The UK maintained its triple-A rating for sovereign debt, S&P announced on Friday. However, it doubts Chancellor of the Exchequer George Osborne will manage to meet his budget deficit target. Leaving the European Union would weaken the country’s prospects, S&P added.

The credit-rating agency believes the Government will need to increase revenues from taxes if it is serious about controlling public borrowing.

Mr. Osborne said he plans to balance the budget over the next twelve months without needing to increase taxes. S&P believes he will have to widen the tax base.

S&P is the only ratings agency out of the big three – which includes Moody’s and Fitch – not to have downgraded the UK’s AAA rating.

S&P said in a statement on Friday that the stable outlook for the UK reflects its assumptions that the country’s fiscal position will gradually strengthen as real-wage and productivity growth improve toward the averages seen before the global crisis, and that the government that wins the 2015 general election will remain committed to fiscal consolidation.

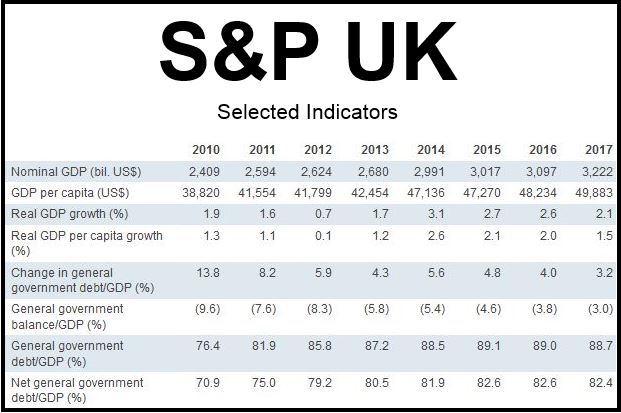

Source: “Ratings On The United Kingdom Affirmed At ‘AAA/A-1+’; Outlook Stable,” S&P.

Assumes UK stays in the EU

The agency added that its outlook also assumes that Britain will remain in the European Union. It views the UK’s EU membership as vital to its longer-term fiscal and growth outcomes, because the region has historically represented over 45% of the country’s net exports of financial services. Leaving the EU would weaken Britain’s prospects, it warned.

S&P forecasts UK GDP growth of more than 3% for 2014 and 2.7% for 2015.

Regarding tax receipts and official projections, S&P wrote:

“We believe the general government deficit will decline more slowly than the official projections, to 5.4% of GDP in calendar-year 2014 (compared to 5.8% in 2013) and toward 3.0% by 2017 compared to the government’s projection of close to 1% for the calendar year ending 2017 (for the fiscal year ending March 2018, the Treasury is targeting net public sector borrowing of 0.7% of GDP).”

“Our projection largely reflects our view that receipts from the oil and financial services sectors will not recover to pre-crisis levels; it also reflects our expectation that recovery in real wage growth will be more protracted and potentially more concentrated compared to previous upturns.”

“This, in our opinion, may depress tax receipts on labor, reflecting the government’s steps to further reduce the tax wedge on lower wage earners.”

S&P believes there is a less than 1-in-3 probability that the rating will be downgraded in the next two years.