UK house prices should rise by 3% and rents by 2% in 2015, according to a forecast published by the Royal Institution of Chartered Surveyors (RICS) on Friday.

The RICS believes Chancellor George Osborne’s recent Stamp Duty reform will help bolster demand, while the continuing lack of supply of property will continue contributing to a buoyant market.

The surveyors in the report expect London, Wales and the South West to post more moderate rises. In fact, London will probably see no price increase next year.

Having raced ahead of the rest of the country during the early stages of the economic rebound following the Great Recession, the RICS says London was “pausing for breath” both in terms of activity and pricing in the last quarter of 2014.

However, some London non-prime areas as well as the eastern boroughs may post price increases in 2015.

Source: “Housing Update – 19th December 2014,” RICS Economics.

Rents

Rental demand growth slowed down in the first quarter of 2014, partly because the sales market had a rebound following the introduction of the “Help to Buy” scheme.

More recently, though, enquiries from potential tenants have started to pick up again, and comfortably outstrip the current supply of rental property.

Chartered surveyors expect the South West and North East of England to post the highest increases in the rental market, while London will likely rise in line with the national average forecast of 2%.

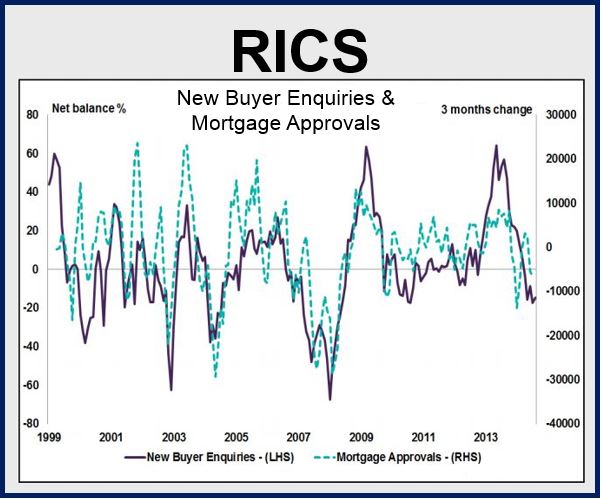

Sales transactions

The total number of sales transactions should increase from 1.22 million in 2014 to 1.25 million in 2015.

Despite some concerns regarding mortgage availability following the Mortgage Market Review, they will be more than offset by firm economic growth and the stamp duty reform boost.

Although 2014’s and 2015’s sales transactions are improvements over the past few years, before the global financial crisis figures were much higher – in 2006, for example, there were 1.67 million sales transactions.

Prices will also keep rising because of a continuing lack of supply in the housing market. However, the RICS reports seeing higher levels of house building projects. Housing starts are expected to rise to 155,000 in England in 2014, compared to 125,000 in 2013 and 100,000 in 2012.

While the increase in housing starts may appear encouraging, it is still nowhere near enough to address the faster growth in population.

The number of repossessions in 2014 are forecast to have fallen to about 23,000, the lowest figure in eight years. The RICS predicts that repossessions for 2015 will decline to below 20,000.

About 90% of new loans are being taken out on fixed rates, which provide a greater degree of protection against severe fluctuations in interest rates.

RICS Head of UK Policy, Jeremy Blackburn said:

“The political ambition to meet the UK’s housing deficit of 240,000 means that debates around planning, development and delivery will monopolize the pre-election period in the run up to May 2015.”

“We’ve seen four housing ministers in this Parliament and there is no reason to think that housing won’t continue to be a political football in the next. What we need is certainty, clarity and confidence from government to keep us building homes. Reforms to Stamp Duty should underpin public confidence and lead to a greater number of housing transactions and we would now look to any future government to review council tax.”