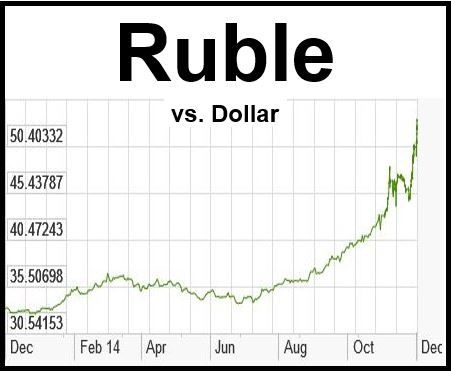

The ruble continues on its downward spiral, smashing past the 50 per US dollar barrier, marking an all-time low, as declining oil prices and economic sanctions bear down on the Russian currency. With its central bank announcing in November that it wouldn’t intervene any more, the ruble is likely to continue sliding.

The Russian ruble has been by far the weakest major currency in 2014. Since January this year, it has depreciated against the dollar by 36.5 percent, falling to 51.668 in early trading in London on Monday.

This is the worst ruble decline since the 1998 Russian financial crisis.

The ruble was already moving downward before the Ukrainian crisis and the annexation of Crimea. Economic sanctions helped push it further down. Russia’s biggest crisis, however, is the relentless fall in the price of oil, which has fallen by 37% since its June peak.

Russia’s economy relies on oil income. It is one of the world’s largest producers. Oil and natural gas make up about half of the country’s budget, which it can only balance when oil sells at $100 per barrel.

The ruble has been by far the worst performing major currency this year. (Chart: X-Rates)

Given that OPEC decided at last week’s meeting to maintain its 30 million barrels per day production level, all bets are on a further decline in oil prices in the months to come.

On Friday, Russia’s central bank said it was extending currency swap limits for the next two weeks in the hope that speculators will stop betting on a declining ruble.

Adding to Russia’s woes, China reported manufacturing growth at a six-month low. China is a major market for exports of Russian raw materials.

Russian investors are watching anxiously, waiting to see whether the Bank of Russia will intervene. Since early November, the central bank has not intervened in the foreign exchange market. It says it will only do so if a ruble decline threatens the country’s financial stability.

Does this current collapse of the currency count as a threat? Most people would think so.