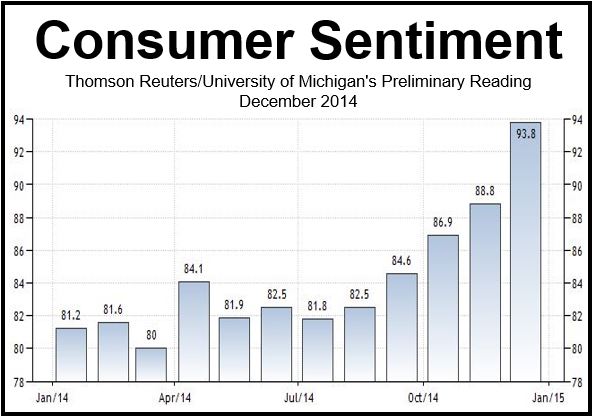

US consumer sentiment continues improving, reaching an almost 8-year high in December, according to the Thomson Reuters/University of Michigan’s preliminary reading released on Friday, which reached 93.8, compared to 88.8 in November.

The last time the gauge was so high was in January 2007.

According to Reuters, the Index was well above the median forecast of 89.5 predicted by 70 economists in a poll.

The Consumer Expectations index, which gauges how consumers see the near future, increased from 79.9 to 86.1. This was also a near 8-year high.

The Index that measures how consumers rate the country’s current economic conditions increased from 102.7 to 105.7, another quasi-8-year record.

Director of the survey, Richard Curtin, said expectations for wage increase reached their highest level since 2008 “and consumers voiced the most favorable buying attitudes in several decades.”

With oil prices plunging by more than 40% since June 2014, consumers are noticing a surge in their disposable income. Add to this sustained hiring and accelerating wage growth, and retailers have an ideal combination of economic components for bumper holiday sales.

Source: Thomson/Reuters, University of Michigan.

Despite good news, stock markets fell sharply

Despite a raft of strong economic indicators during the past few months, stock markets have had a terrible week. The Dow Jones Industrial Average closed on Friday -3.8% down on the previous week, the sharpest 1-week fall since November 2011. A total of $1.2 trillion vanished from global equities.

Investors have become overwhelmed with so much alarming data emerging outside the United States. Oil prices hitting a five-year low, slowing growth in China, a zero-growth European Union, and bad news from Japan, have weighed on stock traders’ behavior.

Falling oil prices are good for consumers, because they spend less filling their vehicles with fuel and have more spare cash, but they are not necessarily good for the country’s overall economy and financial markets.

US shale-oil producers, for example, will have to scale down production, hiring plans, and investments.

Stock markets not only took a beating over the past week in the US, the London Stock Exchange had a 3-year record 1-week fall, while France, Germany and Italy all posted declines.