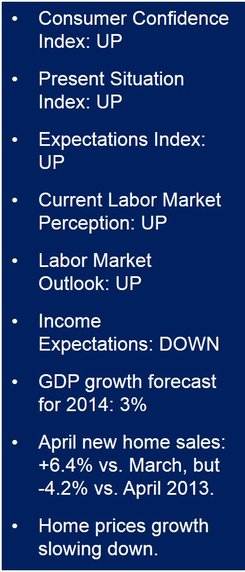

The US Consumer Confidence Index improved moderately in May after falling in April, says The Conference Board. The Consumer Confidence Index edged up from 81.7% in April to 83.0 in May (1985=100). The Present Situation and Expectations indexes also increased slightly to 80.4 (78.5) and 84.8 (83.9) respectively. The housing market, however, remains uncertain.

Consumers in May had a better perception of present day conditions. The number of respondents saying business conditions are “good” fell to 21.1% compared to 22.2% in April, but those saying conditions are “bad” also fell, from 24.8% to 24.1%.

The labor market

Current labor market conditions were better perceived by consumers, with 14.1% claiming jobs are “plentiful” compared to 13% in April, while the proportion of people claiming jobs are “hard to get” fell moderately to 32.3% from 32.8%.

Consumers judged the outlook for the labor market more positively in May, with 15.4% expecting more job opportunities over the next six months compared to 14.7% in April, and those expecting worsening job prospects increasing to 18.3% from 18%.

The percentage of people expecting their incomes to fall, however, rose to 14.5% from 12.9%.

There was a moderate increase in Consumer Expectations in May, with 17.5% expecting business conditions to improve over the next six months compared to 17.2% in April, and those expecting things to get worse falling slightly from 10.5% to 10.2%.

US GDP growth picking up again

After slowing down dramatically in the first quarter of 2014 due to abnormally harsh weather conditions, the US economy appears to be gathering pace again. The Conference Board Leading Economic Index for April increased 0.4% after rising 1% in March and 0.5% in February.

The Conference Board forecasts GDP (gross domestic product) growth nearing 3% for this year.

President of the Federal Reserve of Atlanta, Dennis Lockhart, forecast 3% (annualized) GDP growth for Q2 2014. He also predicted a recovery in the housing market after the recent lull.

Lockhart said “It is little early to say based on data. But I am pretty confident it will be at or exceed 3 percent in the second quarter. Generally, I see the housing market improving and contributing to this picture of a better economy.”

Mixed housing data

According to the US Census Bureau, April new home sales rose by 6.4% compared to March, but were still 4.2% below April 2013’s total. After moderating over the last year, economists were encouraged by April’s figures.

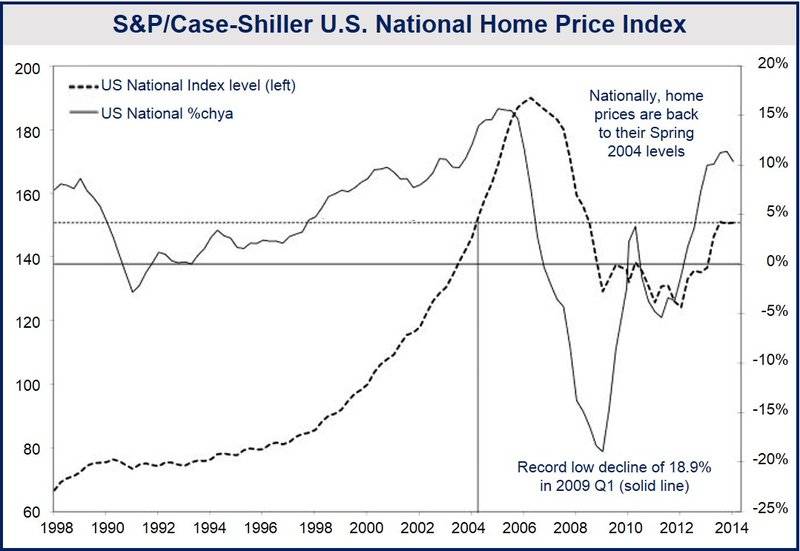

However, an S&P/Case-Shiller Home Price Index report published today showed that the home prices increase continues losing steam. If home prices increase more slowly, Americans have less wealth via home equity, which tends to have a dampening effect on the economy.

The prices of homes in 10 major US cities increased 12.6% in March 2014 compared to March 2013, while the 20-city price index rose 12.4%, down from 12.9% registered year-on-year in February.

David Blitzer, Chairman of the Index Committee at S&P Down Jones Indices, said:

“Annual price increases for the two Composites have slowed in the last four months and 13 cities saw annual price changes moderate in March. The National Index also showed decelerating gains in the last quarter. Among those market seeing substantial slowdowns in price gains were some of the leading boom-bust markets including Las Vegas, Los Angeles, Phoenix, San Francisco and Tampa.”

“Despite signs of decelerating prices, all cities were higher than a year ago and all but New York were higher in March than in February. However, only Denver and Dallas have set new post-crisis highes and they experienced relatively lower peak levels than other cities. Four locations are fairly close to their previous hishg: Boston (8%), Charlotte (9%), Portland (13%) and San Francisco.”

(Source: S&P Down Jones Indices)

Blitzer said data on housing remain mixed. Housing starts in April recovered from a fall in March, but nearly all the gain was in apartment construction and not the building of family homes. Although mortgage rates are near a 7-month low, recent comments by the Federal Reserve point to problems in bank lending standards. He also cited high student loan debt as an obstacle for many first time buyers.