Elon Musk may be a divisive figure, but the dude has also got a huge and cult-like following – a following that has spent the last few weeks rejoicing that the technoking has finally gone ahead and bought Twitter. Now they can invest in the platform they oh so love to tweet on. Moreover, once the deal goes through, Twitter shares will probably show less volatility… oh wait. Twitter stock doesn’t exist anymore on the market. Yup, the company has officially become a part of X Holdings II, which belongs to Elon Musk, and its stock was delisted from The New York Stock Exchange.

Well, first every stakeholder gets $54.20 (yes, that’s a 4/20 reference, classic Elon) for every Twitter share in their portfolio – that’s the price Elon Musk paid per share to own the social media giant. Why did he do that? Well, who knows why Elon does anything, but here’s a short digest as to the possible reasons.

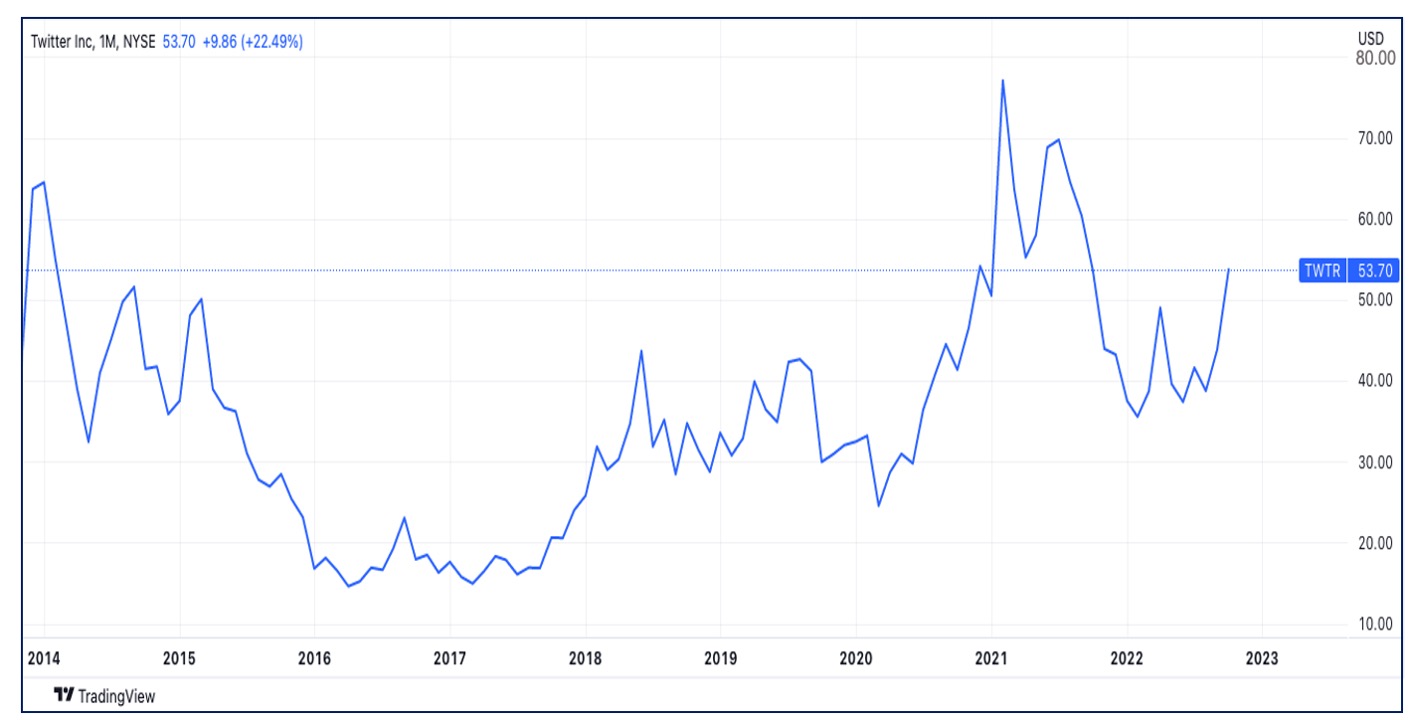

In April 2022, Musk out of nowhere became Twitter’s largest shareholder and also claimed that he would buy the social network. After that, a dramatic series of events unfolded, spanning over six months and punctuated by more twists and turns than anyone expected. Musk decided to cancel the deal, which prompted Twitter to take him to court, and when those court hearings were due to begin, he once again resumed the talks… So, while Musk was living it up and changing his mind faster than the weather, every piece of news harshly hit Twitter’s share price. The whole affair finally came to a close in September, complete with a kitchen sink and mass layoffs.

The history of Twitter as a public company lasted for 9 years and had many of its own bright moments. Hopefully you’re not one of the unlucky ones that invested in Twitter when it cost $75.

However, there are still a bunch of stocks that are affected by Musk and his mad moves.

First and foremost of those is Tesla, of course. Musk is the CEO of this EV giant and its shares have lost more than 45% since Elon said in April that he would buy Twitter. We know, it sounds like the company is just spinning its wheels, but analysts are actually pretty optimistic on the future of Tesla despite its volatile founder and CEO – the average forecast expects an upside of around 50% in the next 12 months.

The second one that feels the effects of Musk’s moves is PayPal. Musk is kinda like a “parent” to this payments behemoth, though he didn’t actually found the brand. And this year, PayPal stock is going through a rough stretch — it has already seen a 60% drop. But, experts once again remain fairly bullish on the brand’s future, with their average forecast sitting at about +30%. Sounds alright.

Etsy and Gamestop are two more Elon Musk-related companies. Etsy is loved by analysts, they think that its stock might increase by around 17% in the next 12 months. Unfortunately for Gamestop, it is the only company from our list that experts have a bearish rating on.

So, does this all mean that adding Tesla, PayPal, and Etsy to your portfolio will make you happy? Well… no. First, you need to do your own research before making any investment decisions. Second, most analysts still believe that the American market is overvalued, and no stock is above a bear market. Well, almost no stock.

Analysts maintain their optimism despite all the events that have bruised the market in the last few years. The Covid pandemic, the military conflict between Russia and Ukraine, the energy crisis, record inflation — the list goes on, and these are all factors that obviously cannot be ignored.

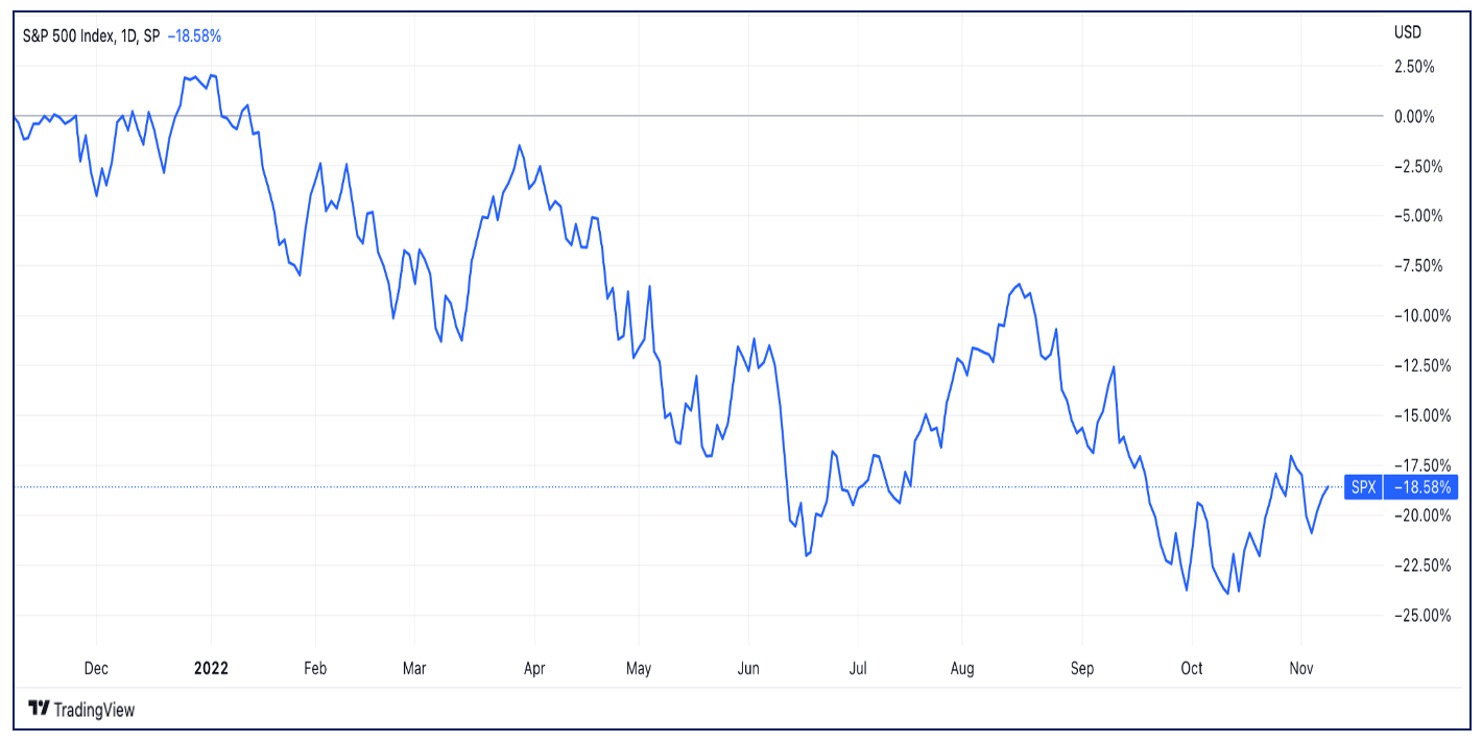

Indices aren’t immune to external pressures either. For example, the S&P 500 index, containing the stocks of the 500 biggest companies listed in the US, has dropped by about 19% in the last 12 months.

If the S&P 500 continues its trend of declines, that damage will overflow into the entire US market – including the aforementioned Tesla, PayPal and Etsy. So, always remember to do your own research and analysis before buying or selling any asset – and don’t forget that there are always companies that will go up while the rest of the market goes down. You know what they say: one man’s meat is another man’s poison.