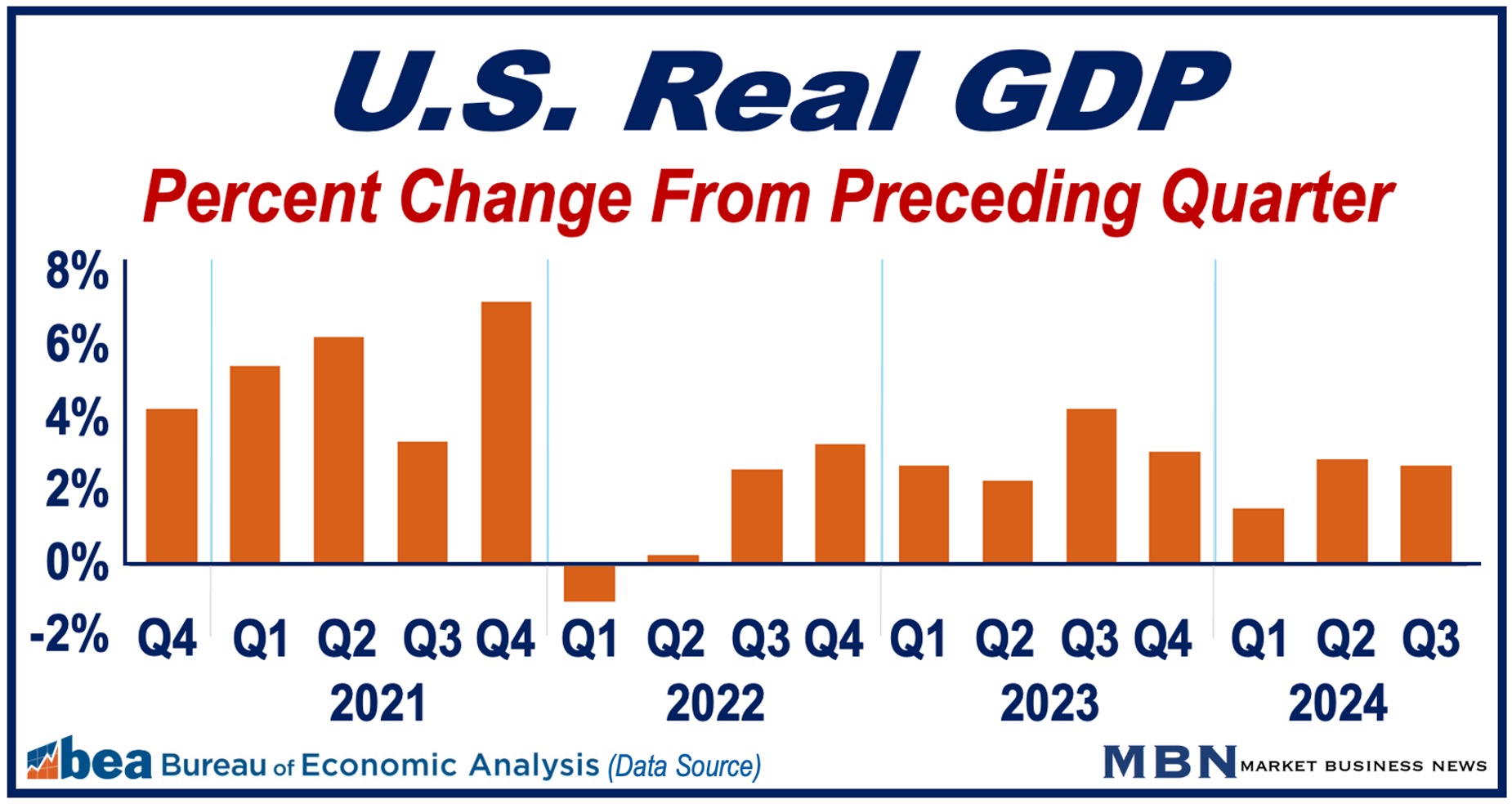

The U.S. economy grew at an annual rate of 2.8% in the third quarter of 2024, according to data released by the U.S. Bureau of Economic Analysis (BEA). This was slightly less than the 3% growth registered in the previous quarter.

Economists had expected GDP growth of 3% in the third quarter. Even so, the latest figure still indicates a strong economy that has overcome recession fears.

This growth highlights the continued impact of consumer spending, exports, and government expenditures, especially on defense, on the country’s economic performance.

Key Contributors to U.S. Economic Growth

-

Consumer Spending

Consumer spending makes up approximately 70% of the US economy. Hence, when it rises, the economy usually benefits significantly.

Consumer expenditures increased at an annual rate of 3.7%, a noticeable rise from 2.8% in the previous quarter. Americans spent more on healthcare, food services, accommodations, and prescription drugs.

Stronger consumer spending is mainly due to rising wages, low unemployment, and some relief from cooling inflation rates.

Regarding consumer spending, the BEA reported the following:

“The increase in consumer spending reflected increases in both goods and services. Within goods, the leading contributors were other nondurable goods (led by prescription drugs) and motor vehicles and parts”.

“Within services, the leading contributors were health care (led by outpatient services) as well as food services and accommodations.”

-

Government Expenditure

Federal spending increases were largely aimed at strengthening the country’s defense capabilities and supporting public infrastructure.

Defense expenditures rose by 9.7%, contributing 0.6 percentage points to the GDP.

-

International Trade

Exports rose by 8.9%, driven primarily by *capital goods, which bolstered the GDP despite a significant jump in imports of 11.2%. Import growth can offset overall GDP calculations because it represents money spent on goods produced outside the U.S., thus reducing net economic output.

* Capital Goods are items used to produce other goods or services, like machinery or tools.

Investment Trends – a Mixed Bag

-

Construction

Private investments overall, however, slowed in the third quarter. Investments in new housing slowed significantly, as did nonresidential construction, including office space and warehousing.

-

Equipment and Technology

However, business spending on equipment, especially technology, helped to moderate the overall downturn in private investment.

Investments in artificial intelligence and other technologies suggest American companies are planning for longer-term productivity improvements, which could support future U.S. economic growth.

Inflation and Income Data

-

Inflation

The Personal Consumption Expenditures (PCE) price index, an important measure for the Federal Reserve, showed an increase of 1.5% in the third quarter. This was lower than the 2.5% second quarter increase.

Core inflation, which excludes food and energy costs, rose by 2.2% in Q3, which was down from 2.8% in Q2.

Inflation seems to be moving closer to the Federal Reserve’s 2% target, easing pressure on consumers and potentially signaling a shift in the Fed’s interest rate strategy.

-

Income

Both personal and disposable incomes also increased in the third quarter, albeit at a slower pace.

Regarding disposable and personal incomes, the BEA wrote:

“Current-dollar personal income increased $221.3bn in Q3, compared with an increase of $315.7bn in Q2. The increase primarily reflected an increase in compensation.”

“Disposable personal income increased $166.0bn, or 3.1%, in Q3, compared with an increase of $260.4bn, or 5.0%, in Q2. Real disposable personal income increased 1.6%, compared with an increase of 2.4%.”

Economic Outlook

In its upcoming meetings, the Federal Reserve is expected to reduce interest rates.

With the U.S. economy showing resilience despite higher borrowing costs, economists suggest steady growth will likely continue without significant inflation risks.

Conclusion

Overall, the BEA’s latest GDP figures indicate that the U.S. economy is navigating current challenges well, though slower growth in private investment and residential construction may limit expansion in future quarters.

For now, strong consumer spending, government expenditure, and moderating inflation provide a solid foundation for continued economic stability.