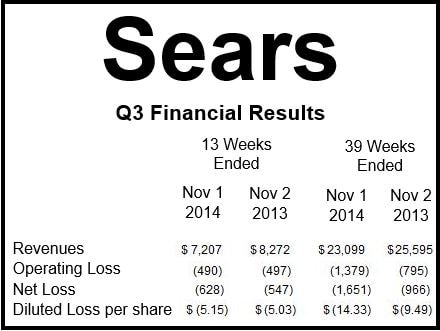

Sears Holdings Corp. posted a third quarter $548 million loss ($5.15 per share), versus a $534 million loss ($50.3 per share) in Q3 last year. Its per-share loss was $2.71 excluding certain tax components, the cost of store closures, and some other items.

Domestic adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) was $(296) million for Q3 2014, versus $(310) million in Q3 2013.

The Illinois-based retail giant emphasized that it has enough funds to meet its financial obligations, adding that its balance sheet has improved. The company says it plans to close down about 235 loss-making stores by the end of the year.

President and CEO Eddie Lampert says Sears continues focused on delivering an integrated retail experience with its customers through ‘Shop your Way’.

Mr. Lampert said in a statement:

“During the quarter, we unveiled or expanded several Integrated Retail customer initiatives, which helped drive online and multi-channel sales. Our members are responding to our transformation, and we are encouraged by the year-over-year domestic Adjusted EBITDA trends, which mark a positive departure from the prior six quarters. At the same time, we continue to enhance the Company’s capital structure and liquidity to support our transformation into an integrated membership-focused company.”

Source: Sears Holdings Corp.

Mr. Lampert has tried to streamline Sears by selling off assets, such as its stake in Sears Canada and Lands’ End. His aim is to transform an asset-heavy company into a nimble money-making business with better-integrated units.

Revenues fell by about $1.1 billion to $7.2 billion in Q3 2014 (ending Nov 1), versus $8.3 billion in the same quarter last year. Most of the decline was due to $384 million from the separation of the Lands’ End business, $340 million in lower revenue because of fewer Sears Full-Line and Kmart stores, and $326 million linked to Sears Canada, which was de-consolidated in October.

Sales in domestic comparable stores fell by 0.1%, consisting of a 0.7% fall at Sears Domestic and a 0.5% rise at Kmart.

Compared to Q3 2013, gross margin fell by $330 million to $1.6 billion. The gross margin of Kmart rose by 50 basis points due mainly to an increase in the apparel category, which had fewer discounts last quarter. Sears Domestic, on the other hand, posted a gross margin rate decline of 190 basis points.

Administrative and selling expenditure was $251 million down in Q3 2014 versus Q2 2014.

Sears posted a $490 million operating loss in the third quarter compared to $497 million for the same quarter last year.