The UK budget surplus dwindled in July to just £1billion – the first post-Brexit vote month – compared to £1 billion in July 2016, according to the Office for National Statistics (ONS). The British electorate voted to leave the European Union in a referendum held on 23rd June, 2016. Brexit stands for Britain Exiting the EU.

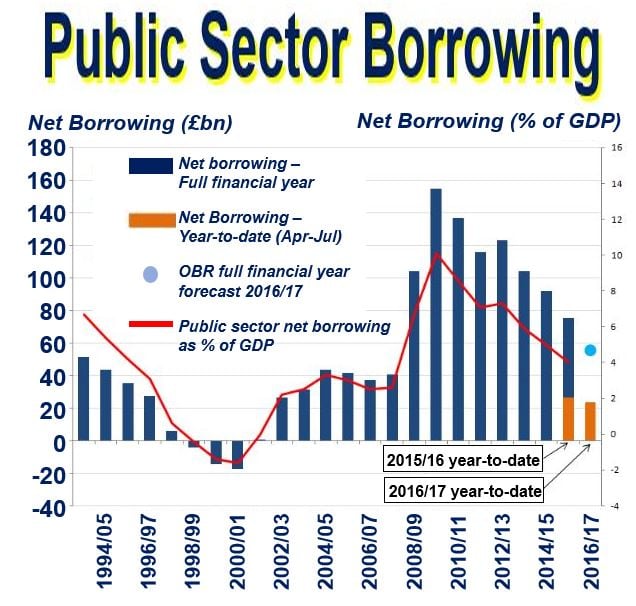

According to the ONS, public sector borrowing (excl. public sector banks) declined by £3 billion to £23.7 billion during the April-to-July 2016 period (current financial year-to-date) versus the same period in 2015.

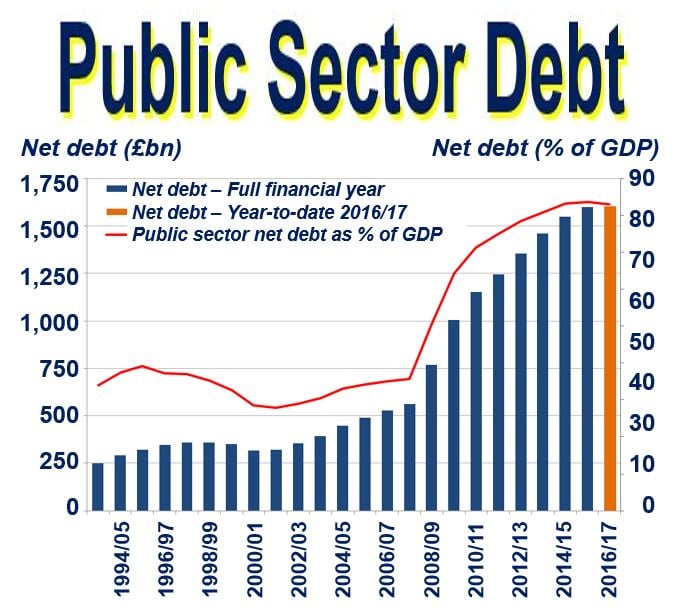

The public sector net debt (excl. public sector banks) at the end of July this year was £1,604.2 billion, which was equivalent to 82.9% of GDP (gross domestic product), an increase of £35.3 billion compared to the same month last year.

The amount borrowed by the public sector has been declining since the peak in the financial year ending March 2010. (Image: ons.gov.uk)

The amount borrowed by the public sector has been declining since the peak in the financial year ending March 2010. (Image: ons.gov.uk)

July is usually a surplus month as far as public finances are concerned, because of corporation tax revenues. For the financial year-to-date, public borrowing was 11.3% lower than during the same period in 2015.

GDP currently expanding

July was the second consecutive month of debt falling on the year as a percentage of GDP, and suggests that GDP is currently growing (year-on-year) faster than net debt is.

Regarding just two months’ worth of data, the ONS added:

“However, care should be taken when inferring trends from only two months’ data, especially given the provisional nature of centred GDP estimates for the latest month.”

During the April-to-July period this year, the central government’s net cash requirement declined to £22.2 billion, which was £5.1 billion less than for the same period last year.

The ONS pointed that that this bulletin showed the public sector’s fiscal position as at 31st July 2016, which included the first post-Brexit month data. It added that these figures were estimates and could later be revised.

Public sector debt increased at a faster rate following the banking crisis in the financial year ending March 2008 (Image: ons.gov.uk)

Public sector debt increased at a faster rate following the banking crisis in the financial year ending March 2008 (Image: ons.gov.uk)

Budget surplus not priority

The new Chancellor of the Exchequer, Philip Hammond, has given some clear hints that he intends to take a more gradual approach to reducing the deficit and will not be bound by George Osborne’s (the previous Chancellor’s) targets. In other words, stimulating economic growth and preserving employment matters to him more than maintaining a budget surplus.

How Hammond’s policies will differ from Osborne’s are not yet clear – we will have a better idea when he presents his Autumn Statement in November this year.

According to David Gauke, the Chief Secretary to the Treasury:

“With the public finances in surplus in July, our economy starts from a position of strength to face any economic turbulence following the vote to leave the EU. As we keep working to cut the deficit, we are well-placed to handle any challenges and seize the opportunities as our economy adjusts.”

John McDonnel, the Labour Party’s shadow Chancellor, said:

“The UK economy needs immediate investment from the government, rather than sticking to the failed policies of George Osborne which have helped create the problem.”

“Britain is on hold waiting for Philip Hammond to tell us whether he will stick to his predecessor’s planned cuts to investment, and firms and households can’t wait until the autumn to find out.”

Fiscal targets less likely now

Mr. Osborne had planned to reduce public sector net borrowing to £55.5 billion in 2016-2017 from £74.9 billion in 2015-2016. Even before June’s referendum, those targets were seen as very optimistic by most experts.

If they were challenging before the Brexit vote, they will be completely impossible now.

Chief UK and European Economist at IHS Global Insight, Howard Archer, was quoted by the BBC as saying:

“The UK’s vote to leave the European Union clearly put the fiscal targets for 2016-17 and beyond out of reach.”

“The public finances look poised to take a serious hit from probable significantly weakened economic activity after the Brexit vote, taking a toll on tax receipts in particular. It also seems probable that unemployment will rise, while any slowdown in the housing market will hit Stamp Duty receipts.”

Suren Thiru, Head of Economics at the British Chamber of Commerce said:

“Although the UK’s public finances recorded a surplus in July, due to stronger corporation tax receipts, the improvement was less than many had expected.”

“Fixing the public finances remains a major challenge, and is likely to be an increasingly uphill task if economic growth slows in the coming months. If the economy does weaken, the UK will struggle to generate sufficient tax receipts needed to make meaningful progress in reducing the deficit.”

“More needs to be done to strengthen the UK’s tax base. The government should use the extra fiscal headroom from abandoning the 2020 target to support firms looking to invest, and deliver on major infrastructure projects that will boost jobs and growth.”

Video – UK economic data this week

This has been a week of post-Brexit vote economic data, with publications regarding jobs, retail sales, inflation and public finances. According to this ProactiveInvestors Stocktube video, most of the data has caught people by surprise.