The US GDP growth rate during the last quarter of 2013 was 2.4% annualized, much lower than the preliminary 3.2% estimate, says the Bureau of Economic Analysis, part of the US Department of Commerce. The downward revision is due to much weaker-than-expected consumer spending.

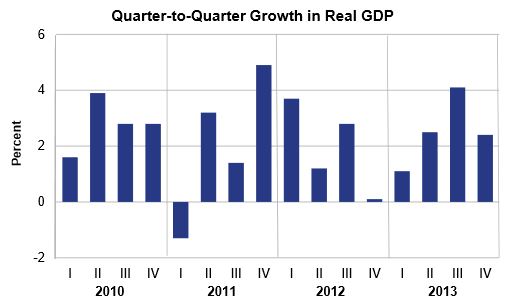

During the third quarter of 2013, real GDP (gross domestic product) grew by 4.1%.

As most economic indicators point to a slow first quarter for 2014, due mainly to severe winter weather, most analysts expect a slow start to this year.

The latest GDP estimate is based on more complete data than the preliminary estimate, the Commerce Department explains. The latest data shows more positive contributions from exports, non-residential fixed investment, private inventory investment and PCE, which were partly offset by negative contributions from state and local government spending, residential fixed investment, and federal government spending.

Imports, which are subtracted from the GDP calculation, increased.

Real GDP growth is measured at seasonally adjusted annual rates (Source: Dept of Commerce)

US GDP growth hampered by weak consumer spending

Slower GDP growth was mainly driven by:

- A slowing down in private inventory investment.

- A greater decline in federal government spending.

- Downturns in residential fixed investment.

- A reduction in imports.

US GDP growth is highly dependent on consumer spending, which represents approximately 70% of the country’s economic activity. Vehicle sales and some other retail products suffered because of extremely bad weather conditions.

The BBC quotes Chris Williamson, chief economist at financial firm Markit, who said “The details of the report suggest that investment is growing at an increased rate and underlying demand continued to expand at a reassuringly robust rate, given the headwinds during the closing months of 2013.”

Lower spending and higher taxes slowed US economy in 2013

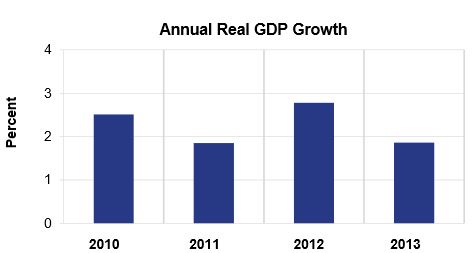

US GDP growth for the whole of 2013 was 1.9%, compared to an increase of 2.8% in 2012. The economy grew more slowly in 2013 because government spending was lower and federal taxes had been raised, their combined effect reduced growth by about 1.5 percentage points, economists estimate.

(Source: Department of Commerce)

Federal taxes were raised and spending was cut in order to counter a rapidly-expanding budget deficit.

Despite a slow start, 2014 is expected to be a much better year than 2013, the majority of economists believe. John Silvia, chief economist at Wells Fargo Securities LLC. In Charlotte, North Carolina, in an interview with Bloomberg Personal Finance said “The first quarter is starting out pretty weak, and a lot of that is weather. 2014 is going to be a much better year than 2013.”

According to the Federal Reserve, the US economy is forecast to grow by between 2.8% and 3.2% in 2014, and unemployment is expected to gradually fall to between 6.3% and 6.6%.

Video – Skipping vacations bad for US GDP growth

Are you the type of person who works most weekends and cancels vacations because of last minute projects and new deadlines? Do you skip birthdays?

If you are you are not alone. Over forty percent of US employees who are paid time off never used about 3.2 of those days in 2013.

We all know that taking time off has considerable health benefits, and also helps improve productivity. A team of researchers at Oxford Economics found that skipping your vacation may actually be bad for US economic growth.

In this video below, Ruben Ramires from The Street speaks with Oxford’s Adam Sacks.