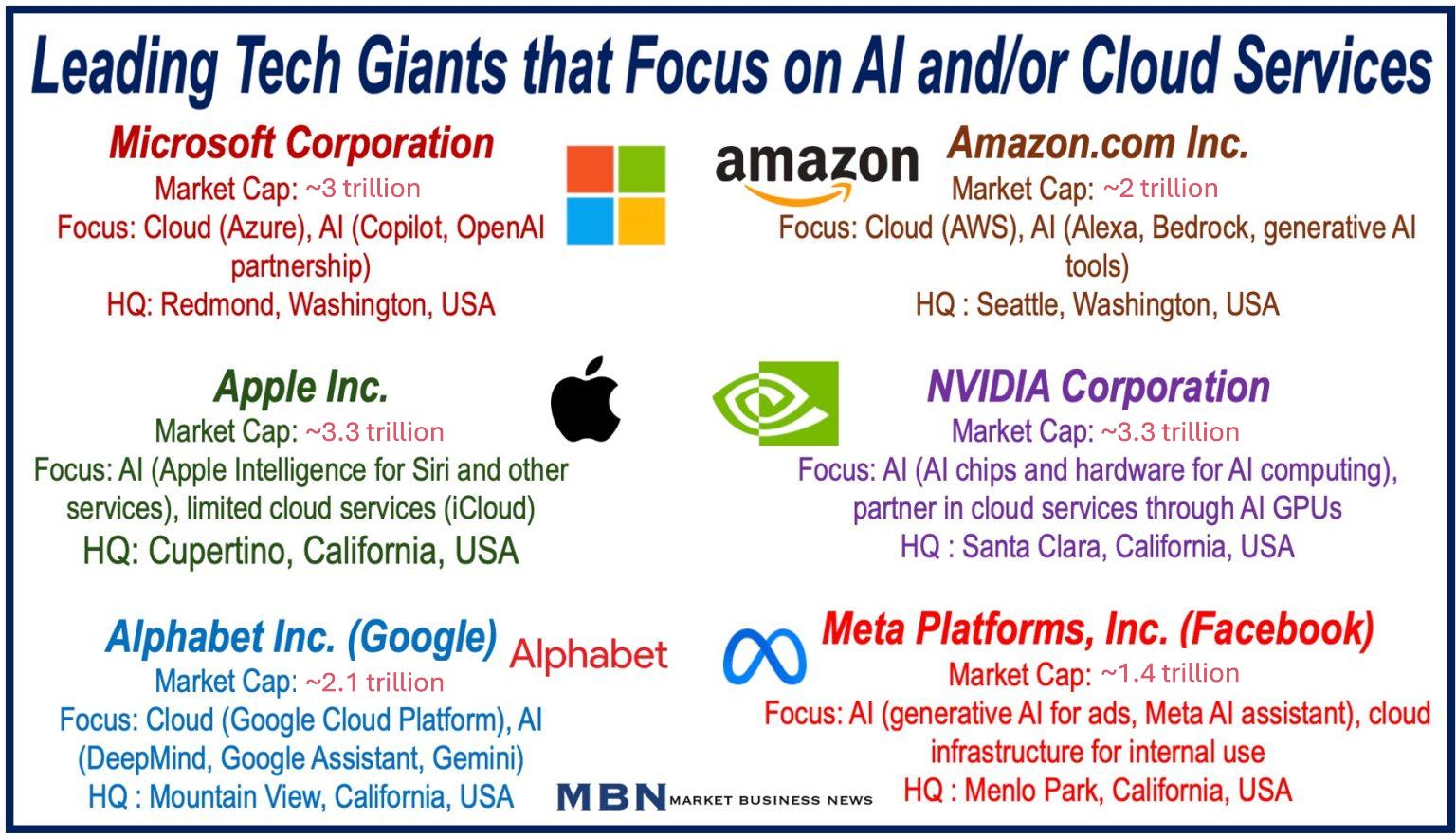

Tech giants are experiencing a transformative period. Companies like Meta, Microsoft, Alphabet, and Amazon are making substantial investments in cloud infrastructure and artificial intelligence (AI).

Recent earnings data show that these investments are helping companies work more efficiently and deliver better products and services to their customers.

Cloud and AI Fuel Revenue Growth

Amazon, Microsoft, and Alphabet have all seen robust growth in their cloud services, driven in large part by the demand for AI-powered solutions.

-

AWS

Amazon Web Services (AWS) reported revenue of $27.5 billion last quarter, which represented a 19% increase over the same quarter last year. Andy Jassy, Amazon’s CEO, was particularly bullish about AWS’ outlook.

-

Azure

Azure cloud platform posted a 34% increase. AI-related demand accounted for 12 percent of this growth.

-

Google Cloud

Alphabet’s Google Cloud achieved a 35% increase in revenue. According to the company, growth was driven by both AI infrastructure and generative AI solutions.

As these tech giants adopt AI tools more widely, their internal processes are benefitting. More than a quarter of Google’s new code is generated by AI, with engineers reviewing and refining it—a strategy that accelerates development while maintaining quality.

Tech Giants – Huge Investment in AI Infrastructure

Demand for AI is growing apace. To meet this demand, tech giants are investing billions of dollars in infrastructure:

-

Microsoft

Microsoft’s capital expenditure last quarter reached $15 billion, with a focus on expanding Azure’s data centers.

-

Alphabet

Alphabet reported $13 billion in capital spending.

-

Amazon

Amazon’s AWS anticipates a total of $75 billion in capital investment for 2024, mainly to meet cloud infrastructure needs.

-

Meta

Meta expects capital expenditures of up to $40 billion for 2024. CEO Mark Zuckerberg explained that AI-driven tools are boosting user engagement and improving ad performance by about 7%.

The Chip Battle: Meeting AI’s Hardware Demands

As AI applications expand, so does the demand for specialized hardware, especially AI chips. Amazon is developing its own chips, Inferentia and Trainium, to deliver superior performance and more competitive pricing for AI tasks in AWS.

-

AMD vs. Nvidia

Advanced Micro Devices, Inc. (AMD) faces challenges in competing with Nvidia Corporation, the current leader in AI chip technology. Both companies are based in Santa Clara, California.

Despite releasing new data-center chips, AMD still trails Nvidia, which has recently launched powerful new models optimized for large-scale AI tasks.

-

Samsung & SK Hynix

Another key chipmaker is Samsung Electronics Co., Ltd., which is based in Suwon, South Korea. Samsung is making strides in getting its chips certified for AI tasks. However, it has lagged behind competitors like SK Hynix, based in Icheon, South Korea, partly due to delays in certification from Nvidia.

As demand for AI-ready chips continues to grow, this competitive landscape is likely to evolve rapidly.

Generative AI: Changing How Companies Operate

Generative AI tools are transforming customer experience and boosting operational efficiency. Generative AI is a type of AI that creates new content, like text, images, or music, by learning patterns from large datasets. Examples include ChatGPT, DALL-E, and Midjourney.

-

Amazon

Amazon’s generative AI products, such as the shopping assistant Rufus and development tool Bedrock, are growing rapidly.

-

Alphabet (Google)

Google has also reported strong results, with its AI-powered search tools reaching over a billion monthly users.

-

Meta

Meta has leveraged AI to create more than 15 million ads for businesses, leading to a notable increase in conversions.

-

Microsoft

Microsoft has integrated generative AI into products like Microsoft 365 Copilot for Office apps (Word, Excel, PowerPoint).

Microsoft’s Azure OpenAI Service offers cloud-based AI models for custom applications, and its Fabric analytics tool is widely used by Fortune 500 companies. Microsoft is the major partner in ChatGPT, a popular generative AI tool.

Balancing Growth with Investor Expectations

Although investors have shown admirable patience, there is some concern about how long their “jam tomorrow” stance will have to continue. The costs associated with building data centers and procuring AI chips are immense.

Microsoft, for example, has nearly doubled its capital expenditure from the previous year. The tech giants are under enormous pressure to show high returns for their investments.

However, industry experts suggest that this AI boom is likely to continue, as companies demonstrate tangible returns on their AI and cloud investments.

Microsoft, Amazon, Meta, Alphabet, and other tech leaders are positioning themselves for long-term gains. The stakes are high, but if the current momentum sustains, AI infrastructure could prove to be one of the most lucrative tech investments of this decade.

And Tomorrow?

It will be interesting to see whether there will be consolidation in the industry over the next couple of decades, and which companies will come out on top. Consolidation, in this context, means the merging or acquisition of companies within the industry, leading to fewer but larger players dominating the market.