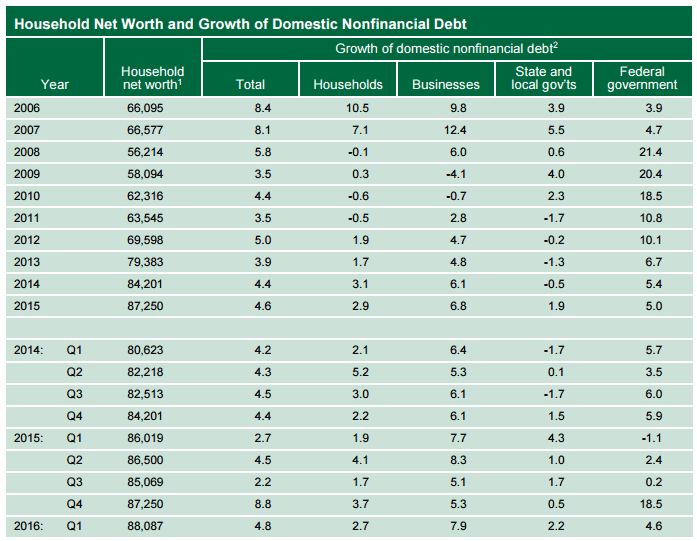

US household wealth rose by one percent in the first quarter of 2016 to a record $88.1 trillion, according to data released by the Federal Reserve on Thursday.

The increase in wealth was boosted by a $477.5 billion increase in the value of household real-estate assets, with owner’s equity as a share of total real-estate holdings up from 56.9 percent to 57.8 percent.

The value of financial assets, which includes stocks and pension funds, rose by $299.5 billion.

Household debt increased at an annual rate of 2.7 percent in the first quarter of 2016, while consumer credit, including student and auto loans, grew 6.1 percent, and mortgage debt (excluding charge-offs) grew 1.6 percent at an annual rate – a fourth consecutive gain.

Federal government debt increased 4.6 percent at a seasonally adjusted annual rate in the first quarter, while State and local government debt rose at an annual rate of 2.2 percent.

Total non-financial debt rose at a 4.8 percent annual pace.

The results highlight the economic recovery since the financial crisis. In 2009 US household wealth plunged to as low as $55 trillion – it has since recovered by over $33 trillion.

In addition, the wealth increase in the first quarter is believed to have been more widely shared than in previous periods as home ownership is one of the middle-class’s primary sources of wealth – the wealthiest Americans rely more on financial assets. The U.S. homeownership rate is currently at 63.7 percent.

“Real estate wealth tends to be a bit more evenly spread across households than equities,” Paul Ashworth, chief U.S. economist for Capital Economics, told the Wall Street Journal.

He added: “People are freer to go out and spend now, based on those wealth gains.”