Tesco first quarter sales decline steeply, the third successive quarter fall for the United Kingdom’s biggest supermarket retailer. Increasing fierce competition among UK supermarkets is affecting sales across the sector. In April the company reported an annual profits fall of 6%.

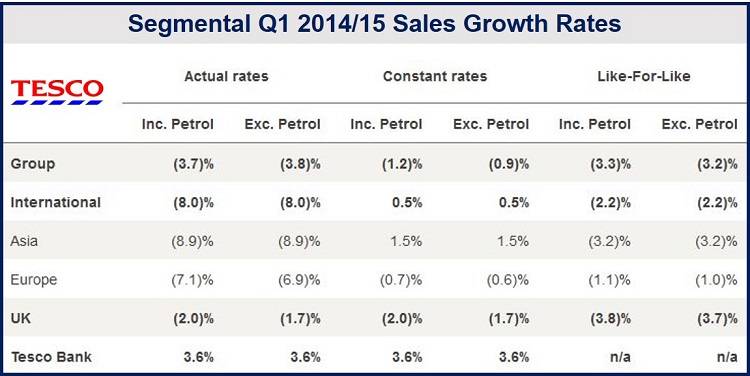

Tesco PLC registered a 3.7% decline in UK sales including VAT (gasoline excluded) for the three-month period ending on May 24th.

20-year record fall

According to UK media on Wednesday, Tesco executives are talking about the steepest decline in sales in two decades.

Grocery market analyst Kantar Worldpanel wrote this week regarding supermarket share figures in the UK, “Tesco, Sainsbury’s and Morrisons have all lost market share since this period last year.” Tesco currently has a 29% market share compared to 30.5% one year ago.

The UK’s major supermarkets have had to reduce their prices, especially of essential items such as eggs, bacon, bread and milk, in response to fierce competition from rivals. German discounters Lidl and Aldi are attracting shoppers at record numbers.

Tesco’s CEO, Philip Clarke, said the company’s discount campaign has benefited customers and it is now more competitive than it has been for several years.

Mr. Clarke admitted that personally, he had not experienced such a large decline in sales during his 40 years in the retail business. He also said “I have never seen a period of such intense transformation either for the industry.”

Investors are starting to wonder about Tesco’s strategy and why all the investment that has occurred over the last year has not paid off. The Telegraph quotes HSBC analyst David McCarthy who described the figures as “shocking”. McCarthy suggests that Tesco stores are losing more than 1 million shoppers each week.

In an interview with the Financial Times, Bernstein analyst Bruno Moneyne estimated that 50% of the like-for-like sales fall was caused by less indiscriminate use of vouchers, price cuts and store disruption. “This means that when we come through this disruption, Tesco’s run rate is still minus 2 per cent like-for-like, implying ongoing market share losses. We expect this quarter to represent a low point for Tesco, but no return to positive like-for-like in sight,” he said.

Tesco cut prices

Mr. Clarke added:

“Since February, we have cut prices on the products that matter most, cut home delivery charges and made Grocery Click & Collect free. We launched Clubcard Fuel Save nationwide in March and have already helped over a quarter of UK households cut the cost of filling their tanks. Our store refresh programme is on track to bring a new face of Tesco to 650 neighbourhoods this year including over 100 of our Extra stores.”

“As expected, the acceleration of our plans is impacting our near-term sales performance. The first quarter has also seen a continuation of the challenging consumer trends in the UK, reflecting still subdued levels of spending in addition to the more structural changes taking place across the retail industry. We are determined to lead in this period of change, building long-term customer loyalty and positioning the business to win in the multichannel era.”

Partnerships with Tata in India and CRE in China have been completed, Mr. Clarke informed.

Sales in Asia declined by -3.2% and by -1% in Europe. However, growth was reported in Turkey, Poland, Hungary and the Czech Republic.

(Source: Tesco PLC)