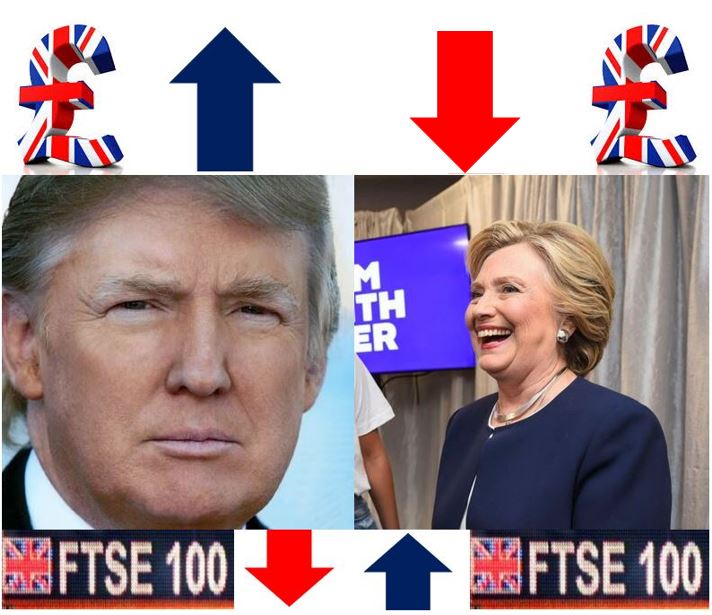

Trump jitters – the prospect of Donald Trump being the next US president – is good for the pound sterling but very bad for socks. The pound has registered its largest weekly gain against the dollar in seven years, while the FTSE-100, Britain’s top share index, registered a seven-week low at the end of this week, as stocks went into a 10-month record nosedive.

The pound’s recent recovery from its alarming falls on the foreign exchanges since the June 23rd Referendum in which Britons voted for Brexit, gathered steam on Friday when it gained one cent against the dollar and traded at $1.2558 by the end of the day – a four-week record.

Sterling’s recovery continued unabated on Friday, despite US labour data which strengthened predictions that official borrowing costs in the United States will go up before the end of the year.

Trump jitters favours the pound sterling but harms share prices in the UK. (Images adapted from: Trump Twitter and Clinton Twitter accounts.

Trump jitters favours the pound sterling but harms share prices in the UK. (Images adapted from: Trump Twitter and Clinton Twitter accounts.

There were 161,000 non-farm jobs created in the US last month, as well as a 0.4% rise in hourly earnings. Currency dealers ignored the US jobs data and focused on the final moments of the Donald Trump and Hillary Clinton race for the presidency.

When Clinton’s lead in the polls narrows, the pound rises. Following a new email investigation by the FBI at the end of October, her lead narrowed sharply, which was soon followed by a steep rise in the value of sterling.

When news of the high court ruling that the UK government cannot trigger article 50 to leave the European Union without parliamentary approval reached the exchange dealers’ ears, the pound received another boost.

The Bank of England’s announcement that a second post-referendum stimulus was not going to happen, was the icing on the cake for the British currency.

Since the end of October, when Mrs. Clinton’s lead in the polls narrowed considerably, London share prices have been falling. (Image: adapted from londonstockexchange.com)

Since the end of October, when Mrs. Clinton’s lead in the polls narrowed considerably, London share prices have been falling. (Image: adapted from londonstockexchange.com)

Trump jitters bad for stocks

Britain’s share prices declined steeply last week, registering the biggest weekly loss since January as pharmaceutical companies came under pressure from political scrutiny ahead of the November 8th US presidential elections.

The FTSE 100, a share index of the 100 companies listed on the London Stock Exchange with the greatest market capitalization, closed 1.4% down on Friday, falling to its lowest level since the middle of September.

The FTSE 100 declined by over 4% since opening on Monday – such a fall had not been seen in ten months.

A decline in some metal prices pulled down mining company stocks. FTNMX1770, the UK mining index, declined by 2.3%, led by steep falls in Fresnillo, Randgold Resources, Anglo American and BHP Billiton.

Investors predict turbulent market conditions ahead, with Prime Minister Theresa May appealing against the high court ruling. The likelihood of there being a general election soon has increased dramatically.

The Guardian quoted Paul Hollingsworth, Chief UK Economist at Capital Economics, a London-based economic consultancy, who said:

“Just as markets were looking forward to getting the US election out of the way, this week has seen speculation that another UK election could be right around the corner.”

Since Clinton’s lead narrowed, the pound, unlike the FTSE 100, has done well. It seems that a Trump presidency is good for the British currency. (Image: adapted from xe.com)

Since Clinton’s lead narrowed, the pound, unlike the FTSE 100, has done well. It seems that a Trump presidency is good for the British currency. (Image: adapted from xe.com)

Is Trump good for UK economy?

If Donald Trump won the elections, would it be good or bad for the UK economy? President Barack Obama warned before the 23rd June Referendum that Britain would be ‘at the back of the queue’ regarding a special trade deal with the United States. Mrs. Clinton would probably do the same if she were elected.

Mr. Trump said that if he became president he would put the UK right at the front of the queue.

If negotiations with the EU don’t go well and a Hard Brexit is on the cards, wouldn’t a Trump administration favour Britain more? In a Hard Brexit, the UK would lose unfettered access to the EU market – exports would have tariffs slapped on them.

It might be good for Britain if Mr. Trump does not break his word. Unfortunately, his track record suggests he might (break his word).

Video – Will the pound soar?

The pound has responded to a range of stimuli, and not only Trump jitters. There is talk now of a strong sterling revival. Others say the devaluation will continue further, especially when Article 50 is triggered.