Payday advances are simply cash loans that one can get from a lender which are payable once they receive their monthly paycheck. Lending institutions charge interest for the loan, which tend to generally have short repayment periods from a few days to a month or less after the person receiving the loan is expecting to receive their paycheck.

With the current pandemic, meeting needs has become more tasking, with more people struggling to access money for healthcare, food, and other necessities. Payday advances are pretty popular as they offer prompt solutions for those urgently in need of money. They are also available to those who have poor credit and cannot secure loans from other credit facilities such as banks. The loans are handed out based on one’s income and ability to repay and are therefore easily accessible to those with low income.

Another reason for their popularity is that some people prefer borrowing from institutions instead of friends and family, thus choosing to secure payday advances from these institutions. On the other hand, some do not have any other alternative and settle on payday advances. Taking out a payday advance is easy and convenient. To help you secure one with ease, here are some important things to know about payday advance.

1. Client Protection Laws

There are laws put in place to ensure that those receiving payday advances are not exploited. These laws state the maximum limits that lenders can charge their clients. This helps keep the interest rates at reasonable levels. Simply put, they prevent the loans from appreciating at a rate that may be difficult for the client to repay.

2. They are easily accessible as they are quick and easy to apply

There are numerous lending institutions offering payday advances. The process of acquiring a payday advance is also pretty simple and does not consume too much time. In fact, it can be done online, at one’s convenience.

The process is as easy as providing the lender with a postdated check stating the amount, which includes the financing fee and other charges that may apply. In some cases, one need only provide bank account details so that the lender can withdraw the loaned amount and other fees once the paycheck is deposited.

The simple process of applying for payday advances also makes it easier for those who do not have much financial education, and the elderly to apply without needing much assistance. Further, most of these transactions are done automatically using technology and do not require physical presence for processing. The lender can transfer the funds directly to the borrower’s account as well as withdraw automatically at the agreed time.

3. No credit checks required

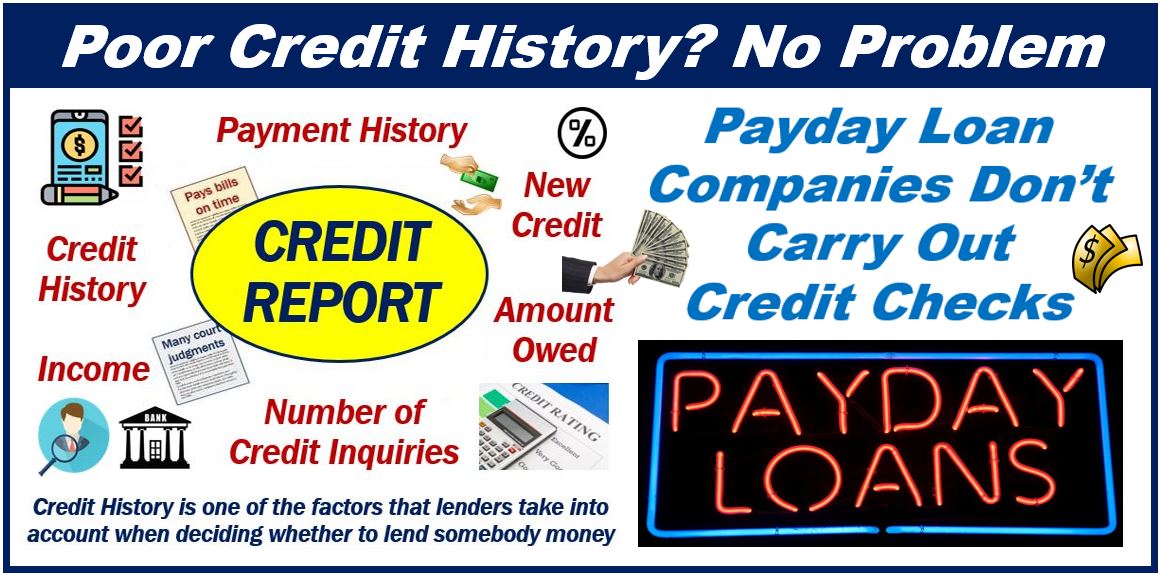

Traditional lending institutions such as banks look into one’s credit history before determining whether they qualify to receive a loan or not. With paycheck advances, this is not the case. In fact, in most cases, they do not have any impact on one’s credit history. This makes them accessible even to those with adverse credit histories.

4. They are processed promptly and are available instantly

Payday advances can help meet immediate needs and manage emergencies conveniently as they are processed within a brief period. Despite proper financial planning and savings, certain circumstances may require an immediate need of money. In the event of an emergency that requires money and without the lime to liquidate assets, payday advances can come in very handy. They can be processed as soon as 24 hours after application.

Applications can be made around the clock on any day of the week regardless of whether it is a weekend or a holiday. With payday checks, there is little to no chance of application rejection. Since the applicant makes the application directly, there are no unnecessary charges that would have arisen from working with middlemen.

5. They don’t require security

Most payday advances do not require the traditional forms of security to process your advance. You do not need to own property or a car to access a payday advance. As long as one can provide bank account details or a check, they can get the advance. This makes it easier for those with low incomes to access them.

6. High level of confidentiality

Payday advances can be accessed confidentially since lenders are bound by law to protect their client information. They ensure that client details are not shared with anyone without their consent. They also provide instant access to finances without burdening friends and family and straining personal relationships. It’s one of the best ways to get financial help without exposing your financial vulnerability to the world.