non-U.S. firms, but the largest actions do appear to be aimed squarely at our tax base.” (Image: Wikipedia)

US Treasury Secretary Jack Lew says the European Commission is singling out American companies for tax investigations. “I have raised the issue that the pattern of the action appears to be highly focused on U.S. firms. They point to some small actions against non-U.S. firms, but the largest actions do appear to be aimed squarely at our tax base.” (Image: Wikipedia)

While nearly everybody in Europe agrees that the move is a political one, it is not a case of attacking corporate America, but rather one of showing eurosceptics at home that it can act in the interest of its voters (citizens). Eurosceptics threaten to pull the EU apart, and have frequently accused it of being bending too much for the corporate world at the expense of its citizens.

No special treatment?

Several lawyers in Europe say that Apple’s arrangement with the Irish authorities was legal and theoretically available to other companies too, so it could not have received an advantage that was selective – this would make the accusation of state aid invalid.

Reuters quoted Tim Wach, Global Managing Director at Taxand, who said:

“There’s nothing that I have seen in any of the cases that have been taken by the European Commission that suggests there is selective application of the rules.”

Other lawyers, however, point out that Apple’s bizarre tax structure – involving companies with no physical head office – means its tax rulings probably do not have many close comparators. The arrangement led to an incredibly low tax rate – something the vast majority of other companies did not enjoy.

Many lawyers believe that Apple’s legal team will find it extremely hard to overturn the selectivity argument.

Ireland and some other European nations attract many US companies that decide to base there operations there. The United States has the highest corporation tax rates among the advanced economies – 40% in the US compared to just 15% in Ireland.

The Austrian Chancellor Christian Kern said his country’s sausage stalls paid more tax than Starbucks or Amazon.inc.

Video – EU Apple Tax Ruling

Besides Apple, European Commission regulators have been investigating the tax arrangements between its member states and several American companies, including McDonald’s, Amazon and Google.