People carry a lot less physical cash than they used to, and for good reason; the use of debit and credit cards offers massive benefits and convenience. But a debit card is different from a credit card. To understand the difference between these two cards, you must first learn about each one individually, understand their unique traits, and understand how they work.

Use of a Debit Card

Let’s start by understanding the general use of a debit card. It’s important to know that when you go to a bank to open a basic money account (commonly known as a debit or checking account), you are opening an account with your own money. With a debit account, you have access directly tied to the amount you have in your account. When you open this type of account, banks will typically give you a debit card, which you can use to make purchases from the funds in your account. Instead of having to carry coins and bills, you can now use your debit card to make payments.

Origin of the Word “Debit”

According to the Online Etymology Dictionary, the word “debit” originates from Latin, from the term debitum, meaning “debt” or “what is owed.” Back then it was used to describe an amount that should be deducted from an account, i.e., an amount someone owed or the amount of debt.

NOTE: It’s always important to remember that the debit account is connected to the debit card.

How Does a Debit Card Work?

With a debit card, you can pay for anything you can think of without needing to carry cash. You can also use ATMs (cash machines) to withdraw your money if you need cash. It’s important to remember that the money you have in your debit account is the money available to use, so if you try to overspend, the purchase cannot be completed — unless you have an overdraft.

For example, if you deposit $100 of your own money into a debit account and use your debit card with a balance of $100 to buy something for $10, you will have $90 left in your account. But if you try to make a purchase of $110, the transaction will be rejected, because there is $10 missing to complete the purchase.

Advantages of a Debit Card

A debit card can help you learn more about controlling spending or managing money, as you can only spend the money available in your account for payments and purchases. This means that you have to learn how much you can actually spend after covering fixed expenses, such as utilities, rent, or mortgage. Using a debit card does not accrue interest, as you are using your own money.

NOTE: Although using a debit card is free, it’s essential to consider the type of debit account you have, as sometimes the bank requires a minimum balance to be maintained in the account to avoid interest charges.

Important Points to Remember

- A debit card can teach responsible management of your own money.

- The use and management of money on a debit card does not generate credit history, as there is no money borrowed from the bank.

- Depending on where you withdraw money, the ATM may charge a fee for cash withdrawals. Research where your bank’s or partner’s ATMs are located to avoid unnecessary fees.

- Some debit cards offer fraud protection in case the card is used by someone else or has been stolen.

The Credit Card

Now that we know how to use our money with a debit card, let’s look at what a credit card is.

A credit card is a form of financial credit granted by a bank. Therefore, the money you have access to with a credit card is money that a financial institution is lending you. When using a credit card, you are actually using money borrowed from the bank and must pay it back later. It’s important to remember that this money is not directly tied to the balance in your debit account; the bank is lending it.

NOTE: It’s worth noting that, although a credit card may look like a debit card, when making payments, you are using money borrowed from the bank.

How Does a Credit Card Work?

When obtaining a credit card, it’s important to check the credit limit; in other words, the amount of money the bank is lending. Remember that you do not necessarily have to use or spend all the money granted by the bank.

When the bank issues a credit card, you must be aware of the following:

- Spending Period: This is the cycle or period during which you use the credit card for purchases and expenses. This period runs from a start date to a cut-off date.

- Cut-off Date: This is the deadline for transactions until the bank calculates the total amount spent during that period and sends a detailed statement.

- Payment Date: This is the date that the amount owed, which may include interest for the money used during that period, must be paid. This date is usually 20 days after the cut-off date. It’s also important to note that if you pay the total amount spent, you won’t have to pay off any interest. This is why it’s essential to only use what you can pay back.

Example of Using a Credit Card

To understand this better, let’s look at an example:

The bank assigns a credit limit of $500 to Mr. X. During his spending period, Mr. X only buys $100 worth of chocolates. By the time his cut-off date arrives, he will only need to pay $100 on his payment date.

Now, let’s say Mr. X’s spending period runs from the 16th of the previous month to the 15th of this month. Mr. X only buys $100 worth of chocolates on the 11th of this month, so that’s the only purchase he will have to pay by this month’s payment date.

Considering that the payment date is 20 days later, Mr. X must pay the $100 he spent on chocolates by the 5th of next month.

It’s important to note that if Mr. X pays $100 in total, the bank does not charge him interest. However, if he only pays $50, the bank will charge interest on the remaining $50.

Now let’s assume Mr. X pays a day after the payment date, on the 6th. He will have to pay interest on the total amount that was not paid on time. The amount in interest is decided by the interest rate of the credit card, some banks offer lower rates, while others may have higher rates.

NOTE: It’s important to remember that interest is “the cost of what the bank lent” for not paying on time, and the interest percentage is set by the bank. If the total is not paid, the debt increases, and there is a risk of it growing. It’s essential to only use the amount you can pay back.

Advantages of a Credit Card

If you need to buy something and don’t have all the capital on hand or feel comfortable paying in installments, you can make a purchase with a credit card and pay it off gradually. Credit cards offer many purchasing benefits, such as interest-free installment payments and points for purchases made. Additionally, a credit card helps you build a credit history, in other words, a rating of how well you manage money borrowed from the bank. Remember that using a card responsibly helps you build and maintain a good credit history. Having a good credit history can grant you access to more types of loans or credit.

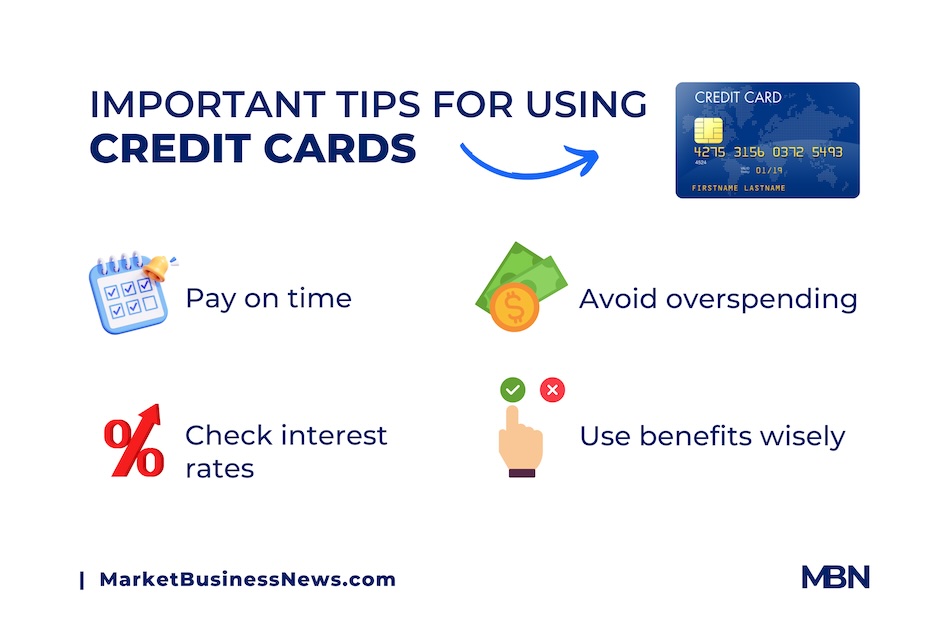

Important Points to Remember

- Always pay on time to prevent debt from accruing interest or growing.

- Be careful not to overspend. It’s important to know how much you have spent to be able to pay it off by the monthly due date without worries.

- If you can, try to pay the total balance. Make the credit card a useful tool and not another debt, as it can become a long-term, unmanageable debt if not managed correctly.

- When acquiring a card, it’s essential to check interest rates and extra costs for using the card. For example, some credit cards have an “annual fee” just for having the card.

- If you have more than one card, it’s advisable to use each one based on its benefits. For example, if you frequently shop at a supermarket and have a credit card that offers benefits for purchases there, like 3% cash back on every purchase, then it’s wise to use that card for purchases at that supermarket rather than using it at a restaurant, as it provides an extra benefit to the user when shopping at that supermarket.

Tip: Make sure to use it responsibly, ensuring you can repay what you borrow.

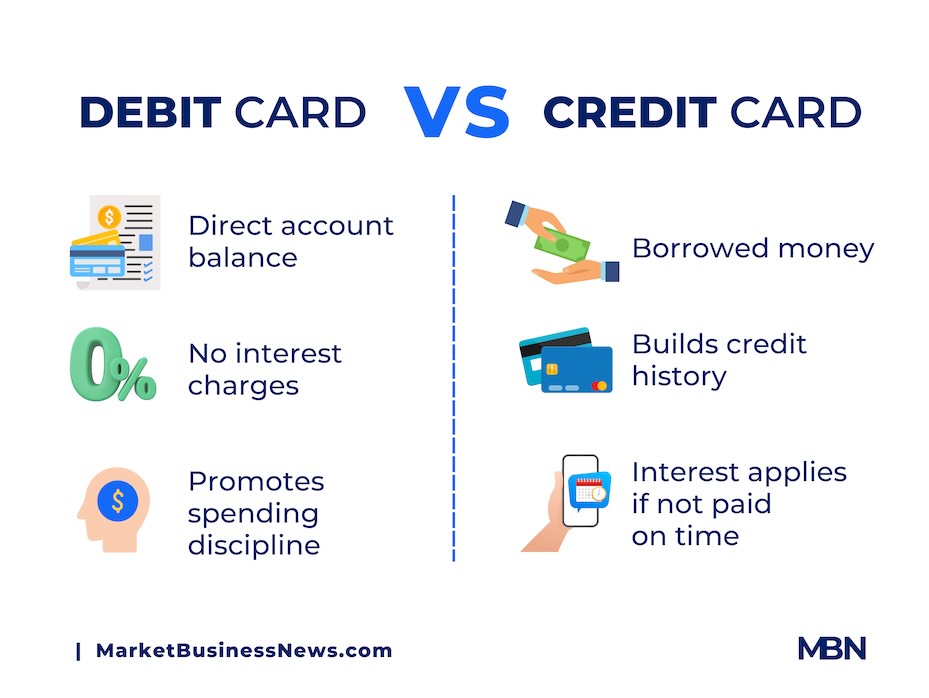

Key Differences Between a Credit Card and a Debit Card

Debit Card:

- Uses the balance available in the bank account.

- Promotes responsible money management.

- No interest is charged for card use.

- Usually, it does not offer rewards for card use.

Credit Card:

- Uses money provided by the bank or lender.

- If transactions are not managed properly, it’s possible to spend more than can be repaid.

- Builds credit history.

- Provides exclusive benefits for purchases and more fraud protection.

Examples of Using the Cards

Now that you understand more about the two types of cards, let’s look at examples of how to use them better:

- A debit card is ideal for managing the money you have; it’s useful for daily purchases or withdrawing cash, as it deducts from your available money, allowing for easy direct expense control without generating debt.

- A credit card is ideal for making large purchases, like furniture or electronics, taking advantage of the benefit of installment payments without being left with no money in your debit account for smaller purchases. This also applies to travel, whether for hotels or car rentals, where a credit card is often required as a guarantee. Additionally, during emergencies, a credit card can help cover immediate costs.

Conclusion

In conclusion, debit cards and credit cards are very useful financial products that help us make purchases with ease and manage money better. Ultimately, the choice of use depends on your financial goals, the benefits provided by the cards, and the situation at hand. Depending on the context, each has its advantages and disadvantages; that’s why it’s essential to learn the benefits of each to avoid mismanagement. Learning to use these cards can help you make more informed financial decisions.