The latest US Producer Price Index (PPI) from the Bureau of Labor Statistics revealed a notable increase for October, raising concern among economists, investors, businesspeople, and policymakers about persistent inflationary pressures.

The PPI, which measures producer prices—that is, wholesale prices paid by businesses for goods and services—rose by 0.2% for the month and 2.4% on an annual basis.

October’s figure follows a revised annual increase in September of 1.9%.

What is PPI and Why Does It Matter?

As mentioned above, the PPI measures the average change in price that producers charge for their goods and services.

Think of it as an early warning sign for inflation: if producers charge more and businesses must pay more for supplies, those costs often get passed on to consumers in the form of higher prices.

A change in PPI can take a few months to a year to work its way through to the economy’s overall inflation rate, depending on several factors such as supply chains and how businesses handle rising costs.

Current producer prices help us understand where inflation may be headed. It is a crucial figure for central bankers, who in the US are part of the Federal Reserve System (Fed). The Fed uses this data to make decisions about interest rates.

If the Fed had been considering cutting interest rates over the past month but then saw an increase in the latest PPI figure, they might decide to delay the rate cut and wait for the next month’s data.

October Producer Prices See Notable Increase

October’s PPI growth was in line with market expectations. However, it is an indication that inflation has not yet been fully tamed.

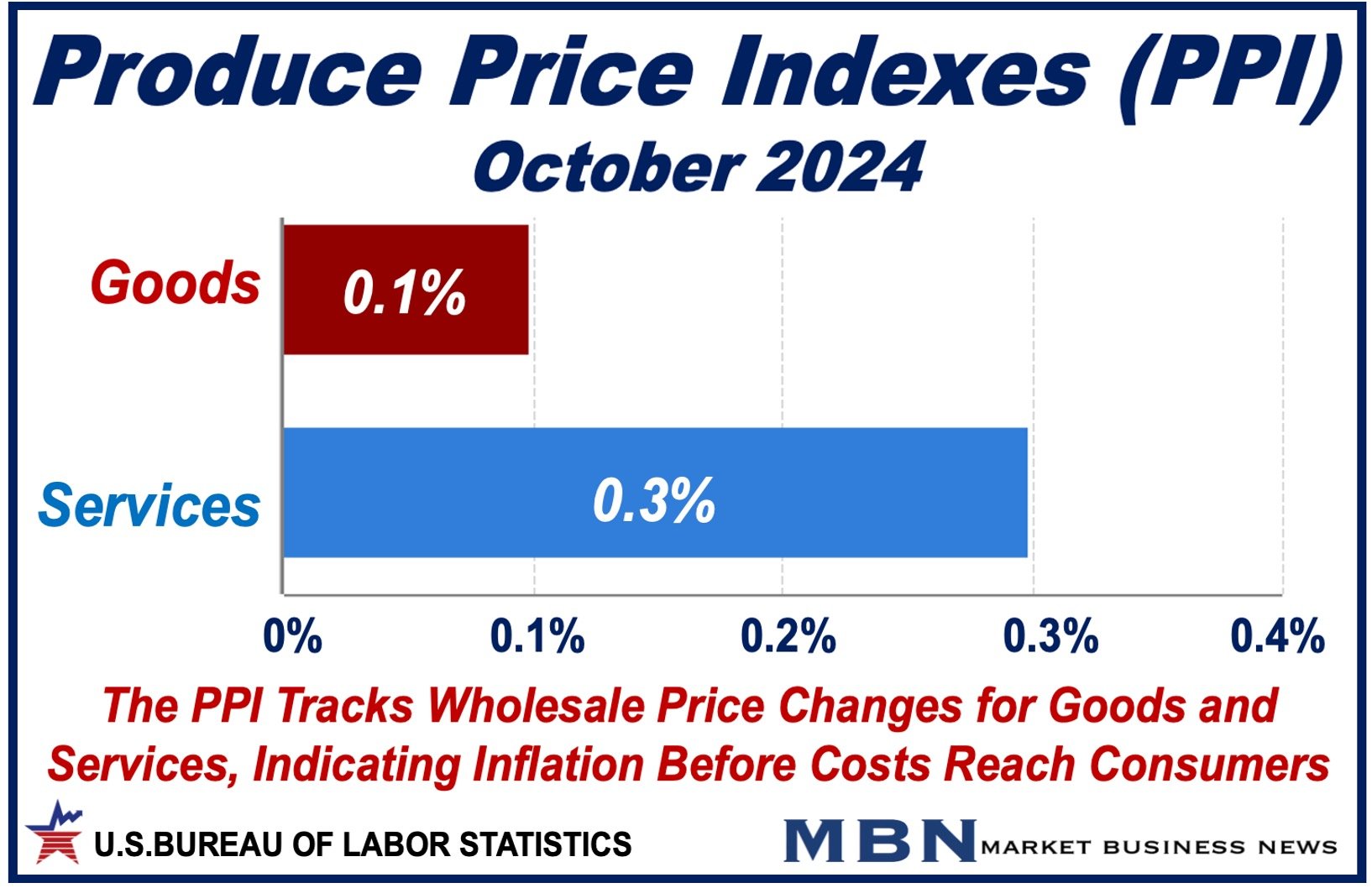

Producer prices have been steadily rising over the past twelve months, driven largely by the services sector.

The core PPI, which doesn’t include volatile food or energy components, increased by 0.3% for October and 3.1% year-over-year, which was more than experts had forecast.

Services Inflation Pushed Up PPI Figure

Service inflation drove the October surge. Portfolio management fees rose by 3.6%, while airline fares jumped by 3.2%, both of which contributed significantly to the overall increase.

Healthcare costs showed mixed results, with hospital outpatient care costs rising by 0.6% while inpatient care services fell slightly.

Wholesale goods prices increased by only 0.1%, indicating that goods inflation was significantly lower than services inflation.

Economic Impact and Market Reactions

The release of the PPI data had immediate effects on financial markets. US stocks remained subdued, while Treasury yields rose slightly, reflecting investor concerns about potential future inflation.

The US dollar initially rose against a basket of major currencies but then retreated slightly.

What This Means for Interest Rates

The Federal Reserve faces a difficult path ahead. It has already lowered interest rates several times this year to combat slowing economic growth.

However, with persistent inflation, it is difficult to decide whether to lower rates further or keep them unchanged.

The financial markets had priced in a high probability of a 25-basis-point cut (0.25%). However, that was before the latest report. Is it less likely to happen now? Nobody knows.

As of November 14, 2024, the Federal Reserve’s rate is 4.50% to 4.75%. A 25-basis-point cut would lower it to 4.25% to 4.50%.

The Labor Market

The labor market also plays a key role in shaping the Fed’s decisions. So far this year, it has shown resilience despite recent challenges like hurricanes and strikes.

Jobless claims have fallen, suggesting ongoing strength in employment. However, external factors, such as potential tariff impacts, geopolitical tensions, energy price fluctuations, and global economic slowdowns, could significantly affect the labor market, inflation, and other aspects of the economy.

Conclusion

Whether the Fed can continue its path toward stable inflation and economic growth, or opts for further policy adjustments, will depend on what happens in the coming months.

In a Reuters article published by AOL, Stephen Juneau, a U.S. economist at Bank of America Securities, said the following regarding expected rate cuts:

“We still expect the Fed to cut rates by 25 basis points in December, but the risk appears to be tilting towards a shallower cutting cycle given resilient activity and stubborn inflation.”