Scotiabank announced on Tuesday that it would be cutting 1,500 jobs globally, and will also take a total of $451 million in pre-tax charges in Q4. Approximately 1,000 of all the job losses will occur in Canada.

The charges are related to changes in estimates and additional credit provisions, as well as restructuring charges.

Approximately $148 million of the Q4 provisions will be linked to severance and restructuring costs.

There is a $109 loan loss provision related to lending in the Caribbean region, a $129 million write down in a Venezuelan bank, plus a $47 million charge related to unremitted dividends from Banco del Caribe (Venezuela).

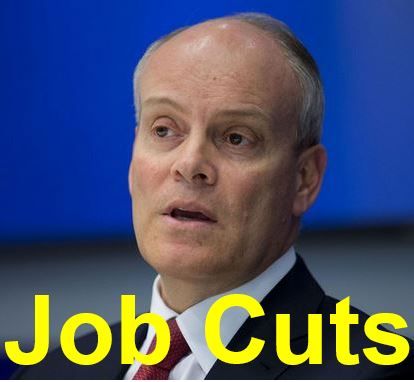

Brian Porter has worked at Scotiabank since 1981. He became President in November 2012, and CEO in November 2013.

Brian Porter has worked at Scotiabank since 1981. He became President in November 2012, and CEO in November 2013.

Despite these measures, Canada’s third largest bank reiterated its 2014 guidance. Scotiabank posted net profit of $5.57 billion for the first three quarters of this year.

The bank warned that diluted earnings per share will be impacted by about $0.28, while its Common Equity Tier 1 capital ratio will also be affected (10 basis points).

President and Chief Executive Officer Brian Porter said:

“Scotiabank remains committed to our three strategic focus priorities: being more focused on our customers; enhancing our leadership depth, diversity and deployment; and being better organized to serve our customers, while reducing structural costs. Today’s announcement is a result of making some difficult but necessary decisions to support our long-term goals.”

“Everyone impacted by these changes will be treated with fairness and respect and deserves our thanks for their important contributions to Scotiabank. We are confident that these initiatives will allow us to continue investing in high-growth areas of the Bank. Notwithstanding these unusual charges, we remain confident that our 2014 reported results will be within our financial objectives for the full year.”

The Toronto-based bank says the downsizing means reductions in workforce at all levels of the company. At its international division it will be closing down about 120 branches. Downsizing refers to taking measures to make a business more streamlined, usually by firing workers, closing departments and plant or branch closures.

The drive to become leaner and more efficient will lead to a reduction in annual costs of $120 million, the bank said. The full benefits will not become apparent until FY2016 (which starts in November 2015).