UK GDP growth has been revised downward to 3% from 3.2% for 2014, and from 2.8% to 2.6% and 2.5% to 2.4% for 2015 and 2016 respectively by the British Chambers of Commerce (BCC).

The BCC also warned that any short-term increases in interest rates would present the British economy with a huge risk, because the country is dependent on consumer spending and mortgages.

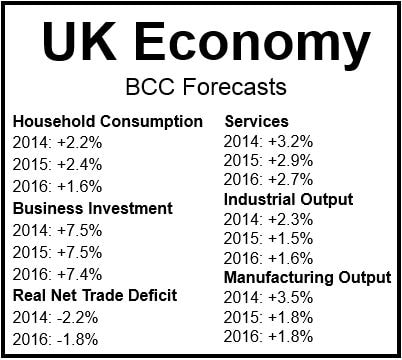

Despite the downgrade, it still represents the fastest pace of growth since 2007. The downward revision is mainly due to slower-than-expected growth in household consumption, services and exports, which led to weaker Q3 GDP growth.

While welcoming the strong 2014 growth indicated by the forecast, BCC Director General, John Longworth, says the downgraded prediction is a worrying warning sign. He urges the Government to address key areas that are undermining companies’ ability to expand, such as access to finance.

Even though services output and household consumption are predicted to grow at a slower-than-previously forecast rate, they will still be the main contributors to the economy’s expansion in the next few years, the BCC says.

It forecasts business investment growth of 7.5% in 2014, 7.5% in 2015, and then 7.4% in 2016.

Data Source: British Chambers of Commerce.

In the third quarter of 2015, UK interest rates will probably increase to 0.75% from their current 0.5%, two quarters later than in the previous forecast.

The UK is expected to post 0.7% growth in Q4 2014 over the previous quarter, followed by an average of 0.6% per quarter next year.

Mr. Longworth said:

“Although this updated forecast slightly lowers our growth predictions, it also confirms that Britain will be one of the fastest-growing developed economies as we close out 2014. This is a great achievement, and businesses up and down the country should be congratulated for their hard work and resolve to drive the recovery in the face challenges and uncertainty both at home and abroad.”

“However, there is no reason why a 3% growth rate should be the height of our ambitions. Downgrades to our growth forecast are a warning sign that we still face a number of hurdles before securing a balanced and sustainable recovery. A number of headwinds from the global economy are also having a real impact on British businesses. The Eurozone is weak, with a real risk of deflation. Growth in emerging markets has slowed and political uncertainty in Ukraine, the Middle East and elsewhere is affecting business confidence. Uncertainty in the economy generally affects consumer confidence as does the consumer spending and debt cycle.”

Exporters and potential exporters urgently need support, Mr. Longworth added, given the country’s flat export figures.

Chief Economist at the BCC, David Kern, said:

“In the short term, the main concern for the UK is a continuation of the slowdown in recent months. A deceleration in growth may be unavoidable, given the weaker trends in the global economy, particularly in the Eurozone. However, it is important to counter the impact of these downward pressures by maintaining low interest rates and pro-business policies, in order to minimize the risk of the recovery stalling. In the longer term the key structural risks facing the UK are persistent low productivity and the twin fiscal and trade deficits. Unless these issues are addressed resolutely, they could undermine Britain’s future credibility.”

“Despite stronger than expected economic growth, the UK’s ability to generate tax revenues has deteriorated – due to weak earnings, the decline in oil and gas output, as well as big profit reductions from financial institutions. The UK must now persevere with the difficult job of cutting the deficit, while focusing on policies that support higher productivity.”