US consumer spending in January increase more than expected, largely driven by a higher demand for heating, according to figures published by the Bureau of Economic Analysis, part of the US Department of Commerce. Outlays on services registered their biggest rise since 2001.

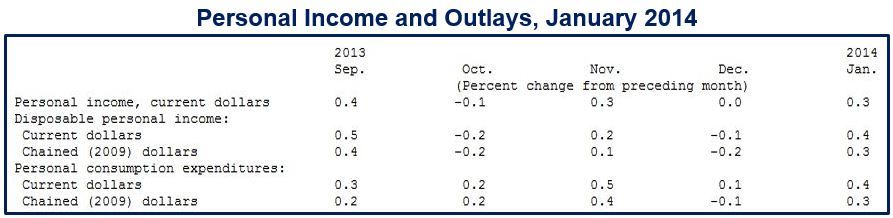

There was a $48.1 billion or 0.4% increase in US consumer spending in January, after a revised December increase of 0.1% (rather than a preliminary estimate of 0.4%).

A Reuters poll of economists had expected consumer spending to rise by 0.1 in January. Consumer spending accounts for over two-thirds of the US economy.

Large gain in services spending

Services spending jumped by 0.9%, the largest gain since 2001. January’s abnormally severe weather conditions significantly increased demand for utilities. There was also a marked rise in health care spending.

While utilities spending rose considerably, consumers spent 0.6% less on goods in January.

Increased consumer spending does not appear to have had much of an effect on the country’s currently low inflation rate. A price index for consumer spending increased by 0.1% in January, compared to 0.2% in December. During a 12-month period ending in January 2014, prices have increased by 1.2%, versus 1.1% in December.

The US Federal Reserve is aiming for an annual inflation rate of 2%.

(Source: Bureau of Economic Analysis)

US economy mixed performance

US consumer spending reflects a patchy performance over the last few months, with the economy dented by unusually severe weather. The January decline in retail sales was blamed on the weather, as were slower employment growth and home sales.

The Wall Street Journal quoted Peter Newland, a Barclays economist, who said “Such strong services consumption growth will not persist, although spending on goods should pick up once weather effects pass.”

Personal income increased in January

Personal income rose by $43.9 billion (0.3%) in January compared to a $5.5 billion (0.1%) fall in December, while disposable personal income grew by $45.2 billion (0.4%) in January.

January personal incomes increased mainly thanks to a number of provisions in the Affordable Care Act. Many Americans are now entitled to subsidies to offset health insurance costs.

Some cost-of-living adjustments in social security payments which took effect in January also boosted personal income figures.

Video – US consumer spending January (Bloomberg)