US job creation slowed in May to its weakest pace of growth in over five years as manufacturing and construction employment fell sharply.

According to the US Labor Bureau, only 38,000 jobs were created in the US last month, down from 123,000 jobs created in April – representing the smallest monthly gain since September 2010.

The figures were much worse than what economists had forecast of approximately 164,000 new “non-farm” jobs.

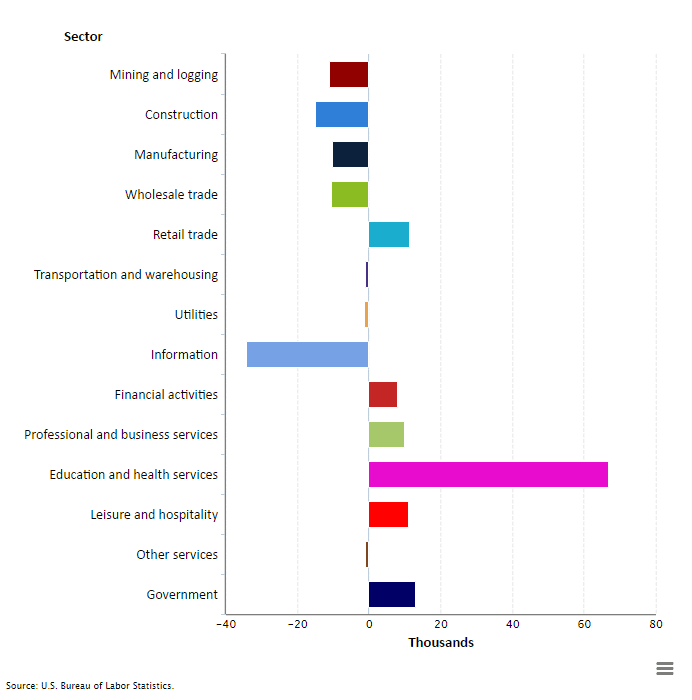

Employment change by industry, May 2016, seasonally adjusted:

Health care added 46,000 jobs last month, while employment in professional and business services only increased by 10,000 after rising a 55,000 rise in April.

Within manufacturing, employment in durable goods declined by 18,000 in May, with job losses of 7,000 in machinery and 3,000 in furniture and related products. Mining employment dropped by 10,000.

The unemployment rate fell from 5 percent down to 4.7 percent, however, this was mainly due to the fact almost half a million people dropped out of the labor force – not because of robust hiring.

Friday’s weak job data has clouded the outlook of another interest rate hike by the Federal Reserve this summer – the US central bank will likely wait for a cleaner read on payrolls before hiking rates again.

“This is a smack in the face for the US economy,” Diane Swonk of DS Economics told The Financial Times.

“They [the Fed] need to see a much better June number to keep July on the table . . . When you are losing momentum going into the meeting, that is not when you raise rates.”

“For the Fed, these data present a dilemma. The unemployment rate tells them unambiguously that policy needs to be tightened, but if they choose to believe the slowdown in payrolls will persist, they will expect unemployment to rise again even if rates are left unchanged,” Ian Shepherdson of Pantheon Macroeconomics told The Wall Street Journal.

“Their response will be the usual: They’ll wait.”