Time Inc is going to be acquired by Iowa-based Meredith Corporation for a sum of $2.8bn (£2.1bn) in an all-cash deal backed by conservative billionaire brothers Charles and David Koch.

Meredith has had its eye on Time Inc for a while now. The company attempted to buy Time earlier this year as well as four years ago.

Despite the deal being backed by Koch Equity Development, the Koch family won’t a have a board seat or otherwise influence the company’s operation – meaning they won’t have any managerial or editorial input.

The transaction was approved by the Boards of Directors of Meredith and Time Inc. It is expected to close during the first quarter of 2018.

Time has been beleaguered by declining ad revenues since it was spun off from Time Warner in 2014.

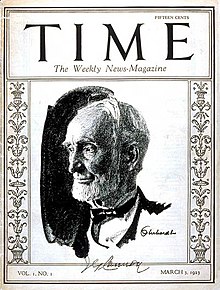

Time Inc. owns and publishes over a hundred magazines, including its namesake Time, in addition to other major publications such as People, Sports Illustrated, Entertainment Weekly and Fortune magazines.

“This all-cash transaction, and the immediate, certain value it provides, is in the best interests of the company and its shareholders,” Time’s Chairman John Fahey said in a statement.

“We are creating a premier media company serving nearly 200 million American consumers across industry-leading digital, television, print, video, mobile, and social platforms positioned for growth,” said Meredith Corporation Chairman and CEO Stephen M. Lacy in a statement.

“We are adding the rich content-creation capabilities of some of the media industry’s strongest national brands to a powerful local television business that is generating record earnings, offering advertisers and marketers unparalleled reach to American adults. We are also creating a powerful digital media business with 170 million monthly unique visitors in the U.S. and over 10 billion annual video views, enhancing Meredith’s leadership position in reaching Millennials.”

“This is a transformative transaction for Meredith Corporation, and follows a fiscal 2017 in which we posted the highest revenues, profit and earnings per share in our 115-year history,” said Meredith President and Chief Operating Officer Tom Harty.

“When you combine our strong local television business – which has grown operating profit 15 percent annually over the last five years – with the trusted, premium multiplatform content creation of Meredith and Time Inc., it creates a powerful media company serving consumers and advertisers alike. We look forward to completing the transaction; welcoming the Time Inc. employees to Meredith; delivering on our pledge to achieve identified synergies; and growing shareholder value.”