UK economic growth in the second quarter could be as low as just 0.1%, research firm Markit said on Thursday.

Markit said its Purchasing Managers’ Index (PMI) surveys for April suggest economic growth stalled in April to an estimated 0.1%, with the country’s services sector expanding at its slowest pace in over three years.

Markit’s construction PMI earlier this week pointed to the slowest growth in construction activity in almost three years, while a separate survey revealed manufacturing activity contracted in April for the first time in three years.

Chris Williamson, chief economist at Markit, said the surveys were a “triple-whammy of disappointing news”.

“Some of the slowdown may be attributable to the early timing of Easter, though April also saw an increase in the number of companies reporting that uncertainty about the EU referendum caused customers to hold back on purchases, exacerbating already-weak demand linked to global growth jitters and ongoing government spending cuts,” he said.

“The deterioration in April pushes the surveys into territory which has in the past seen the Bank of England start to worry about the need to revive growth.”

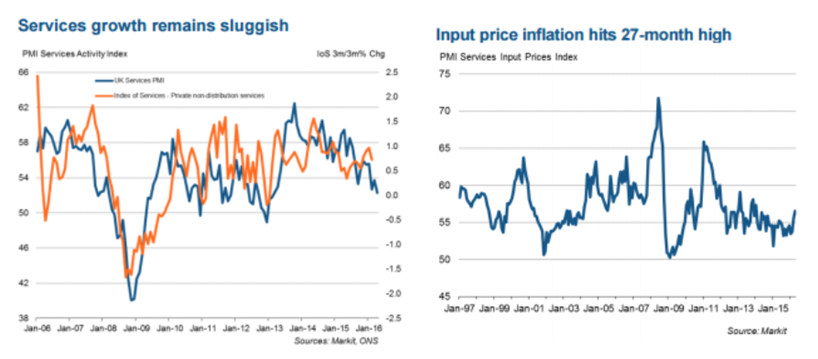

The business activity index on the Markit/CIPS UK Services PMI poll fell from 53.7 in March to 52.3 in April, the lowest reading since February 2013 and indicative of only a very slight rise in services output – in comparison, the index has averaged 55.2 since its first reading in 1996.

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, commented:

“The UK’s services sector is stuck between a rock and a hard place. Mounting global economic uncertainty at the top of the supply chain and the reality of the new National Living Wage at the bottom mean that firms are feeling the pinch from both ends. As a result, the sector credited with being the main driver of the UK’s economic fortunes appears to be slowing down.

“The looming EU referendum has had a profound effect on the sector, keeping prices relatively stagnant and delaying new orders. At the other end of the supply chain, the National Living Wage has compounded cost increases, resulting in the overall rate of input price inflation hitting a 27-month high. Together, these factors have squeezed margins while fewer than half of businesses expect to grow over the next twelve months.”

“The EU referendum and introduction of the National Living Wage are unique moments in time for the UK services sector, and indeed the wider economy. The question lingers as to how deep an impact they will both have on the sector in the long term.”

Howard Archer, chief UK and European economist at IHS Global Insight, was quoted by Reuters as saying:

“There is now compelling evidence that heightened uncertainty ahead of June’s referendum on EU membership is taking an increasing toll on economic activity.

“A much weakened set of April purchasing managers’ surveys for the services, manufacturing and construction surveys follows on from consumer confidence weakening to a 16-month low in April and the CBI reporting lacklustre retail sales”