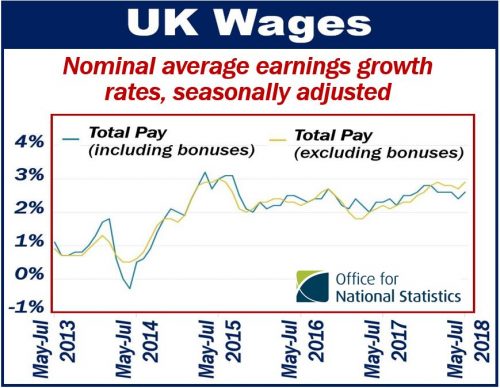

UK wages grew faster than experts had expected in the three months to July 2018. During those three months, UK wages continued to outstrip inflation. Wages have managed to outstrip inflation for four consecutive months.

According to the Office for National Statistics (ONS), UK wages, excluding bonuses, rose by 2.9%. This was well above the country’s inflation rate.

The Office for National Statistics is a non-ministerial department which reports directly to the British Parliament. It is the executive office of the UK Statistics Authority.

UK wages ‘robust’

The ONS described Britain’s labour market as ‘robust.’ The number of people in the UK in work is at a historical high.

The ONS wrote:

“Latest estimates show that average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.9% excluding bonuses, and by 2.6% including bonuses, compared with a year earlier.”

“Latest estimates show that average weekly earnings for employees in Great Britain in real terms (that is, adjusted for price inflation) increased by 0.5% excluding bonuses, and by 0.2% including bonuses, compared with a year earlier.”

UK wages outstrip inflation

For the three-month period to July, the inflation rate was 2.4%. For just the month of July, the annual inflation rate stood at 2.5%. Therefore, inflation during the three-month period to July was lower than the growth rate of UK wages.

BBC News quoted Andrew Wishart, an economist at Capital Markets, who said:

“Competition for workers is finally starting to provide greater support to wages. We still think that the MPC will hold off raising interest rates again until the near-term uncertainty due to the Brexit negotiations is resolved.”

MPC stands for Monetary Policy Committee. It is a Bank of England Committee that is responsible for making decisions about the Bank Rate. The Bank Rate is the rate at which the Bank of England lends money to its domestic financial institutions.

Last month, the Bank of England raised its key interest rate for the second time in ten years. The current interest rate stands at 0.75%, which is the highest since March 2009.