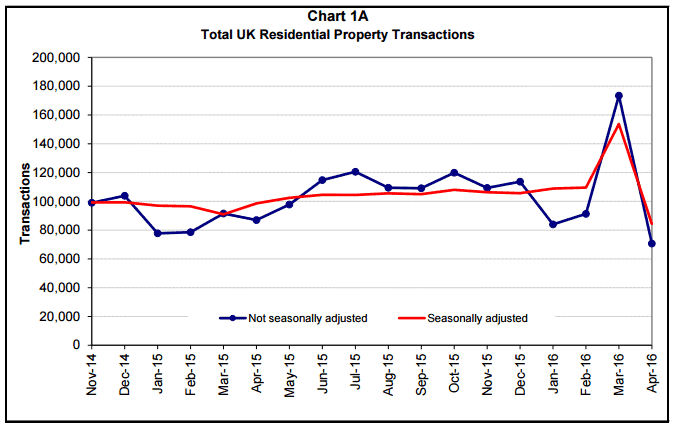

The recent changes to stamp duty have had a significant impact on British property sales, with UK property sales down 45% between March and April, according to figures released by HM Revenue and Customs (HMRC).

At the beginning of last month landlords and buyers of second homes across Britain faced a higher rate of stamp duty when buying a property – an extra 3 percent surcharge on top of the rate for the value of property being purchased.

The number of properties sold in April dropped from a record high of 164,400 in March down to 94,370.

There were 84,280 residential and 10,090 non-residential transactions last month. The number of transactions in April was 14.5% lower compared with the same month last year.

HMRC said in its monthly property report:

“The large increase in transactions for March 2016 followed by the substantial reduction in April is likely to be associated with the introduction of the higher rates on additional properties in April 2016. However, whilst April 2016 is lower than April 2015, it should be noted that the total for March and April 2016 is still substantially higher than the corresponding period last year.

“The additional property rates were announced in the Autumn Statement 2015 for England, Wales and Northern Ireland, and in the Scottish Government’s draft 2016-17 budget for Scotland. Additional non-tax factors may have played a role as well, for example the Bank of England’s plans to curb Buy-to-Let mortgages resulting in a rush to purchase.”