The UK credit outlook has been improved to “stable” from “negative” by Standard & Poor’s (S&P), which had lowered the outlook in 2012. The credit agency maintained the UK’s AAA borrowing strength (sovereign debt) rating; it is the only major agency to give the UK a triple-A.

S&P also warned that UK’s sovereign debt rating may be under threat if Britain left the European Union. The Conservatives have said that if they win next year’s general elections, they will hold a referendum on Britain’s membership.

Citing potential damage to trade, S&P wrote:

“We believe that if the UK were to leave the EU, this would weaken the UK’s economic prospects, and be a negative factor for the rating.”

“Our opinion reflects not only the considerable trade links between the UK and the EU, but, more importantly, the likely loss to the UK of a portion of its inbound direct investment, in particular to those non-European investors who have historically located in the UK.”

3% economic growth predicted

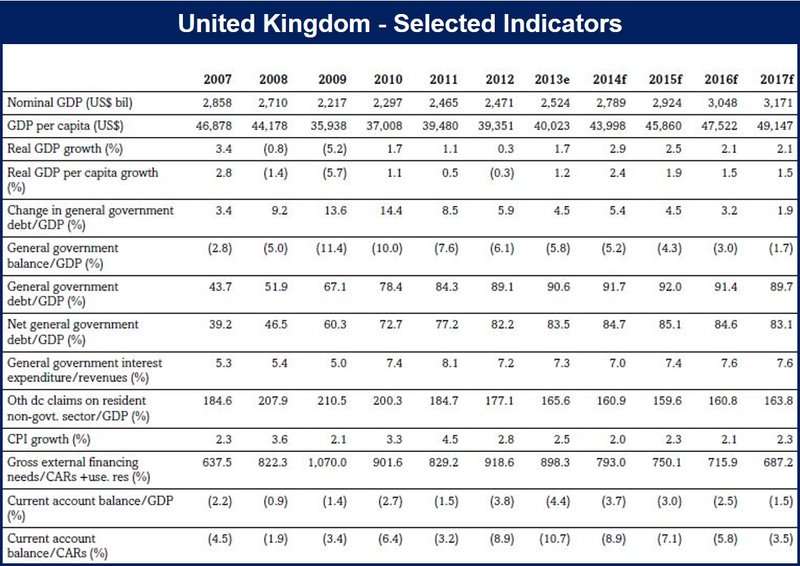

According to S&P, UK GDP (gross domestic product) should expand by 3% this year, and by 2.5% in 2015, driven by strong private consumption and business investment.

S&P added “We anticipate that the UK’s economic recovery will continue to broaden, benefiting the public finances.”

The British economy expanded by 0.8% in Q1 2014, and is forecast to be have the fastest-growing GDP among the G7 nations this year. With five consecutive quarters of economic growth, it is the longest period of continuous expansion since the financial crisis struck.

Fitch, a rival agency, maintained the UK’s AA+ credit rating, one notch below the top triple-A, and also gave it a “stable” outlook.

When the Conservative-Liberal coalition took power in 2010, it promised to protect the country’s credit rating. However, the subsequent economic slowdown and growing debt caused Fitch and Moody’s to strip the country of the triple-A ratings in 2013.

Housing market will stabilize

S&P appears less concerned about the potential threat posed by the UK’s accelerating housing market, saying future property prices are likely to be “more contained” when the Bank of England introduces macroprudential measures. This was in contrast to the International Monetary Fund (IMF) which last week warned the UK about the increase of risky mortgages.

The size of new mortgages in relation to mortgagee incomes has risen alarmingly rapidly, making borrowers more vulnerable to sudden changes in interest rates or income, the IMF explained.

The credit rating agency said the UK has exceptional labor, monetary and product-market flexibility, a diversified and prosperous economy, and a stable and predictable political and institutional framework.

It believes that the risks to a sustainable economic rebound have diminished, and that the financial sector is now in a stronger position than it has been for many years, “reflecting higher levels of capital, and considerable balance sheet repair since 2009. The outlook reflects what we see as lessening risks of additional shocks to the general government balance sheet over the next two years.”

Mark Carney, the Governor of the Bank of England signaled in a speech on Thursday that interest rates might rise earlier than expected. Analysts believe he was suggesting a possible rise at the end of 2014. His hawkish comments lifted the pound to a five-year high of €1.251 and $1.6981.

(Source: S&P)